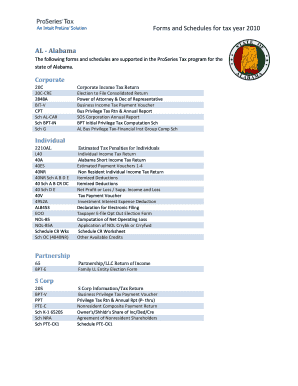

Forms and Schedules for Tax Year AL Alabama the Following Forms and Schedules Are Supported in the ProSeries Tax Program for the

Understanding the Forms and Schedules for Tax Year AL

The Forms and Schedules for Tax Year AL represent the essential documents required for filing taxes in Alabama. These forms are tailored to meet the specific needs of Alabama taxpayers and ensure compliance with state tax regulations. The ProSeries Tax Program supports a variety of these forms, enabling users to efficiently complete their tax returns. Familiarity with these forms is crucial for accurate tax reporting and maximizing potential deductions.

How to Use the Forms and Schedules for Tax Year AL

Using the Forms and Schedules for Tax Year AL involves several steps that facilitate the accurate completion of your tax return. Begin by gathering all necessary financial documents, including W-2s, 1099s, and any relevant receipts. Next, select the appropriate forms for your tax situation, which can include individual income tax forms, schedules for deductions, and credits. The ProSeries Tax Program simplifies this process by guiding users through the selection and completion of each required form.

Steps to Complete the Forms and Schedules for Tax Year AL

Completing the Forms and Schedules for Tax Year AL requires careful attention to detail. Start by entering your personal information accurately, including your name, address, and Social Security number. Proceed to report your income from various sources, ensuring that all figures are consistent with your documentation. Next, calculate any deductions and credits you may qualify for, using the appropriate schedules. Finally, review your completed forms for accuracy before submitting them to avoid potential delays or penalties.

Key Elements of the Forms and Schedules for Tax Year AL

Key elements of the Forms and Schedules for Tax Year AL include various sections designed to capture essential tax information. These elements typically encompass personal identification details, income reporting sections, and areas for deductions and credits. Understanding these components is vital for ensuring that all necessary information is included and accurately reported. Each form may also have specific instructions that outline how to fill them out correctly, which can be found within the ProSeries Tax Program.

Filing Deadlines for the Forms and Schedules for Tax Year AL

Filing deadlines for the Forms and Schedules for Tax Year AL are crucial for compliance with state tax regulations. Generally, Alabama residents must file their state tax returns by April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to these deadlines to avoid late fees and penalties. The ProSeries Tax Program provides reminders and alerts to help users stay on track with their filing obligations.

Required Documents for the Forms and Schedules for Tax Year AL

To complete the Forms and Schedules for Tax Year AL, certain documents are required. These typically include income statements such as W-2 forms from employers, 1099 forms for freelance or contract work, and documentation for any deductions you plan to claim, such as mortgage interest statements or medical expense receipts. Having these documents organized and readily available will streamline the process of filling out your tax forms and ensure accuracy in your reporting.

Digital vs. Paper Version of the Forms and Schedules for Tax Year AL

The choice between digital and paper versions of the Forms and Schedules for Tax Year AL can impact the filing process. Digital forms, available through the ProSeries Tax Program, offer convenience and efficiency, allowing for easy calculations and electronic submission. In contrast, paper forms require manual completion and mailing, which can lead to delays. Digital filing is generally recommended for its speed and ease of use, helping taxpayers meet deadlines more effectively.

Quick guide on how to complete forms and schedules for tax year al alabama the following forms and schedules are supported in the proseries tax program for

Effortlessly Prepare [SKS] on Any Device

The management of online documents has become increasingly popular among organizations and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed paperwork, allowing you to find the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and Electronically Sign [SKS] with Ease

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize relevant sections of your documents or mask sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose your preferred method to deliver your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the frustration of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your preference. Edit and electronically sign [SKS] to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Forms And Schedules For Tax Year AL Alabama The Following Forms And Schedules Are Supported In The ProSeries Tax Program For The

Create this form in 5 minutes!

How to create an eSignature for the forms and schedules for tax year al alabama the following forms and schedules are supported in the proseries tax program for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What forms and schedules are included for tax year AL in the ProSeries Tax Program?

The ProSeries Tax Program supports a comprehensive range of forms and schedules for tax year AL, Alabama. This includes essential documents such as the 40, 40A, and various schedules that cater to individual and business tax needs. By utilizing these forms and schedules, users can ensure compliance with Alabama tax regulations.

-

How does airSlate SignNow integrate with the ProSeries Tax Program?

airSlate SignNow seamlessly integrates with the ProSeries Tax Program, allowing users to eSign and send documents directly within the platform. This integration enhances workflow efficiency, making it easier to manage Forms And Schedules For Tax Year AL, Alabama. Users can streamline their tax preparation process while ensuring all necessary documents are signed and submitted on time.

-

What are the pricing options for using airSlate SignNow with ProSeries?

airSlate SignNow offers flexible pricing plans that cater to various business needs, ensuring cost-effectiveness when managing Forms And Schedules For Tax Year AL, Alabama. Users can choose from monthly or annual subscriptions, with options that scale based on the number of users and features required. This allows businesses to find a plan that fits their budget while accessing essential tax tools.

-

Can I customize the forms and schedules for my specific tax needs?

Yes, airSlate SignNow allows users to customize forms and schedules to meet their specific tax requirements. This feature is particularly beneficial for managing Forms And Schedules For Tax Year AL, Alabama, as it enables users to tailor documents according to their unique situations. Customization ensures that all necessary information is captured accurately for tax filing.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management offers numerous benefits, including enhanced security, ease of use, and efficient workflow. By leveraging this platform, businesses can effectively manage Forms And Schedules For Tax Year AL, Alabama, ensuring that all documents are securely signed and stored. This not only saves time but also reduces the risk of errors in tax submissions.

-

Is there customer support available for users of airSlate SignNow?

Absolutely! airSlate SignNow provides robust customer support to assist users with any questions or issues they may encounter. Whether you need help with Forms And Schedules For Tax Year AL, Alabama, or technical support, the dedicated team is available to ensure a smooth experience. Users can access support via chat, email, or phone.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your tax documents by implementing advanced encryption and security protocols. This ensures that all Forms And Schedules For Tax Year AL, Alabama, are protected from unauthorized access. Users can confidently manage their sensitive tax information, knowing that it is secure throughout the signing and storage process.

Get more for Forms And Schedules For Tax Year AL Alabama The Following Forms And Schedules Are Supported In The ProSeries Tax Program For The

- Communication and interaction with me in the future in only a business like and professional form

- Rental of or otherwise make unavailable or deny a dwelling to any person because of race color religion form

- Furthermore my security deposit must be form

- Situation immediately you will leave me no choice but to evict you from the premises form

- Do so will result in your eviction from the premises for violation of our lease agreement form

- Condition and should have and did recognize it as dangerous form

- Of the lease form

- Please call if you have any questions form

Find out other Forms And Schedules For Tax Year AL Alabama The Following Forms And Schedules Are Supported In The ProSeries Tax Program For The

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation