IRS Form 8718 AMWA, Southwest Chapter Amwasouthwest

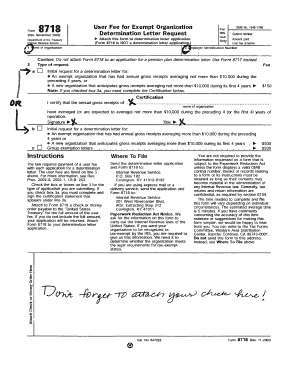

Understanding IRS Form 8718

IRS Form 8718 is a crucial document for organizations seeking recognition as tax-exempt under Section 501(c)(3) of the Internal Revenue Code. This form is specifically designed for the American Medical Writers Association (AMWA), Southwest Chapter, to facilitate its application for tax-exempt status. By completing this form, the chapter can confirm its eligibility and ensure compliance with federal regulations, which is essential for maintaining its nonprofit status.

Steps to Complete IRS Form 8718

Completing IRS Form 8718 involves several important steps. First, gather all necessary information about your organization, including its mission, activities, and financial data. Next, carefully fill out the form, ensuring that all sections are completed accurately. Pay particular attention to the narrative sections where you describe your organization's purpose and activities. After completing the form, review it for accuracy before submitting it to the IRS. It is advisable to keep a copy for your records.

Obtaining IRS Form 8718

IRS Form 8718 can be obtained directly from the IRS website. It is available as a downloadable PDF, which can be printed and filled out manually. Alternatively, organizations may find the form through various nonprofit resources that provide guidance on tax-exempt applications. Ensure that you are using the most current version of the form to avoid any processing delays.

Legal Use of IRS Form 8718

The legal use of IRS Form 8718 is tied to the application for tax-exempt status. Organizations must use this form to demonstrate their compliance with federal tax laws. It is essential to provide truthful and accurate information, as any discrepancies can lead to delays or denials of tax-exempt status. Understanding the legal implications of the information provided is crucial for maintaining compliance with IRS regulations.

Filing Deadlines for IRS Form 8718

Filing deadlines for IRS Form 8718 are critical for organizations seeking timely recognition of their tax-exempt status. Generally, the form should be submitted within 27 months of the organization’s formation to qualify for retroactive tax-exempt status. Missing this deadline can result in the loss of potential tax benefits, so it is essential to be aware of these timelines and plan accordingly.

Required Documents for IRS Form 8718

When submitting IRS Form 8718, organizations must include several supporting documents. These typically include a copy of the organization’s articles of incorporation, bylaws, and a detailed description of its activities. Financial statements and a narrative that outlines the organization’s purpose and programs may also be required. Ensuring that all necessary documents are included with the form can help streamline the approval process.

Quick guide on how to complete irs form 8718 amwa southwest chapter amwasouthwest

Complete [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed materials, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the resources needed to develop, modify, and eSign your documents swiftly without interruptions. Manage [SKS] on any device using airSlate SignNow Android or iOS applications and streamline any document-centric process today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize signNow sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which only takes seconds and holds the same legal status as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searches, or mistakes that require new document copies to be printed. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choice. Edit and eSign [SKS] to ensure effective communication at any step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to IRS Form 8718 AMWA, Southwest Chapter Amwasouthwest

Create this form in 5 minutes!

How to create an eSignature for the irs form 8718 amwa southwest chapter amwasouthwest

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 8718 AMWA, Southwest Chapter Amwasouthwest?

IRS Form 8718 AMWA, Southwest Chapter Amwasouthwest is a specific form used for various administrative purposes within the AMWA organization. It helps streamline processes related to membership and compliance. Understanding this form is crucial for members to ensure they meet all necessary requirements.

-

How can airSlate SignNow assist with IRS Form 8718 AMWA, Southwest Chapter Amwasouth?

airSlate SignNow provides a user-friendly platform for electronically signing and sending IRS Form 8718 AMWA, Southwest Chapter Amwasouth. This solution simplifies the process, making it faster and more efficient. Users can easily track the status of their documents, ensuring timely submissions.

-

What are the pricing options for using airSlate SignNow for IRS Form 8718 AMWA, Southwest Chapter Amwasouth?

airSlate SignNow offers flexible pricing plans tailored to different business needs, including options for individuals and teams. Each plan provides access to essential features for managing IRS Form 8718 AMWA, Southwest Chapter Amwasouth. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing IRS Form 8718 AMWA, Southwest Chapter Amwasouth?

airSlate SignNow includes features such as document templates, real-time tracking, and secure cloud storage, all designed to facilitate the management of IRS Form 8718 AMWA, Southwest Chapter Amwasouth. These tools enhance productivity and ensure compliance with necessary regulations. Additionally, users can collaborate seamlessly with team members.

-

Are there any integrations available with airSlate SignNow for IRS Form 8718 AMWA, Southwest Chapter Amwasouth?

Yes, airSlate SignNow integrates with various applications and platforms, allowing for a seamless workflow when handling IRS Form 8718 AMWA, Southwest Chapter Amwasouth. This includes popular tools like Google Drive, Dropbox, and CRM systems. These integrations help streamline document management and enhance overall efficiency.

-

What are the benefits of using airSlate SignNow for IRS Form 8718 AMWA, Southwest Chapter Amwasouth?

Using airSlate SignNow for IRS Form 8718 AMWA, Southwest Chapter Amwasouth offers numerous benefits, including time savings, reduced paperwork, and enhanced security. The platform ensures that your documents are signed and stored securely, minimizing the risk of loss or unauthorized access. Additionally, it simplifies the entire signing process, making it more accessible.

-

Is airSlate SignNow secure for handling IRS Form 8718 AMWA, Southwest Chapter Amwasouth?

Absolutely! airSlate SignNow employs advanced security measures to protect your documents, including IRS Form 8718 AMWA, Southwest Chapter Amwasouth. With features like encryption and secure cloud storage, you can trust that your sensitive information is safe. Compliance with industry standards further enhances the platform's reliability.

Get more for IRS Form 8718 AMWA, Southwest Chapter Amwasouthwest

- Third party vendor form siue

- Alumni hall of fame nomination form siue

- Candidacy admission form southern illinois university edwardsville siue

- Form i international travel study course request siue

- Form d domestic travel study course request siue

- Student employee of the year nomination form student siue

- College of arts and sciences alumni hall of fame nomination form siue

- Master39s terminal project committee form siue

Find out other IRS Form 8718 AMWA, Southwest Chapter Amwasouthwest

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application