Ohio Schedule E Nonrefundable Business Credits Tax Ohio Form

What is the Ohio Schedule E Nonrefundable Business Credits Tax Ohio

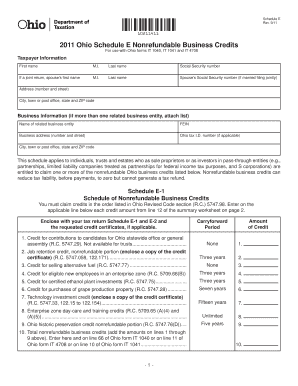

The Ohio Schedule E Nonrefundable Business Credits Tax is a form used by businesses operating in Ohio to claim nonrefundable tax credits. These credits can reduce the amount of tax owed but cannot result in a refund if they exceed the tax liability. This form is essential for businesses looking to take advantage of various tax incentives provided by the state, aimed at encouraging economic growth and investment.

How to use the Ohio Schedule E Nonrefundable Business Credits Tax Ohio

To effectively use the Ohio Schedule E Nonrefundable Business Credits Tax, businesses must first determine their eligibility for available credits. After identifying applicable credits, businesses should complete the form by accurately reporting income, expenses, and any credits being claimed. It is crucial to follow the specific instructions provided with the form to ensure compliance with state tax regulations.

Steps to complete the Ohio Schedule E Nonrefundable Business Credits Tax Ohio

Completing the Ohio Schedule E Nonrefundable Business Credits Tax involves several key steps:

- Gather necessary financial documents, including income statements and expense reports.

- Identify the specific nonrefundable business credits for which you qualify.

- Fill out the form by entering all required information accurately.

- Review the completed form for any errors or omissions.

- Submit the form along with your state tax return by the designated deadline.

Eligibility Criteria

Eligibility for the Ohio Schedule E Nonrefundable Business Credits Tax depends on various factors, including the type of business entity, the nature of the business activities, and compliance with state regulations. Businesses must operate within Ohio and meet specific requirements outlined in the state's tax code to qualify for the credits available on this form.

Required Documents

When completing the Ohio Schedule E Nonrefundable Business Credits Tax, businesses need to prepare several documents to support their claims. These may include:

- Financial statements, such as profit and loss statements.

- Tax returns from previous years.

- Documentation of any business expenses related to the credits being claimed.

- Proof of eligibility for specific credits, such as certificates or approvals from state agencies.

Filing Deadlines / Important Dates

Filing deadlines for the Ohio Schedule E Nonrefundable Business Credits Tax typically align with the state tax return deadlines. Businesses must ensure they submit the form by the due date to avoid penalties. Important dates include the annual tax return deadline, which is usually April 15, and any extensions that may apply for specific circumstances.

Quick guide on how to complete ohio schedule e nonrefundable business credits tax ohio

Effortlessly Create [SKS] on Any Device

Digital document management has gained traction among enterprises and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct format and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without hold-ups. Manage [SKS] across any platform using the airSlate SignNow apps for Android or iOS and enhance any document-centric workflow today.

How to Modify and eSign [SKS] with Ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional hand-written signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or an invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Ohio Schedule E Nonrefundable Business Credits Tax Ohio

Create this form in 5 minutes!

How to create an eSignature for the ohio schedule e nonrefundable business credits tax ohio

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Ohio Schedule E Nonrefundable Business Credits?

Ohio Schedule E Nonrefundable Business Credits are tax credits available to businesses operating in Ohio. These credits can help reduce the overall tax liability for eligible businesses, making it essential for business owners to understand how to claim them effectively.

-

How can airSlate SignNow assist with Ohio Schedule E Nonrefundable Business Credits?

airSlate SignNow provides an efficient platform for businesses to manage their documentation related to Ohio Schedule E Nonrefundable Business Credits. By streamlining the eSigning process, businesses can ensure timely submissions and compliance with tax regulations.

-

What features does airSlate SignNow offer for tax documentation?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are crucial for managing Ohio Schedule E Nonrefundable Business Credits. These features help businesses maintain organization and ensure that all necessary documents are completed accurately.

-

Is there a cost associated with using airSlate SignNow for tax purposes?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. The cost is competitive and provides excellent value, especially for businesses looking to simplify their processes related to Ohio Schedule E Nonrefundable Business Credits.

-

Can airSlate SignNow integrate with other accounting software?

Absolutely! airSlate SignNow can seamlessly integrate with popular accounting software, enhancing your ability to manage Ohio Schedule E Nonrefundable Business Credits. This integration allows for a smoother workflow and better data management across platforms.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow can signNowly enhance your business's efficiency by simplifying the document signing process. This is particularly beneficial when dealing with Ohio Schedule E Nonrefundable Business Credits, as it ensures that all necessary forms are signed and submitted promptly.

-

How secure is airSlate SignNow for handling sensitive tax documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive tax documents. This is crucial for businesses managing Ohio Schedule E Nonrefundable Business Credits, ensuring that all information remains confidential and secure.

Get more for Ohio Schedule E Nonrefundable Business Credits Tax Ohio

- Professionalism northeastern university northeastern form

- 11 foundation year guidance counselor report to the applicant after completing all the relevant questions below give this form

- Fax completed form to nu hrm benefits department at northeastern

- Form ip 45 03 occar ea application form

- Occar ea application form

- Form ssa 3441 bk fill online printable fillable

- State form 49607 application birth certificatepdf

- Form 2g guidelines for completing offer to purchase

Find out other Ohio Schedule E Nonrefundable Business Credits Tax Ohio

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement