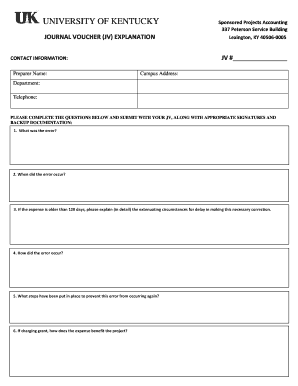

Explanation Form

What is the Explanation Form

The explanation form is a document used to provide detailed information regarding specific circumstances or situations that may require clarification. This form is often utilized in various contexts, such as tax filings, legal matters, or applications where additional information is necessary to support a claim or request. It serves as a means for individuals or businesses to articulate their unique circumstances, ensuring that all relevant details are presented to the appropriate authorities or organizations.

How to Use the Explanation Form

Using the explanation form involves a few straightforward steps. First, identify the purpose of the form and gather all necessary information related to your situation. Next, fill out the form accurately, ensuring that all sections are completed with clear and concise details. It is important to provide any supporting documentation that may enhance your explanation. Once the form is completed, review it for accuracy before submitting it to the relevant agency or organization.

Steps to Complete the Explanation Form

Completing the explanation form requires careful attention to detail. Follow these steps for successful completion:

- Read the instructions carefully to understand the requirements.

- Gather all necessary documents and information that support your explanation.

- Fill out the form, ensuring that you provide clear and concise answers.

- Include any additional documentation that may be required.

- Review the completed form for accuracy and completeness.

- Submit the form according to the specified submission methods.

Legal Use of the Explanation Form

The explanation form is often used in legal contexts to clarify specific situations or to provide additional context for legal documents. It is essential to understand the legal implications of the information provided in the form, as inaccuracies or omissions can lead to complications. Always ensure that the form is filled out truthfully and to the best of your knowledge to avoid potential legal issues.

Key Elements of the Explanation Form

Several key elements are crucial when filling out the explanation form. These include:

- Personal Information: Name, address, and contact details.

- Purpose of the Form: A clear statement of why the form is being submitted.

- Detailed Explanation: A thorough description of the circumstances requiring explanation.

- Supporting Documents: Any relevant documentation that substantiates your claims.

- Signature and Date: Your signature confirming the accuracy of the information provided.

Examples of Using the Explanation Form

There are various scenarios in which the explanation form may be used. For instance, a taxpayer may need to submit this form when reporting unusual income or deductions on their tax return. Similarly, an individual applying for a loan may use the form to clarify their financial situation. Each example highlights the importance of providing clear explanations to facilitate understanding and decision-making by the reviewing authority.

Quick guide on how to complete explanation form

Effortlessly Prepare Explanation Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct forms and securely store them online. airSlate SignNow equips you with all the tools necessary to swiftly create, edit, and electronically sign your documents without delays. Manage Explanation Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and Electronically Sign Explanation Form

- Locate Explanation Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive data using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes moments and holds the same legal validity as a conventional ink signature.

- Review all the information and then click the Done button to save your changes.

- Choose your preferred method for submitting your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, and errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Explanation Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the explanation form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an explanation form in airSlate SignNow?

An explanation form in airSlate SignNow is a document that allows users to provide detailed information or context regarding a specific subject. This feature enhances communication and ensures that all parties involved have a clear understanding of the document's purpose. By utilizing an explanation form, businesses can streamline their processes and improve collaboration.

-

How does airSlate SignNow's explanation form feature benefit my business?

The explanation form feature in airSlate SignNow helps businesses clarify complex information, reducing misunderstandings and errors. By providing detailed explanations, users can ensure that recipients fully grasp the content of the document. This leads to faster approvals and a more efficient workflow.

-

Is there a cost associated with using the explanation form feature?

airSlate SignNow offers various pricing plans that include access to the explanation form feature. Depending on the plan you choose, you can enjoy a range of functionalities designed to meet your business needs. It's advisable to review the pricing options on our website to find the best fit for your organization.

-

Can I customize my explanation form in airSlate SignNow?

Yes, airSlate SignNow allows users to customize their explanation forms to suit their specific requirements. You can add fields, adjust layouts, and include branding elements to ensure that the form aligns with your company's identity. This customization enhances the user experience and makes the form more effective.

-

What integrations does airSlate SignNow offer for explanation forms?

airSlate SignNow integrates seamlessly with various applications, enhancing the functionality of your explanation forms. You can connect with popular tools like Google Drive, Salesforce, and Dropbox, allowing for easy document management and sharing. These integrations help streamline your workflow and improve productivity.

-

How secure are the explanation forms created with airSlate SignNow?

Security is a top priority for airSlate SignNow, and all explanation forms are protected with advanced encryption protocols. This ensures that your sensitive information remains confidential and secure during transmission and storage. You can trust that your documents are safe while using our platform.

-

Can I track the status of my explanation forms in airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your explanation forms in real-time. You can see when a document is viewed, signed, or completed, giving you full visibility into your document workflow and helping you manage deadlines effectively.

Get more for Explanation Form

Find out other Explanation Form

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure

- Electronic signature Maryland Rental agreement lease Myself

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms

- Can I Electronic signature New Mexico Rental lease agreement forms

- How Can I Electronic signature Minnesota Rental lease agreement

- Electronic signature Arkansas Rental lease agreement template Computer

- Can I Electronic signature Mississippi Rental lease agreement

- Can I Electronic signature Missouri Rental lease contract

- Electronic signature New Jersey Rental lease agreement template Free

- Electronic signature New Jersey Rental lease agreement template Secure

- Electronic signature Vermont Rental lease agreement Mobile

- Electronic signature Maine Residential lease agreement Online

- Electronic signature Minnesota Residential lease agreement Easy

- Electronic signature Wyoming Rental lease agreement template Simple

- Electronic signature Rhode Island Residential lease agreement Online

- Electronic signature Florida Rental property lease agreement Free

- Can I Electronic signature Mississippi Rental property lease agreement