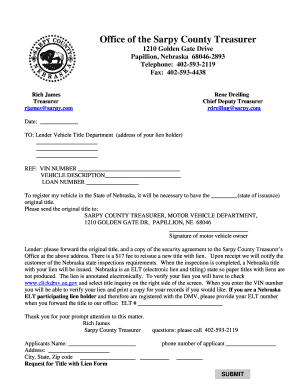

Office of the Sarpy County Treasurer Sarpy County Nebraska Form

Understanding the Office of the Sarpy County Treasurer in Sarpy County, Nebraska

The Office of the Sarpy County Treasurer is responsible for managing the county's finances, including the collection of property taxes and the distribution of funds to various government entities. This office plays a crucial role in ensuring that local services are funded and that financial records are maintained accurately. The Treasurer also oversees the investment of county funds, ensuring that they are managed prudently to benefit the community.

How to Utilize the Office of the Sarpy County Treasurer

Residents and businesses can engage with the Office of the Sarpy County Treasurer in several ways. For property tax payments, individuals can visit the office in person, use the official website for online payments, or send payments via mail. The office provides resources and assistance for understanding tax obligations and available payment options. Additionally, the Treasurer's office offers guidance on financial management and investment opportunities for county funds.

Steps to Complete Transactions with the Office of the Sarpy County Treasurer

To complete a transaction with the Office of the Sarpy County Treasurer, follow these steps:

- Gather necessary documents, such as property tax statements or identification.

- Choose a payment method: online, in-person, or by mail.

- If paying online, navigate to the official website and follow the prompts to complete your payment securely.

- For in-person payments, visit the office during business hours and present your documents to the staff.

- If mailing your payment, ensure it is sent to the correct address and includes all required information.

Required Documents for Transactions

When interacting with the Office of the Sarpy County Treasurer, specific documents may be required. Commonly needed items include:

- Property tax statements for payment processing.

- Identification or proof of residency for verification.

- Any forms related to exemptions or adjustments, if applicable.

Legal Use of the Office of the Sarpy County Treasurer

The Office of the Sarpy County Treasurer operates under state and local laws, ensuring compliance with financial regulations. This includes adhering to guidelines for tax collection, fund management, and public transparency. The office also provides information to residents about their rights and responsibilities regarding property taxes and financial obligations.

Eligibility Criteria for Services

Eligibility for services provided by the Office of the Sarpy County Treasurer generally includes:

- Property ownership within Sarpy County for tax-related services.

- Residency in Sarpy County for accessing local financial services.

- Compliance with state tax laws and regulations.

Quick guide on how to complete office of the sarpy county treasurer sarpy county nebraska

Manage [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed papers, as you can easily access the appropriate form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without any hold-ups. Handle [SKS] on any device using the airSlate SignNow Android or iOS applications, and enhance any document-based procedure today.

The simplest way to alter and eSign [SKS] with ease

- Obtain [SKS] and press Get Form to begin.

- Utilize the features we provide to fill out your document.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, by email, text message (SMS), invite link, or download it to your desktop.

Forget about lost or misfiled documents, cumbersome form searches, or mistakes that necessitate the printing of new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign [SKS] to guarantee excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Office Of The Sarpy County Treasurer Sarpy County Nebraska

Create this form in 5 minutes!

How to create an eSignature for the office of the sarpy county treasurer sarpy county nebraska

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What services does the Office Of The Sarpy County Treasurer in Sarpy County Nebraska provide?

The Office Of The Sarpy County Treasurer in Sarpy County Nebraska offers a range of services including property tax collection, vehicle registration, and financial management for the county. They ensure that all financial transactions are handled efficiently and transparently, providing essential services to residents and businesses alike.

-

How can I access services from the Office Of The Sarpy County Treasurer in Sarpy County Nebraska?

You can access services from the Office Of The Sarpy County Treasurer in Sarpy County Nebraska through their official website or by visiting their office in person. They provide online resources and forms to facilitate easy access to their services, making it convenient for residents to manage their financial obligations.

-

What are the benefits of using airSlate SignNow for document signing related to the Office Of The Sarpy County Treasurer in Sarpy County Nebraska?

Using airSlate SignNow for document signing related to the Office Of The Sarpy County Treasurer in Sarpy County Nebraska streamlines the process of signing and sending important documents. It offers a secure, user-friendly platform that saves time and reduces paperwork, ensuring that your transactions are completed efficiently.

-

Is there a cost associated with services from the Office Of The Sarpy County Treasurer in Sarpy County Nebraska?

Yes, there may be fees associated with certain services provided by the Office Of The Sarpy County Treasurer in Sarpy County Nebraska, such as property tax payments and vehicle registration. It's advisable to check their official website for detailed information on pricing and any applicable fees.

-

What features does airSlate SignNow offer that can benefit users interacting with the Office Of The Sarpy County Treasurer in Sarpy County Nebraska?

airSlate SignNow offers features such as customizable templates, secure eSigning, and real-time tracking of documents. These features enhance the user experience when dealing with the Office Of The Sarpy County Treasurer in Sarpy County Nebraska, ensuring that all documents are processed quickly and securely.

-

Can I integrate airSlate SignNow with other tools for my transactions with the Office Of The Sarpy County Treasurer in Sarpy County Nebraska?

Yes, airSlate SignNow can be integrated with various tools and applications to facilitate smoother transactions with the Office Of The Sarpy County Treasurer in Sarpy County Nebraska. This integration allows users to manage their documents more effectively and ensures that all necessary information is readily available.

-

How does airSlate SignNow ensure the security of documents related to the Office Of The Sarpy County Treasurer in Sarpy County Nebraska?

airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect documents related to the Office Of The Sarpy County Treasurer in Sarpy County Nebraska. This ensures that sensitive information remains confidential and secure throughout the signing process.

Get more for Office Of The Sarpy County Treasurer Sarpy County Nebraska

- Membership application college of central florida form

- Keepsakesform6 doc

- 6799 complete application daytonastate form

- Reclassification affidavit daytona state college form

- Guardianship verification daytona state college daytonastate form

- Office of admissions international student admissions form

- Technical report and resource estimate on the alous copper form

- Aa 1d 2 14 indd reginfo gov reginfo form

Find out other Office Of The Sarpy County Treasurer Sarpy County Nebraska

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP