1120 a Irs Form

What is the 1120 A Irs

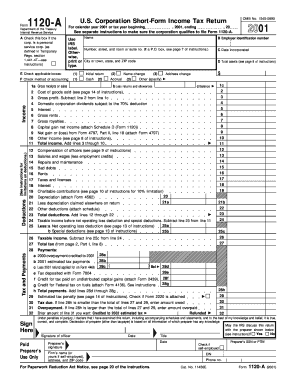

The 1120 A form is a simplified version of the U.S. Corporation Income Tax Return, specifically designed for certain types of corporations. This form allows eligible corporations to report their income, gains, losses, deductions, and credits to the Internal Revenue Service (IRS). It is primarily used by corporations that meet specific criteria, such as those with a limited amount of income and assets. Understanding the purpose of the 1120 A is essential for compliance with federal tax regulations.

How to use the 1120 A Irs

Using the 1120 A form involves several key steps. First, ensure that your corporation qualifies to use this form based on its income and asset thresholds. Next, gather all necessary financial documents, including income statements and expense reports. Complete the form accurately by entering the required information, such as total income and deductions. Finally, review the completed form for accuracy before submitting it to the IRS by the designated deadline.

Steps to complete the 1120 A Irs

Completing the 1120 A form requires careful attention to detail. Follow these steps:

- Determine eligibility based on income and asset limits.

- Collect financial records, including income, expenses, and previous tax returns.

- Fill out the form, ensuring all sections are completed correctly.

- Review the form for any errors or omissions.

- Submit the form to the IRS by the appropriate deadline.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the 1120 A form. Generally, the due date for filing is the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is April 15. It is important to stay informed about any changes to deadlines or extensions that may apply.

Required Documents

To complete the 1120 A form, certain documents are necessary. These typically include:

- Income statements detailing revenue earned.

- Expense reports outlining costs incurred during the tax year.

- Previous tax returns for reference.

- Documentation supporting any deductions or credits claimed.

Penalties for Non-Compliance

Failing to file the 1120 A form on time or submitting inaccurate information can result in significant penalties. The IRS may impose fines for late filing, which can increase over time. Additionally, incorrect reporting may lead to audits or further scrutiny. It is crucial for corporations to ensure compliance to avoid these potential repercussions.

Quick guide on how to complete 1120 a irs

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained popularity among organizations and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The Easiest Way to Modify and eSign [SKS] with Ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specially offers for this purpose.

- Design your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you want to share your form, via email, text message (SMS), or an invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors requiring new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your selected device. Edit and eSign [SKS] and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 1120 A Irs

Create this form in 5 minutes!

How to create an eSignature for the 1120 a irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1120 A IRS form and why is it important?

The 1120 A IRS form is a simplified version of the corporate income tax return for certain corporations. It is important because it allows eligible corporations to report their income, deductions, and tax liability in a straightforward manner, ensuring compliance with IRS regulations.

-

How can airSlate SignNow help with the 1120 A IRS form?

airSlate SignNow streamlines the process of completing and eSigning the 1120 A IRS form. Our platform allows users to easily fill out the form, gather necessary signatures, and securely send it to the IRS, all while maintaining compliance and efficiency.

-

What features does airSlate SignNow offer for managing the 1120 A IRS form?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for the 1120 A IRS form. These features enhance user experience by simplifying the filing process and ensuring that all necessary steps are completed accurately.

-

Is airSlate SignNow cost-effective for filing the 1120 A IRS form?

Yes, airSlate SignNow provides a cost-effective solution for businesses needing to file the 1120 A IRS form. Our pricing plans are designed to accommodate various business sizes, ensuring that you get the best value for your document management needs.

-

Can I integrate airSlate SignNow with other software for the 1120 A IRS form?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, making it easy to manage the 1120 A IRS form alongside your existing tools. This integration helps streamline your workflow and reduces the chances of errors during the filing process.

-

What are the benefits of using airSlate SignNow for the 1120 A IRS form?

Using airSlate SignNow for the 1120 A IRS form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled securely while allowing for quick access and easy collaboration.

-

How secure is airSlate SignNow when handling the 1120 A IRS form?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your 1120 A IRS form and other sensitive documents. You can trust that your information is safe while using our platform for eSigning and document management.

Get more for 1120 A Irs

- Human resource management form

- Information release agreement

- Parental consent and authorization1 rev doc form

- Read the text prior to start of seminar doane college form

- Pre 111 ethics form

- State form 49607 r4 9 11

- Fillable online utm registration form university of

- 7 restraining order washington state courts form

Find out other 1120 A Irs

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself