Application for Certification of Eligibility Oregon Volunteer* EMS Provider Tax Credit ORS 316 Ohsu Form

What is the Application For Certification Of Eligibility Oregon Volunteer* EMS Provider Tax Credit ORS 316 Ohsu

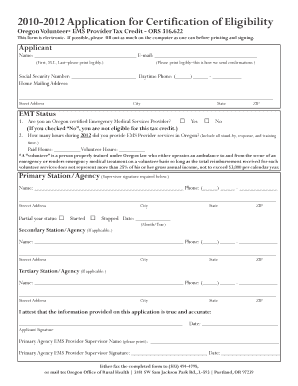

The Application For Certification Of Eligibility Oregon Volunteer* EMS Provider Tax Credit ORS 316 Ohsu is a specific form utilized by volunteer emergency medical services (EMS) providers in Oregon. This application allows eligible individuals to certify their status for a tax credit under Oregon Revised Statutes (ORS) 316. The tax credit is designed to support volunteer EMS providers who contribute their time and skills to serve their communities. By completing this application, volunteers can potentially receive financial benefits that recognize their essential contributions to public safety and health.

Steps to complete the Application For Certification Of Eligibility Oregon Volunteer* EMS Provider Tax Credit ORS 316 Ohsu

Completing the Application For Certification Of Eligibility involves several key steps to ensure accuracy and compliance with state regulations. First, gather all necessary personal information, including your name, address, and Social Security number. Next, confirm your eligibility by reviewing the criteria outlined in ORS 316. Once you have verified your status as a volunteer EMS provider, fill out the application form completely, ensuring that all sections are addressed. After completing the form, review it for any errors or omissions before submitting it to the appropriate state agency.

Eligibility Criteria

To qualify for the Oregon Volunteer EMS Provider Tax Credit, applicants must meet specific eligibility criteria. These include being a certified volunteer EMS provider who has completed a minimum number of service hours within a designated period. Additionally, applicants must not be receiving compensation for their services. It is essential to maintain accurate records of service hours and any relevant certifications to support your application. Understanding these criteria helps ensure that only qualified individuals benefit from the tax credit.

Required Documents

When submitting the Application For Certification Of Eligibility, certain documents are necessary to verify your status as a volunteer EMS provider. Required documents typically include proof of volunteer service hours, a copy of your EMS certification, and any additional documentation that may demonstrate your eligibility. Ensuring that all required documents are included with your application can expedite the review process and increase the likelihood of approval.

Form Submission Methods

The Application For Certification Of Eligibility can be submitted through various methods to accommodate different preferences. Applicants may choose to submit the form online, by mail, or in person at designated state offices. Each submission method has its own guidelines, so it is important to follow the instructions carefully to ensure that your application is processed efficiently. Consider the method that best suits your needs and allows for timely submission.

Application Process & Approval Time

The application process for the Oregon Volunteer EMS Provider Tax Credit involves submitting your completed application along with all required documents to the appropriate state agency. Once submitted, the agency will review your application to verify eligibility and completeness. The approval time can vary based on the volume of applications received and the complexity of individual cases. Typically, applicants can expect to receive a decision within a specified timeframe, which is communicated during the application process.

Quick guide on how to complete application for certification of eligibility oregon volunteer ems provider tax credit ors 316 ohsu

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly and without complications. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign [SKS] effortlessly

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Modify and eSign [SKS] to ensure effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application for certification of eligibility oregon volunteer ems provider tax credit ors 316 ohsu

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Application For Certification Of Eligibility Oregon Volunteer* EMS Provider Tax Credit ORS 316 Ohsu?

The Application For Certification Of Eligibility Oregon Volunteer* EMS Provider Tax Credit ORS 316 Ohsu is a form that allows eligible volunteer EMS providers in Oregon to apply for tax credits. This application helps ensure that volunteers receive the financial support they deserve for their service.

-

How can airSlate SignNow assist with the Application For Certification Of Eligibility Oregon Volunteer* EMS Provider Tax Credit ORS 316 Ohsu?

airSlate SignNow provides an easy-to-use platform for completing and eSigning the Application For Certification Of Eligibility Oregon Volunteer* EMS Provider Tax Credit ORS 316 Ohsu. Our solution streamlines the document process, making it faster and more efficient for users.

-

What are the costs associated with using airSlate SignNow for the application process?

airSlate SignNow offers a cost-effective solution for managing the Application For Certification Of Eligibility Oregon Volunteer* EMS Provider Tax Credit ORS 316 Ohsu. Pricing plans are flexible, allowing users to choose a plan that fits their budget and needs.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as eSigning, document templates, and real-time collaboration, which are essential for efficiently managing the Application For Certification Of Eligibility Oregon Volunteer* EMS Provider Tax Credit ORS 316 Ohsu. These features enhance productivity and ensure compliance.

-

Are there any benefits to using airSlate SignNow for this application?

Using airSlate SignNow for the Application For Certification Of Eligibility Oregon Volunteer* EMS Provider Tax Credit ORS 316 Ohsu provides numerous benefits, including reduced processing time and increased accuracy. Our platform helps users avoid common pitfalls associated with paper-based applications.

-

Can I integrate airSlate SignNow with other software for my application needs?

Yes, airSlate SignNow offers integrations with various software applications, allowing users to streamline their workflow when completing the Application For Certification Of Eligibility Oregon Volunteer* EMS Provider Tax Credit ORS 316 Ohsu. This flexibility enhances overall efficiency.

-

Is airSlate SignNow secure for handling sensitive applications?

Absolutely! airSlate SignNow prioritizes security, ensuring that the Application For Certification Of Eligibility Oregon Volunteer* EMS Provider Tax Credit ORS 316 Ohsu and other documents are protected with advanced encryption and compliance measures. Your data is safe with us.

Get more for Application For Certification Of Eligibility Oregon Volunteer* EMS Provider Tax Credit ORS 316 Ohsu

- Title 2 classification administration ampamp personnelcity of form

- Eldorado valley transfer area deed iis windows server form

- Complaint to establish easement form

- Development code form based codes institute

- Deed of dedication final city of diamondhead form

- Right of way instrument form

- Standard right of way and utility easement agreement form

- Purchaser use easement ingress egress secgov form

Find out other Application For Certification Of Eligibility Oregon Volunteer* EMS Provider Tax Credit ORS 316 Ohsu

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online