7 Exemption for DOMESTIC ONLY NYC Gov Nyc Form

What is the 7 Exemption For DOMESTIC ONLY NYC gov Nyc

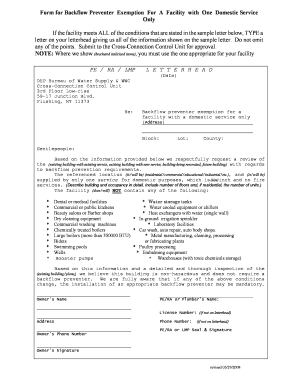

The 7 Exemption for Domestic Only is a specific provision under New York City's tax regulations. This exemption is designed to provide relief for certain domestic entities, allowing them to avoid specific tax obligations under defined circumstances. It primarily applies to businesses that meet certain criteria, ensuring that they are not taxed on income generated within the city. Understanding this exemption is crucial for eligible businesses to optimize their tax strategies and ensure compliance with local laws.

Eligibility Criteria

To qualify for the 7 Exemption for Domestic Only, businesses must meet specific eligibility requirements. These typically include being a domestic entity, such as a corporation or limited liability company, and having a physical presence in New York City. Additionally, the business must demonstrate that it operates primarily within the city and meets revenue thresholds set by the local tax authority. It is essential for businesses to review these criteria carefully to determine their eligibility for the exemption.

Steps to complete the 7 Exemption For DOMESTIC ONLY NYC gov Nyc

Completing the application for the 7 Exemption involves several key steps. First, businesses must gather all required documentation, including proof of domestic status and financial records. Next, they should complete the appropriate application form, ensuring that all information is accurate and up to date. After filling out the form, businesses can submit it to the relevant tax authority, either online or via mail, depending on the submission guidelines. It is advisable to keep copies of all submitted documents for future reference.

Required Documents

When applying for the 7 Exemption for Domestic Only, businesses need to prepare several important documents. These may include:

- Proof of business registration in New York City

- Financial statements demonstrating income sources

- Tax identification numbers

- Any additional documentation requested by the tax authority

Having these documents ready will facilitate a smoother application process and help ensure compliance with all requirements.

Form Submission Methods

Businesses can submit their application for the 7 Exemption through various methods. The most common submission methods include:

- Online submission via the NYC tax authority's official website

- Mailing the completed form to the designated tax office

- In-person submission at local tax offices, if applicable

Each method has its own guidelines and processing times, so it is important for businesses to choose the option that best suits their needs.

Legal use of the 7 Exemption For DOMESTIC ONLY NYC gov Nyc

The legal use of the 7 Exemption for Domestic Only is governed by New York City tax laws. Businesses must ensure that they are compliant with all regulations and that they only claim the exemption if they meet the established criteria. Misuse of the exemption can lead to penalties, including back taxes and fines. Therefore, it is advisable for businesses to consult with a tax professional or legal advisor to navigate the complexities of the exemption and ensure proper adherence to legal requirements.

Quick guide on how to complete 7 exemption for domestic only nyc gov nyc

Easily Prepare [SKS] on Any Device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents quickly and efficiently. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify any document-based task today.

How to Edit and Electronically Sign [SKS] Effortlessly

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 7 Exemption For DOMESTIC ONLY NYC gov Nyc

Create this form in 5 minutes!

How to create an eSignature for the 7 exemption for domestic only nyc gov nyc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 7 Exemption For DOMESTIC ONLY NYC gov Nyc?

The 7 Exemption For DOMESTIC ONLY NYC gov Nyc refers to specific tax exemptions available for domestic services in New York City. This exemption can signNowly reduce the tax burden for eligible residents and businesses. Understanding this exemption is crucial for anyone looking to optimize their tax filings in NYC.

-

How can airSlate SignNow help with the 7 Exemption For DOMESTIC ONLY NYC gov Nyc?

airSlate SignNow provides an efficient platform for managing documents related to the 7 Exemption For DOMESTIC ONLY NYC gov Nyc. With our eSigning capabilities, you can quickly sign and send necessary documents, ensuring compliance and timely submissions. This streamlines the process, making it easier for users to take advantage of the exemption.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for those utilizing the 7 Exemption For DOMESTIC ONLY NYC gov Nyc. Our plans are designed to be cost-effective, ensuring that you get the best value for your investment. You can choose a plan that fits your budget while accessing all essential features.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking, all of which are beneficial for managing documents related to the 7 Exemption For DOMESTIC ONLY NYC gov Nyc. These features enhance efficiency and ensure that your documents are handled securely and professionally. Users can easily navigate the platform to find the tools they need.

-

Are there any benefits to using airSlate SignNow for the 7 Exemption For DOMESTIC ONLY NYC gov Nyc?

Yes, using airSlate SignNow for the 7 Exemption For DOMESTIC ONLY NYC gov Nyc offers numerous benefits, including time savings and improved accuracy in document handling. Our platform reduces the risk of errors and ensures that all documents are compliant with local regulations. This allows users to focus on their core business activities while we handle the paperwork.

-

Can airSlate SignNow integrate with other software for better efficiency?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow when dealing with the 7 Exemption For DOMESTIC ONLY NYC gov Nyc. Whether you use CRM systems, accounting software, or other tools, our integrations help streamline processes and improve overall efficiency. This connectivity ensures that all your documents are easily accessible and manageable.

-

Is airSlate SignNow secure for handling sensitive documents?

Yes, airSlate SignNow prioritizes security, making it a safe choice for handling sensitive documents related to the 7 Exemption For DOMESTIC ONLY NYC gov Nyc. Our platform employs advanced encryption and security protocols to protect your data. You can trust that your documents are secure while using our eSigning and document management services.

Get more for 7 Exemption For DOMESTIC ONLY NYC gov Nyc

- List of documents referenced form

- Event service documentation club coordinators night sky nightsky jpl nasa form

- Protect trademark and corporate identity form

- Oklahoma farm lease agreement oces okstate form

- Client information questionnaire

- 004102a bid form electrical construction balton construction inc

- Restaurant disciplinary action form

- Health alaska govdphvitalstatsalaska marriage certificate request form

Find out other 7 Exemption For DOMESTIC ONLY NYC gov Nyc

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed