St19 Form 2018-2026

What is the St19 Form

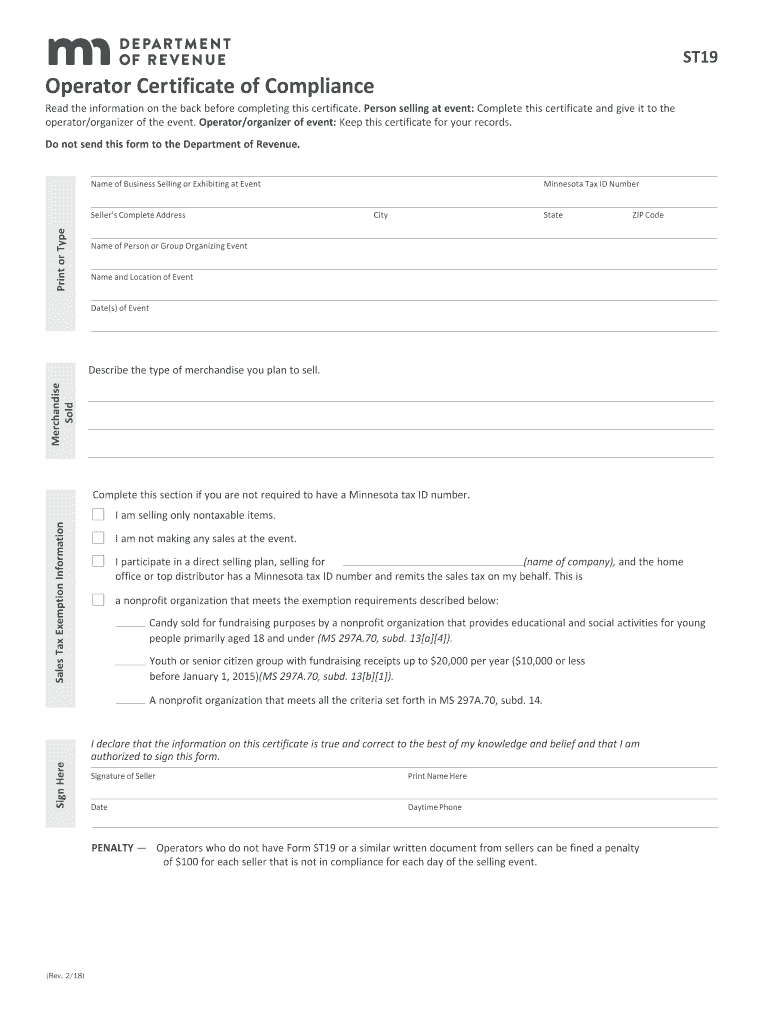

The St19 form, officially known as the Minnesota Revenue Tax Form, is a document used by individuals and businesses in Minnesota to report and pay sales tax. This form is essential for compliance with state tax laws, ensuring that all sales transactions are accurately documented and taxes are appropriately remitted to the state government. The St19 form is particularly relevant for sellers who collect sales tax on goods and services provided within Minnesota.

How to Use the St19 Form

Using the St19 form involves several steps to ensure accurate completion and submission. First, gather all necessary sales data for the reporting period, including total sales, taxable sales, and any exemptions. Next, complete the form by entering the required information, such as your business name, address, and sales figures. After filling out the form, review it for accuracy, sign it, and submit it according to the specified submission methods. This ensures compliance with state regulations and helps avoid penalties.

Steps to Complete the St19 Form

Completing the St19 form requires careful attention to detail. Follow these steps:

- Gather all relevant sales records for the reporting period.

- Enter your business information, including name and address.

- Calculate total sales and taxable sales amounts.

- Input any exemptions or deductions that apply.

- Review all entries for accuracy.

- Sign the form to certify that the information is correct.

Once completed, the form can be submitted online, by mail, or in person, depending on your preference.

Legal Use of the St19 Form

The St19 form is legally binding and must be completed accurately to comply with Minnesota tax laws. Misrepresentation or errors in the form can lead to penalties, including fines or audits. It is crucial to ensure that all information provided is truthful and reflects actual sales activity. The form is designed to facilitate transparency and accountability in tax reporting.

Filing Deadlines / Important Dates

Filing deadlines for the St19 form vary depending on the reporting period. Generally, businesses must file sales tax returns monthly, quarterly, or annually based on their sales volume. It is important to be aware of these deadlines to avoid late fees. Mark your calendar for the due dates to ensure timely submissions and maintain compliance with state regulations.

Form Submission Methods (Online / Mail / In-Person)

The St19 form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Complete and submit the form electronically through the Minnesota Department of Revenue's website.

- Mail: Print the completed form and send it to the designated address provided on the form.

- In-Person: Deliver the form directly to a local Minnesota Department of Revenue office.

Selecting the appropriate submission method can streamline the filing process and ensure that your tax obligations are met efficiently.

Quick guide on how to complete form st 19 2018 2019

Your assistance manual on how to prepare your St19 Form

If you’re wondering how to finalize and submit your St19 Form, here are some brief guidelines on how to streamline tax processing.

To begin, you simply need to create your airSlate SignNow profile to alter how you manage documents online. airSlate SignNow is a user-friendly and robust document solution that enables you to adjust, produce, and finalize your tax papers with ease. With its editor, you can toggle between text, check boxes, and eSignatures and revisit to edit details as necessary. Enhance your tax administration with advanced PDF editing, eSigning, and user-friendly sharing.

Complete the following steps to finalize your St19 Form in a matter of minutes:

- Establish your account and start handling PDFs instantly.

- Utilize our directory to obtain any IRS tax document; explore various forms and schedules.

- Click Get form to access your St19 Form in our editor.

- Input the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-recognized eSignature (if required).

- Review your document and amend any errors.

- Save alterations, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to submit your taxes electronically with airSlate SignNow. Keep in mind that submitting on paper can lead to errors in returns and delay refunds. Furthermore, prior to e-filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct form st 19 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How will a student fill the JEE Main application form in 2018 if he has to give the improvement exam in 2019 in 2 subjects?

Now in the application form of JEE Main 2019, there will be an option to fill whether or not you are appearing in the improvement exam. This will be as follows:Whether appearing for improvement Examination of class 12th - select Yes or NO.If, yes, Roll Number of improvement Examination (if allotted) - if you have the roll number of improvement exam, enter it.Thus, you will be able to fill in the application form[1].Footnotes[1] How To Fill JEE Main 2019 Application Form - Step By Step Instructions | AglaSem

-

Can I fill out separate forms for DU entrance-based and merit-based courses for admission in 2018-19?

Hii Shagun!When i applied for my Admission in DU. I applied from two different portals Merit Based and Entrance Based portals for UG Admission. From this year (2018) now both the portals has combined and now students are required to fill one form for both merit and entrance exams. But now registrations are closed (from 7th june).Hope this answerd your query.

Create this form in 5 minutes!

How to create an eSignature for the form st 19 2018 2019

How to generate an eSignature for the Form St 19 2018 2019 in the online mode

How to make an electronic signature for the Form St 19 2018 2019 in Chrome

How to create an electronic signature for signing the Form St 19 2018 2019 in Gmail

How to make an eSignature for the Form St 19 2018 2019 straight from your mobile device

How to create an electronic signature for the Form St 19 2018 2019 on iOS devices

How to create an electronic signature for the Form St 19 2018 2019 on Android OS

People also ask

-

What is the St19 Form and how is it used?

The St19 Form is a specific document used for various legal and business purposes, often requiring e-signatures for validation. With airSlate SignNow, you can easily create, send, and eSign St19 Forms, ensuring that your documents are processed quickly and securely. Our platform simplifies the entire workflow, allowing you to manage your St19 Forms efficiently.

-

How does airSlate SignNow help with St19 Form management?

airSlate SignNow offers a streamlined solution for managing St19 Forms, enabling users to send, sign, and track documents electronically. The platform features customizable templates and automated workflows, making it easy to handle multiple St19 Forms simultaneously. This efficiency saves time and reduces the risk of errors in your document management process.

-

What are the pricing options for using airSlate SignNow for St19 Forms?

airSlate SignNow offers flexible pricing plans tailored to meet different business needs, allowing you to choose the best option for managing your St19 Forms. Whether you're a small business or a large enterprise, our pricing is designed to be cost-effective while providing full access to all features required for St19 Form management. You can review our pricing plans on our website to find the best fit for your organization.

-

Can I integrate airSlate SignNow with other software for St19 Form processing?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing your ability to process St19 Forms. Whether you use CRM systems, document management tools, or cloud storage services, our integrations allow for a smooth workflow. This connectivity ensures that your St19 Forms can be efficiently managed across different platforms.

-

What benefits does using airSlate SignNow provide for St19 Forms?

Using airSlate SignNow for St19 Forms offers numerous benefits, including enhanced security, increased efficiency, and improved compliance. Our platform employs industry-standard encryption to protect your documents, while e-signature capabilities speed up the signing process. Additionally, you can track the status of your St19 Forms in real-time, ensuring nothing falls through the cracks.

-

Is it easy to eSign a St19 Form with airSlate SignNow?

Absolutely! eSigning a St19 Form with airSlate SignNow is a straightforward process. Users can easily upload their documents, add signature fields, and send them for signing in just a few clicks. Our intuitive interface makes it simple for anyone to manage their St19 Forms without the need for extensive training.

-

What types of organizations can benefit from using airSlate SignNow for St19 Forms?

Various organizations, including small businesses, legal firms, and large corporations, can benefit from using airSlate SignNow for St19 Forms. Any entity that requires efficient document management and secure e-signature capabilities will find our platform valuable. By streamlining the processing of St19 Forms, organizations can enhance productivity and focus on core business activities.

Get more for St19 Form

- Nhung 1 106doc csc hcmiu edu form

- Skillstreaming checklist form

- Humana appointment form

- Consumer request to change information on file nycgov

- Weatherization service agreement benergyservicesorgb form

- Flubber worksheet answer key form

- Bats math quiz glenwood caverns adventure park form

- Life certificate filling in jk bank form

Find out other St19 Form

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy