TAXABLE YEAR Partner S Share of Income, Deductions, Credits, Etc Form

Understanding the TAXABLE YEAR Partner's Share of Income, Deductions, Credits, Etc

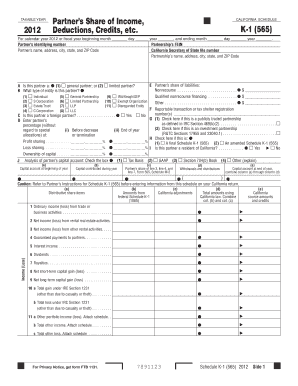

The TAXABLE YEAR Partner's Share of Income, Deductions, Credits, Etc is a crucial tax document for partners in a partnership. It details each partner's allocated share of the partnership's income, deductions, and credits for a specific taxable year. This information is essential for accurately reporting income on individual tax returns. The document allows partners to understand their financial stake in the partnership and ensures compliance with IRS regulations.

How to Use the TAXABLE YEAR Partner's Share of Income, Deductions, Credits, Etc

To effectively use the TAXABLE YEAR Partner's Share of Income, Deductions, Credits, Etc, partners should first review the information provided for accuracy. Each partner must incorporate their share of income and deductions into their personal tax returns, typically using Form 1040. It is important to ensure that the figures align with the partnership's tax return, as discrepancies can lead to audits or penalties.

Steps to Complete the TAXABLE YEAR Partner's Share of Income, Deductions, Credits, Etc

Completing the TAXABLE YEAR Partner's Share of Income, Deductions, Credits, Etc involves several steps:

- Gather all relevant financial documents from the partnership.

- Calculate each partner's share of the income, deductions, and credits based on the partnership agreement.

- Fill out the document accurately, ensuring all figures are correct.

- Distribute copies to each partner for their tax filings.

Legal Use of the TAXABLE YEAR Partner's Share of Income, Deductions, Credits, Etc

The legal use of the TAXABLE YEAR Partner's Share of Income, Deductions, Credits, Etc is mandated by the IRS for partnerships. This form must be completed and provided to each partner to ensure they can report their income accurately. Failure to provide this information can result in penalties for both the partnership and individual partners. It is essential to keep accurate records to support the figures reported.

IRS Guidelines for the TAXABLE YEAR Partner's Share of Income, Deductions, Credits, Etc

The IRS provides specific guidelines for completing and submitting the TAXABLE YEAR Partner's Share of Income, Deductions, Credits, Etc. Partners should refer to IRS publications and instructions related to Form 1065, which is the partnership tax return. Adhering to these guidelines ensures compliance and helps avoid potential audits or discrepancies in tax filings.

Filing Deadlines for the TAXABLE YEAR Partner's Share of Income, Deductions, Credits, Etc

Filing deadlines for the TAXABLE YEAR Partner's Share of Income, Deductions, Credits, Etc align with the partnership's tax return deadlines. Typically, partnerships must file Form 1065 by March 15 for calendar year partnerships. Partners should ensure they receive their share of the income, deductions, and credits in a timely manner to meet their personal tax filing deadlines, usually April 15.

Quick guide on how to complete taxable year partner s share of income deductions credits etc

Complete [SKS] effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed materials, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without delays. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to alter and eSign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you'd like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Alter and eSign [SKS] and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to TAXABLE YEAR Partner S Share Of Income, Deductions, Credits, Etc

Create this form in 5 minutes!

How to create an eSignature for the taxable year partner s share of income deductions credits etc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the TAXABLE YEAR Partner S Share Of Income, Deductions, Credits, Etc.?

The TAXABLE YEAR Partner S Share Of Income, Deductions, Credits, Etc. refers to the specific period during which a partner's income, deductions, and credits are calculated for tax purposes. Understanding this concept is crucial for accurate tax reporting and compliance. airSlate SignNow can help streamline the documentation process related to these financial details.

-

How does airSlate SignNow assist with the TAXABLE YEAR Partner S Share Of Income, Deductions, Credits, Etc.?

airSlate SignNow provides an efficient platform for managing and eSigning documents related to the TAXABLE YEAR Partner S Share Of Income, Deductions, Credits, Etc. This ensures that all necessary forms are completed accurately and submitted on time, reducing the risk of errors and penalties. Our solution simplifies the entire process, making it easier for partners to manage their tax obligations.

-

What features does airSlate SignNow offer for tax-related documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for handling tax-related documents like the TAXABLE YEAR Partner S Share Of Income, Deductions, Credits, Etc. These features enhance efficiency and ensure that all parties involved can access and sign documents seamlessly. Additionally, our platform is user-friendly, making it accessible for everyone.

-

Is airSlate SignNow cost-effective for managing tax documents?

Yes, airSlate SignNow is a cost-effective solution for managing tax documents, including the TAXABLE YEAR Partner S Share Of Income, Deductions, Credits, Etc. Our pricing plans are designed to accommodate businesses of all sizes, ensuring that you get the best value for your investment. By reducing paperwork and streamlining processes, you can save both time and money.

-

Can airSlate SignNow integrate with other accounting software?

Absolutely! airSlate SignNow can integrate with various accounting software, making it easier to manage the TAXABLE YEAR Partner S Share Of Income, Deductions, Credits, Etc. seamlessly. This integration allows for automatic data transfer, reducing manual entry errors and improving overall efficiency. You can connect with popular platforms to enhance your workflow.

-

What are the benefits of using airSlate SignNow for tax documentation?

Using airSlate SignNow for tax documentation, including the TAXABLE YEAR Partner S Share Of Income, Deductions, Credits, Etc., offers numerous benefits. These include enhanced security for sensitive information, faster turnaround times for document processing, and improved collaboration among partners. Our platform ensures that all documents are legally binding and compliant with regulations.

-

How secure is airSlate SignNow for handling sensitive tax information?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect sensitive tax information, including the TAXABLE YEAR Partner S Share Of Income, Deductions, Credits, Etc. Our platform is designed to ensure that your documents are safe from unauthorized access, giving you peace of mind while managing your tax obligations.

Get more for TAXABLE YEAR Partner S Share Of Income, Deductions, Credits, Etc

- Blank psychiatric document form

- Missed appointment fee notice form

- Assessment the political development of imperial china form

- Njhmfa low income tax credit tenant income self form

- Commercial credit application part 1 general applicant information legal business name

- Commercial credit application form or011 9

- 0172 0575 form

- Membership application 2 15 ymca of the inland northwest form

Find out other TAXABLE YEAR Partner S Share Of Income, Deductions, Credits, Etc

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later