AR2220 Underpayment of Estimated Tax Form

What is the AR2220 Underpayment Of Estimated Tax

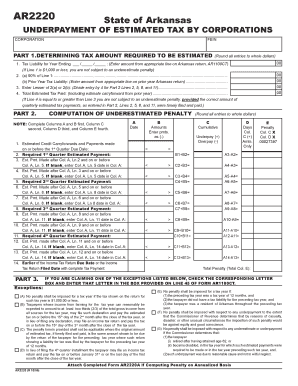

The AR2220 Underpayment Of Estimated Tax is a form used by taxpayers in the United States to report any underpayment of estimated taxes. This form is particularly relevant for individuals and businesses that do not withhold enough taxes throughout the year, leading to a tax liability. The AR2220 allows taxpayers to calculate the amount owed due to underpayment and helps them avoid penalties associated with insufficient tax payments. Understanding this form is crucial for maintaining compliance with tax obligations and ensuring accurate reporting to the IRS.

How to use the AR2220 Underpayment Of Estimated Tax

To effectively use the AR2220 Underpayment Of Estimated Tax, taxpayers should first gather their financial information, including income, deductions, and any previous estimated tax payments made during the year. The form guides users through calculating the total estimated tax liability and determining if any underpayment has occurred. It is essential to follow the instructions carefully, as accurate completion will ensure proper reporting and minimize potential penalties. Once completed, the form can be submitted along with any payment due.

Steps to complete the AR2220 Underpayment Of Estimated Tax

Completing the AR2220 involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Calculate your total estimated tax liability for the year.

- Determine the amount of tax already paid through withholding or estimated payments.

- Complete the form by filling in the required fields, including calculations for any underpayment.

- Review the form for accuracy before submission.

Following these steps will help ensure that the AR2220 is completed correctly and submitted on time.

Filing Deadlines / Important Dates

Filing deadlines for the AR2220 Underpayment Of Estimated Tax are crucial for compliance. Typically, taxpayers must submit this form by the due date of their annual tax return. For most individuals, this date is April 15. However, if taxpayers file for an extension, the deadline may be extended to October 15. It is important to stay informed about any changes to these dates, as they can vary based on specific circumstances or IRS updates.

Penalties for Non-Compliance

Failing to comply with the requirements of the AR2220 can result in significant penalties. The IRS may impose a penalty for underpayment of estimated tax, which is calculated based on the amount of underpayment and the length of time the payment is overdue. Additionally, interest may accrue on any unpaid balance, further increasing the total amount owed. Understanding these penalties emphasizes the importance of timely and accurate filing of the AR2220.

Who Issues the Form

The AR2220 Underpayment Of Estimated Tax is issued by the Arkansas Department of Finance and Administration. This state-level agency oversees tax administration and ensures compliance with state tax laws. Taxpayers should refer to the official guidelines provided by the department for the most accurate and up-to-date information regarding the form and its requirements.

Quick guide on how to complete ar2220 underpayment of estimated tax

Prepare [SKS] effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to adjust and eSign [SKS] easily

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select pertinent sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, time-consuming form searching, or errors that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choosing. Edit and eSign [SKS] to ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ar2220 underpayment of estimated tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the AR2220 Underpayment Of Estimated Tax form?

The AR2220 Underpayment Of Estimated Tax form is used by taxpayers in Arkansas to report any underpayment of estimated tax. This form helps ensure compliance with state tax laws and allows taxpayers to calculate any penalties or interest due. Understanding this form is crucial for accurate tax reporting and avoiding unnecessary fees.

-

How can airSlate SignNow assist with the AR2220 Underpayment Of Estimated Tax?

airSlate SignNow provides a seamless platform for eSigning and sending the AR2220 Underpayment Of Estimated Tax form. With our user-friendly interface, you can easily fill out and submit your tax documents electronically, saving time and reducing the risk of errors. Our solution ensures that your forms are securely signed and delivered.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our cost-effective solutions allow you to manage your documents, including the AR2220 Underpayment Of Estimated Tax, without breaking the bank. You can choose from monthly or annual subscriptions based on your usage requirements.

-

Are there any features specifically designed for tax document management?

Yes, airSlate SignNow includes features specifically designed for tax document management, such as templates for the AR2220 Underpayment Of Estimated Tax form. You can automate workflows, set reminders for deadlines, and track the status of your documents. These features streamline the process and help ensure timely submissions.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easy to manage your tax documents, including the AR2220 Underpayment Of Estimated Tax. This integration allows for efficient data transfer and helps maintain accurate records across platforms, enhancing your overall workflow.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, such as the AR2220 Underpayment Of Estimated Tax, offers numerous benefits. You gain access to a secure, efficient, and user-friendly platform that simplifies the signing process. Additionally, our solution helps reduce paper usage and enhances collaboration among team members.

-

Is airSlate SignNow compliant with tax regulations?

Yes, airSlate SignNow is designed to comply with relevant tax regulations, ensuring that your use of the AR2220 Underpayment Of Estimated Tax form meets legal standards. Our platform employs advanced security measures to protect sensitive information, giving you peace of mind when handling tax documents.

Get more for AR2220 Underpayment Of Estimated Tax

- Cost of attendance coa form

- University policy policy on policies form

- Undergraduate permit to study at american university form

- Internship registration form american university

- Request form american university

- Consent amp release form american university

- Download fall cap form american university

- Media services reserve materials deposit form

Find out other AR2220 Underpayment Of Estimated Tax

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe