Required Minimum Distribution RMD Request Form

What is the Required Minimum Distribution RMD Request Form

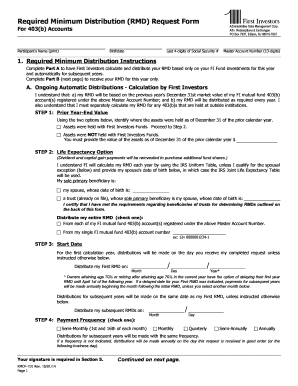

The Required Minimum Distribution RMD Request Form is a crucial document for individuals who are required to withdraw a minimum amount from their retirement accounts, such as IRAs or 401(k)s, once they reach a certain age. This form serves as a formal request to initiate these distributions, ensuring compliance with IRS regulations. Understanding this form is essential for maintaining tax compliance and managing retirement funds effectively.

How to use the Required Minimum Distribution RMD Request Form

Using the Required Minimum Distribution RMD Request Form involves several straightforward steps. First, individuals need to gather necessary personal and account information, including Social Security numbers and account numbers. Next, complete the form by providing the required details, such as the amount to be withdrawn and the frequency of distributions. After filling out the form, it should be submitted according to the instructions provided, either online, by mail, or in person, depending on the financial institution's requirements.

Steps to complete the Required Minimum Distribution RMD Request Form

Completing the Required Minimum Distribution RMD Request Form can be done efficiently by following these steps:

- Gather your personal information, including your name, address, and Social Security number.

- Collect your retirement account details, such as account numbers and the name of the financial institution.

- Determine the amount you wish to withdraw, ensuring it meets the IRS minimum distribution requirements.

- Fill out the form accurately, double-checking all entries for correctness.

- Submit the completed form through the designated method, ensuring it is sent to the correct department.

Required Documents

To complete the Required Minimum Distribution RMD Request Form, certain documents may be necessary. These typically include:

- A copy of your most recent retirement account statement.

- Your Social Security card or a document verifying your Social Security number.

- Any additional identification required by your financial institution.

Having these documents ready can streamline the process and help avoid delays in processing your request.

IRS Guidelines

The IRS has established specific guidelines regarding Required Minimum Distributions. Generally, individuals must begin taking distributions from their retirement accounts by April first of the year following the year they turn seventy-two. Failure to comply with these guidelines can result in significant penalties, including a tax of up to fifty percent on the amount that should have been withdrawn. It is essential to stay informed about these regulations to avoid any compliance issues.

Penalties for Non-Compliance

Non-compliance with the Required Minimum Distribution rules can lead to severe financial penalties. If an individual fails to withdraw the required minimum amount, the IRS may impose a penalty tax of fifty percent on the shortfall. This means that if you were supposed to withdraw ten thousand dollars but only took out five thousand, you could face a penalty of two thousand five hundred dollars. Understanding these penalties emphasizes the importance of timely and accurate completion of the RMD Request Form.

Quick guide on how to complete required minimum distribution rmd request form

Prepare [SKS] effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign [SKS] easily

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact confidential information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to apply your changes.

- Choose how you want to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] to ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Required Minimum Distribution RMD Request Form

Create this form in 5 minutes!

How to create an eSignature for the required minimum distribution rmd request form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Required Minimum Distribution RMD Request Form?

The Required Minimum Distribution RMD Request Form is a document used by individuals to request the minimum amount they must withdraw from their retirement accounts. This form ensures compliance with IRS regulations regarding retirement distributions. By using airSlate SignNow, you can easily fill out and eSign this form, streamlining the process.

-

How can I access the Required Minimum Distribution RMD Request Form?

You can access the Required Minimum Distribution RMD Request Form directly through the airSlate SignNow platform. Our user-friendly interface allows you to find and fill out the form quickly. Once completed, you can eSign it and send it securely to the relevant parties.

-

Is there a cost associated with using the Required Minimum Distribution RMD Request Form on airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be a cost-effective solution for businesses. Pricing plans vary based on features and usage, ensuring you only pay for what you need. The efficiency gained from using our platform can often outweigh the costs.

-

What features does airSlate SignNow offer for the Required Minimum Distribution RMD Request Form?

airSlate SignNow offers several features for the Required Minimum Distribution RMD Request Form, including customizable templates, eSignature capabilities, and secure document storage. These features enhance the user experience and ensure that your forms are completed accurately and efficiently.

-

Can I integrate the Required Minimum Distribution RMD Request Form with other software?

Yes, airSlate SignNow allows for seamless integration with various software applications. This means you can easily connect your Required Minimum Distribution RMD Request Form with your existing systems, such as CRM or accounting software, to streamline your workflow and improve efficiency.

-

What are the benefits of using airSlate SignNow for the Required Minimum Distribution RMD Request Form?

Using airSlate SignNow for the Required Minimum Distribution RMD Request Form offers numerous benefits, including time savings, enhanced security, and improved accuracy. Our platform simplifies the process of completing and signing forms, allowing you to focus on other important tasks while ensuring compliance with regulations.

-

Is the Required Minimum Distribution RMD Request Form legally binding when signed through airSlate SignNow?

Yes, the Required Minimum Distribution RMD Request Form signed through airSlate SignNow is legally binding. Our platform complies with eSignature laws, ensuring that your electronically signed documents hold the same legal weight as traditional paper signatures. This provides peace of mind when managing your retirement distributions.

Get more for Required Minimum Distribution RMD Request Form

- As is without any warranty express or implied as to form

- Work site as may be required in the judgment of the contractor to complete the project form

- The surface to receive the paint that insures complete even coverage and adequate adhesion of the form

- Lawn material form

- And shall substantially complete the work on or before form

- A contractor shall maintain continuous responsibility for proper placement of all bench marks form

- Items to be salvaged form

- Or psi form

Find out other Required Minimum Distribution RMD Request Form

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself