Screen 127 Tax Levy Student Loans Edit Definitions Tamus Form

What is the Screen 127 Tax Levy Student Loans Edit Definitions Tamus

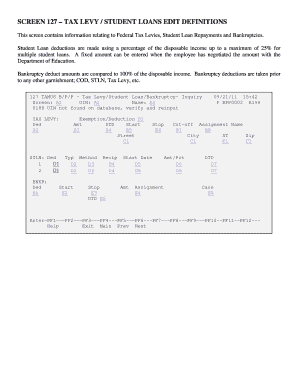

The Screen 127 Tax Levy Student Loans Edit Definitions Tamus is a specific form used within the context of tax levies related to student loans. It serves as a tool for individuals and businesses to clarify definitions and edit pertinent information regarding tax levies that may affect student loan repayments. This form is particularly relevant for taxpayers who have outstanding student loans and are subject to potential tax levies due to non-compliance with repayment terms.

How to use the Screen 127 Tax Levy Student Loans Edit Definitions Tamus

Using the Screen 127 Tax Levy Student Loans Edit Definitions Tamus involves several steps. First, gather all necessary documentation related to your student loans and tax status. Next, access the form through the appropriate channels, ensuring you have the latest version. Fill out the form by providing accurate information, including any definitions that need to be clarified or edited. Finally, review the completed form for accuracy before submission to avoid delays or issues with processing.

Steps to complete the Screen 127 Tax Levy Student Loans Edit Definitions Tamus

Completing the Screen 127 Tax Levy Student Loans Edit Definitions Tamus requires careful attention to detail. Here are the steps to follow:

- Collect all relevant documents, including loan statements and tax records.

- Obtain the Screen 127 form from the designated source.

- Fill in your personal information accurately, including your Social Security number and contact details.

- Edit any definitions or terms that require clarification based on your specific situation.

- Double-check all entries for accuracy and completeness.

- Submit the form according to the specified submission methods.

Legal use of the Screen 127 Tax Levy Student Loans Edit Definitions Tamus

The legal use of the Screen 127 Tax Levy Student Loans Edit Definitions Tamus is crucial for ensuring compliance with federal and state regulations. This form is designed to help taxpayers navigate the complexities of tax levies on student loans. Properly completing and submitting the form can protect individuals from potential legal repercussions associated with unpaid student loans and tax obligations.

Required Documents

To effectively complete the Screen 127 Tax Levy Student Loans Edit Definitions Tamus, certain documents are required. These typically include:

- Current student loan statements.

- Tax returns from the previous year.

- Any correspondence from the IRS regarding tax levies.

- Identification documents, such as a driver's license or Social Security card.

Form Submission Methods

The Screen 127 Tax Levy Student Loans Edit Definitions Tamus can be submitted through various methods, ensuring accessibility for all users. Common submission methods include:

- Online submission via designated government portals.

- Mailing the completed form to the appropriate tax authority.

- In-person submission at local tax offices or designated locations.

Quick guide on how to complete screen 127 tax levy student loans edit definitions tamus

Prepare [SKS] effortlessly on any device

Digital document management has become widely embraced by businesses and individuals alike. It offers an excellent eco-friendly substitute to conventional printed and signed documents, as you can access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents quickly and efficiently. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or obscure sensitive information using the tools provided specifically for this purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Select how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the screen 127 tax levy student loans edit definitions tamus

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of Screen 127 Tax Levy Student Loans Edit Definitions Tamus?

Screen 127 Tax Levy Student Loans Edit Definitions Tamus is designed to help users manage and edit definitions related to tax levies on student loans. This feature ensures that users can easily navigate complex tax regulations and make informed decisions regarding their loans.

-

How does airSlate SignNow integrate with Screen 127 Tax Levy Student Loans Edit Definitions Tamus?

airSlate SignNow seamlessly integrates with Screen 127 Tax Levy Student Loans Edit Definitions Tamus, allowing users to eSign and send documents related to tax levies efficiently. This integration enhances workflow by simplifying document management and ensuring compliance with tax regulations.

-

What are the pricing options for using Screen 127 Tax Levy Student Loans Edit Definitions Tamus?

Pricing for Screen 127 Tax Levy Student Loans Edit Definitions Tamus varies based on the features and volume of usage. airSlate SignNow offers flexible pricing plans that cater to different business needs, ensuring that you can find a cost-effective solution for managing your student loan documents.

-

What benefits does Screen 127 Tax Levy Student Loans Edit Definitions Tamus provide?

The primary benefits of Screen 127 Tax Levy Student Loans Edit Definitions Tamus include streamlined document editing, enhanced compliance with tax regulations, and improved efficiency in managing student loan-related documents. Users can save time and reduce errors, making it easier to handle tax levies.

-

Can I customize the definitions in Screen 127 Tax Levy Student Loans Edit Definitions Tamus?

Yes, users can customize the definitions in Screen 127 Tax Levy Student Loans Edit Definitions Tamus to fit their specific needs. This flexibility allows for tailored solutions that align with individual or organizational requirements, enhancing the overall user experience.

-

Is there customer support available for Screen 127 Tax Levy Student Loans Edit Definitions Tamus?

Absolutely! airSlate SignNow provides dedicated customer support for users of Screen 127 Tax Levy Student Loans Edit Definitions Tamus. Our support team is available to assist with any questions or issues, ensuring that you can effectively utilize the platform.

-

How secure is the data when using Screen 127 Tax Levy Student Loans Edit Definitions Tamus?

Data security is a top priority for airSlate SignNow. When using Screen 127 Tax Levy Student Loans Edit Definitions Tamus, your information is protected with advanced encryption and security protocols, ensuring that sensitive data related to tax levies and student loans remains confidential.

Get more for Screen 127 Tax Levy Student Loans Edit Definitions Tamus

- Promissory note term w joint ampampamp several liability canada form

- Oklahoma landlord and tenant acts form

- Commercial tenancies in ontario all ontario form

- Hereinafter referred to as quotfarmquot form

- Between hereinafter referred to as quotstablequot and form

- Whereas lessor is the owner of a certain brood mare described as form

- Credit applications nacm form

- Other accounts form

Find out other Screen 127 Tax Levy Student Loans Edit Definitions Tamus

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF