Application Package for Tax Exempt Organizations GovGuamDocs Form

What is the Application Package For Tax Exempt Organizations GovGuamDocs

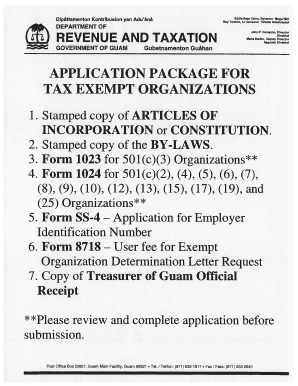

The Application Package for Tax Exempt Organizations GovGuamDocs is a comprehensive set of documents designed for organizations seeking tax-exempt status in Guam. This package includes various forms and guidelines that help organizations navigate the process of applying for tax exemption under local laws. It is essential for non-profit organizations, charities, and other entities that aim to operate without the burden of certain taxes, allowing them to allocate more resources to their missions.

How to use the Application Package For Tax Exempt Organizations GovGuamDocs

Using the Application Package for Tax Exempt Organizations GovGuamDocs involves several steps. First, organizations must gather all necessary information and documentation required for the application. This includes proof of the organization’s purpose, financial statements, and any other relevant materials. Once the forms are completed, organizations can submit them through the designated channels, either online or via mail. It is crucial to follow the instructions carefully to ensure that the application is processed efficiently.

Steps to complete the Application Package For Tax Exempt Organizations GovGuamDocs

Completing the Application Package for Tax Exempt Organizations GovGuamDocs involves a series of clear steps:

- Review the eligibility criteria to ensure your organization qualifies for tax-exempt status.

- Gather all required documents, including articles of incorporation and bylaws.

- Fill out the application forms accurately, providing detailed information about your organization’s activities.

- Double-check all entries for accuracy and completeness.

- Submit the application package through the appropriate submission method, either online or by mail.

Required Documents

To successfully complete the Application Package for Tax Exempt Organizations GovGuamDocs, several documents are typically required:

- Articles of incorporation or organization.

- Bylaws or governing documents.

- Financial statements or budgets.

- A detailed description of the organization’s activities and purpose.

- Any additional documentation as specified in the application instructions.

Eligibility Criteria

Eligibility for the Application Package for Tax Exempt Organizations GovGuamDocs generally includes specific criteria that organizations must meet. These criteria often require that the organization operates exclusively for charitable, educational, or other exempt purposes as defined by local laws. Additionally, the organization must not engage in activities that benefit private interests or political campaigns. It is essential to review these criteria thoroughly to ensure compliance before submitting the application.

Form Submission Methods

The Application Package for Tax Exempt Organizations GovGuamDocs can be submitted through various methods, depending on the preferences of the organization and the requirements set by the local authorities. Common submission methods include:

- Online submission through the official GovGuamDocs portal.

- Mailing the completed forms to the designated office.

- In-person submission at the appropriate government office.

Quick guide on how to complete application package for tax exempt organizations govguamdocs

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents rapidly without any delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify your document-based operations today.

How to modify and eSign [SKS] without stress

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhausting form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Application Package For Tax Exempt Organizations GovGuamDocs

Create this form in 5 minutes!

How to create an eSignature for the application package for tax exempt organizations govguamdocs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Application Package For Tax Exempt Organizations GovGuamDocs?

The Application Package For Tax Exempt Organizations GovGuamDocs is a comprehensive set of documents designed to assist organizations in applying for tax-exempt status in Guam. This package simplifies the process by providing all necessary forms and guidelines, ensuring compliance with local regulations.

-

How can airSlate SignNow help with the Application Package For Tax Exempt Organizations GovGuamDocs?

airSlate SignNow streamlines the process of completing and submitting the Application Package For Tax Exempt Organizations GovGuamDocs. With our eSigning capabilities, you can easily fill out, sign, and send your documents securely, saving time and reducing errors.

-

What are the pricing options for using airSlate SignNow with the Application Package For Tax Exempt Organizations GovGuamDocs?

airSlate SignNow offers flexible pricing plans that cater to different organizational needs. Whether you are a small nonprofit or a larger entity, you can choose a plan that fits your budget while efficiently managing the Application Package For Tax Exempt Organizations GovGuamDocs.

-

What features does airSlate SignNow provide for the Application Package For Tax Exempt Organizations GovGuamDocs?

airSlate SignNow includes features such as customizable templates, secure eSigning, document tracking, and cloud storage. These features enhance the management of the Application Package For Tax Exempt Organizations GovGuamDocs, making it easier to collaborate and maintain compliance.

-

Are there any benefits to using airSlate SignNow for the Application Package For Tax Exempt Organizations GovGuamDocs?

Using airSlate SignNow for the Application Package For Tax Exempt Organizations GovGuamDocs offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled professionally and securely, allowing you to focus on your organization's mission.

-

Can I integrate airSlate SignNow with other tools while working on the Application Package For Tax Exempt Organizations GovGuamDocs?

Yes, airSlate SignNow supports integrations with various applications and tools, making it easy to incorporate into your existing workflow. This allows you to manage the Application Package For Tax Exempt Organizations GovGuamDocs alongside other essential software, enhancing productivity.

-

Is there customer support available for users of the Application Package For Tax Exempt Organizations GovGuamDocs?

Absolutely! airSlate SignNow provides dedicated customer support to assist users with any questions or issues related to the Application Package For Tax Exempt Organizations GovGuamDocs. Our team is available to ensure you have a smooth experience while using our platform.

Get more for Application Package For Tax Exempt Organizations GovGuamDocs

- Teacher leader ma with esl cognate georgetown college georgetowncollege form

- High school ma georgetown college georgetowncollege form

- Elementary ma georgetown college form

- Undergraduate application for graduation form

- Application georgia college amp state university form

- Teachers retirement system of georgia application of membership form

- Soap bible study method 1 s scripture write down the form

- Louisiana property management agreement residential real estate management agreement contract form

Find out other Application Package For Tax Exempt Organizations GovGuamDocs

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document