Charitable Gift Match Program Guidelines Wimmer Solutions Form

Understanding the Charitable Gift Match Program Guidelines

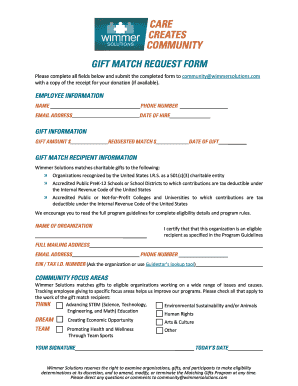

The Charitable Gift Match Program Guidelines outline the framework for organizations that match employee donations to eligible charities. This program encourages philanthropy by amplifying the impact of individual contributions. Typically, companies establish specific criteria for matching donations, including eligibility requirements for both employees and the charities they support. Understanding these guidelines is essential for employees who wish to maximize their charitable giving through their employer's program.

Key Elements of the Charitable Gift Match Program Guidelines

Several key elements define the Charitable Gift Match Program Guidelines. These include:

- Eligibility Criteria: Guidelines specify which employees can participate, often including full-time and part-time staff.

- Matching Ratio: Companies may match donations at various ratios, such as one-to-one or two-to-one, depending on their policies.

- Eligible Charities: Not all organizations qualify for matching gifts. The guidelines typically list approved charities, often requiring them to be registered as 501(c)(3) organizations.

- Donation Limits: There may be caps on the total amount an employee can have matched in a calendar year.

Steps to Complete the Charitable Gift Match Program Guidelines

Completing the Charitable Gift Match Program process involves several straightforward steps:

- Confirm Eligibility: Verify that you meet the eligibility criteria set forth by your employer.

- Select a Charity: Choose a charity from the approved list that aligns with your philanthropic goals.

- Make a Donation: Donate to the selected charity, ensuring it meets the minimum contribution requirement.

- Submit the Matching Gift Request: Complete and submit the matching gift request form provided by your employer, including proof of your donation.

- Follow Up: Check with your employer’s HR department to confirm the processing of your matching gift request.

Legal Use of the Charitable Gift Match Program Guidelines

The Charitable Gift Match Program Guidelines must comply with federal and state laws governing charitable contributions. Employers must ensure that their matching gift programs adhere to IRS regulations, particularly regarding tax-deductible contributions. Employees should keep records of their donations and the matching gift requests for tax purposes. Understanding the legal framework helps both employers and employees navigate potential compliance issues effectively.

Examples of Using the Charitable Gift Match Program Guidelines

Consider a scenario where an employee donates $100 to a local nonprofit organization. If the employer has a one-to-one matching policy, the nonprofit would receive an additional $100 from the employer, doubling the impact of the employee's contribution. Another example could involve an employee who donates $500 to a registered charity that supports education. If the employer matches at a two-to-one ratio, the charity would benefit from a total of $1,500, significantly enhancing the support provided to educational initiatives.

Filing Deadlines and Important Dates

Employees should be aware of specific deadlines associated with the Charitable Gift Match Program. These may include:

- Donation Submission Deadline: The date by which donations must be made to qualify for matching.

- Matching Gift Request Deadline: The last date to submit the matching gift request form for the current fiscal year.

- Annual Review Dates: Employers may conduct annual reviews of their matching gift programs, which could affect future eligibility and guidelines.

Quick guide on how to complete charitable gift match program guidelines wimmer solutions

Easily prepare [SKS] on any device

Digital document management has become widely embraced by organizations and individuals. It offers an ideal environmentally-friendly substitute to traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without interruptions. Manage [SKS] on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The simplest way to alter and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or an invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious document searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the charitable gift match program guidelines wimmer solutions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Charitable Gift Match Program Guidelines Wimmer Solutions?

The Charitable Gift Match Program Guidelines Wimmer Solutions outline the criteria and processes for matching employee donations to eligible charities. These guidelines ensure that contributions are maximized and that employees are encouraged to support their favorite causes. Understanding these guidelines is essential for both employees and employers to effectively participate in the program.

-

How can airSlate SignNow assist with the Charitable Gift Match Program?

airSlate SignNow streamlines the documentation process for the Charitable Gift Match Program Guidelines Wimmer Solutions. By providing an easy-to-use platform for eSigning and sending necessary forms, it simplifies the submission of matching gift requests. This efficiency helps organizations manage their charitable contributions more effectively.

-

What features does airSlate SignNow offer for managing charitable donations?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning, all of which are beneficial for managing charitable donations. These features align with the Charitable Gift Match Program Guidelines Wimmer Solutions, ensuring that all documentation is handled efficiently. This allows organizations to focus more on their charitable initiatives rather than paperwork.

-

Is there a cost associated with using airSlate SignNow for the Charitable Gift Match Program?

Yes, airSlate SignNow offers various pricing plans that cater to different organizational needs, including those implementing the Charitable Gift Match Program Guidelines Wimmer Solutions. The cost is competitive and reflects the value of the features provided, ensuring that businesses can manage their charitable contributions without breaking the bank.

-

What are the benefits of using airSlate SignNow for charitable gift matching?

Using airSlate SignNow for charitable gift matching provides numerous benefits, including increased efficiency and reduced processing time. By adhering to the Charitable Gift Match Program Guidelines Wimmer Solutions, organizations can ensure compliance while enhancing employee engagement in charitable activities. This ultimately leads to a more robust corporate social responsibility strategy.

-

Can airSlate SignNow integrate with other platforms for charitable donations?

Yes, airSlate SignNow offers integrations with various platforms that facilitate charitable donations, making it easier to adhere to the Charitable Gift Match Program Guidelines Wimmer Solutions. These integrations allow for seamless data transfer and improved workflow management, ensuring that all aspects of the donation process are covered efficiently.

-

How does airSlate SignNow ensure the security of charitable donation documents?

airSlate SignNow prioritizes security by employing advanced encryption and compliance measures to protect all documents related to charitable donations. This is particularly important when following the Charitable Gift Match Program Guidelines Wimmer Solutions, as sensitive information must be handled with care. Users can trust that their data is secure throughout the entire process.

Get more for Charitable Gift Match Program Guidelines Wimmer Solutions

- Suspension review form john 316 mission john316mission

- Nurse to nurse transfer report from or manager form

- Xi 15 a nursing intake assessment form

- Dss 1464 form

- Type of facility form

- North carolina social work certification and licensure form

- Proof of debt form 34085690

- Engagement de prise en charge ibz spf intrieur form

Find out other Charitable Gift Match Program Guidelines Wimmer Solutions

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free