Non Tax Filer Form 10 the New School Newschool

What is the Non Tax Filer Form 10 The New School Newschool

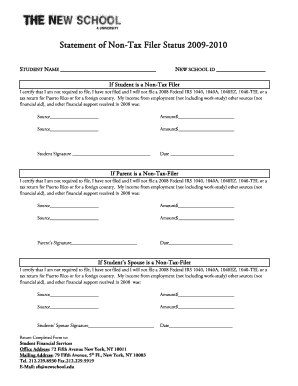

The Non Tax Filer Form 10 is a specific document utilized by students at The New School who do not have a tax filing requirement. This form is essential for individuals who may need to provide proof of income or financial status for various purposes, including financial aid applications or enrollment verification. It serves as a declaration that the individual has not filed a tax return for the specified year, which can be crucial for maintaining eligibility for certain programs or benefits.

How to obtain the Non Tax Filer Form 10 The New School Newschool

To obtain the Non Tax Filer Form 10, students can visit The New School's official website or contact the financial aid office directly. The form may be available for download in a PDF format, allowing for easy access and completion. Additionally, students can inquire about the form during advising sessions or through student services, ensuring they receive the correct version and any necessary instructions for submission.

Steps to complete the Non Tax Filer Form 10 The New School Newschool

Completing the Non Tax Filer Form 10 involves several straightforward steps:

- Download the form from The New School's website or obtain a physical copy from the financial aid office.

- Fill in personal information, including your name, student ID, and contact details.

- Indicate the tax year for which you are declaring non-filing status.

- Provide any required supporting documentation, such as proof of income or financial statements, if applicable.

- Review the completed form for accuracy before signing and dating it.

Once completed, the form should be submitted according to the instructions provided, either online, by mail, or in person.

Legal use of the Non Tax Filer Form 10 The New School Newschool

The Non Tax Filer Form 10 is legally recognized as a valid document for confirming non-filing status. It is often required by educational institutions for financial aid assessments and can be used in various contexts where proof of income or financial status is necessary. Students must ensure that the information provided on the form is accurate and truthful to comply with legal standards and avoid potential penalties.

Eligibility Criteria

Eligibility to use the Non Tax Filer Form 10 typically includes:

- Students enrolled at The New School who have not filed a tax return for the specified year.

- Individuals who meet specific income thresholds that exempt them from filing requirements.

- Students seeking financial aid or other benefits that require proof of non-filing status.

It is essential for students to confirm their eligibility before completing the form to ensure compliance with institutional requirements.

Required Documents

When filling out the Non Tax Filer Form 10, students may need to provide certain supporting documents. These can include:

- Proof of income, such as pay stubs or bank statements, if applicable.

- Any relevant financial aid documentation that supports the need for the form.

- Identification documents, such as a student ID or Social Security number, to verify identity.

Gathering these documents in advance can facilitate a smoother completion and submission process.

Quick guide on how to complete non tax filer form 10 the new school newschool

Accomplish [SKS] effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to easily locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, amend, and electronically sign your documents swiftly without any hiccups. Manage [SKS] on any operating system utilizing airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign [SKS] smoothly

- Locate [SKS] and click on Get Form to begin.

- Utilize the features we provide to complete your document.

- Mark important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign [SKS] and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Non Tax Filer Form 10 The New School Newschool

Create this form in 5 minutes!

How to create an eSignature for the non tax filer form 10 the new school newschool

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Non Tax Filer Form 10 The New School Newschool?

The Non Tax Filer Form 10 The New School Newschool is a specific document required for students who do not file taxes. This form helps verify income status for financial aid and enrollment purposes. Completing this form accurately is essential for ensuring eligibility for various programs.

-

How can I access the Non Tax Filer Form 10 The New School Newschool?

You can easily access the Non Tax Filer Form 10 The New School Newschool through the official New School website or directly from the airSlate SignNow platform. Our user-friendly interface allows you to download and fill out the form seamlessly. Ensure you have all necessary information ready to expedite the process.

-

What are the benefits of using airSlate SignNow for the Non Tax Filer Form 10 The New School Newschool?

Using airSlate SignNow for the Non Tax Filer Form 10 The New School Newschool offers numerous benefits, including easy document signing and secure storage. Our platform ensures that your information is protected while providing a streamlined process for submitting your form. Additionally, you can track the status of your submission in real-time.

-

Is there a cost associated with using airSlate SignNow for the Non Tax Filer Form 10 The New School Newschool?

airSlate SignNow offers a cost-effective solution for managing the Non Tax Filer Form 10 The New School Newschool. We provide various pricing plans to suit different needs, including a free trial for new users. This allows you to explore our features without any initial investment.

-

Can I integrate airSlate SignNow with other applications for the Non Tax Filer Form 10 The New School Newschool?

Yes, airSlate SignNow supports integrations with various applications, making it easier to manage the Non Tax Filer Form 10 The New School Newschool alongside your other tools. You can connect with popular platforms like Google Drive, Dropbox, and more. This integration enhances your workflow and document management efficiency.

-

What features does airSlate SignNow offer for the Non Tax Filer Form 10 The New School Newschool?

airSlate SignNow provides a range of features for the Non Tax Filer Form 10 The New School Newschool, including electronic signatures, document templates, and real-time collaboration. These features simplify the process of completing and submitting your form. Additionally, our platform allows for easy tracking and management of your documents.

-

How secure is my information when using airSlate SignNow for the Non Tax Filer Form 10 The New School Newschool?

Security is a top priority at airSlate SignNow. When using our platform for the Non Tax Filer Form 10 The New School Newschool, your information is protected with advanced encryption and secure storage solutions. We comply with industry standards to ensure that your data remains confidential and safe.

Get more for Non Tax Filer Form 10 The New School Newschool

- North dakota state university conflict of interest disclosure statement form

- 4 h sheep breeding project lifetime record form

- Guidelines for international travel form

- Preschool development and routine form

- Family weekend ndsu ndsu form

- January 28 ferpa responsibilities for faculty and staffoffice of form

- Student recital rehearsal request docx form

- Master39s degree plan of study and supervisory committee form

Find out other Non Tax Filer Form 10 The New School Newschool

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT