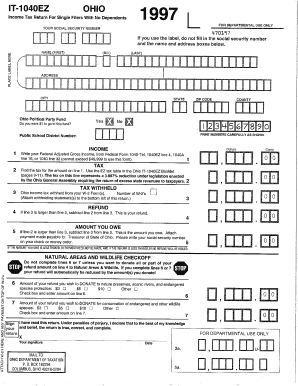

IT1040 Instructions Ohio Department of Taxation Form

What is the IT1040 Instructions Ohio Department Of Taxation

The IT1040 Instructions are a comprehensive guide provided by the Ohio Department of Taxation for individuals filing their state income tax returns. This form is essential for residents of Ohio to report their income, calculate their tax liability, and claim any applicable deductions or credits. The instructions detail the necessary steps for completing the IT1040 form accurately, ensuring compliance with state tax laws.

Key elements of the IT1040 Instructions Ohio Department Of Taxation

Understanding the key elements of the IT1040 Instructions is crucial for successful tax filing. These elements include:

- Filing Status: Information on how to choose the correct filing status based on personal circumstances.

- Income Reporting: Guidelines on what types of income must be reported, including wages, interest, and dividends.

- Deductions and Credits: Details on available deductions and credits that can reduce tax liability, such as the personal exemption and various tax credits.

- Payment Options: Instructions on how to pay any taxes owed, including online payment methods and mailing options.

Steps to complete the IT1040 Instructions Ohio Department Of Taxation

Completing the IT1040 form involves several steps to ensure accuracy and compliance. Follow these steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your filing status and total income for the year.

- Calculate your taxable income by applying any deductions and credits.

- Complete the IT1040 form, ensuring all information is accurate and complete.

- Review the form for errors and ensure all required signatures are present.

- Submit the form either electronically or by mail, based on your preference.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the IT1040 form. Typically, the deadline for filing state income tax returns in Ohio is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers should be aware of any extensions available and the deadlines for making payments to avoid penalties.

Required Documents

When preparing to file the IT1040, certain documents are required to ensure accurate reporting. These documents include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of other income sources, such as rental income or dividends.

- Documentation for deductions and credits claimed, such as receipts for charitable contributions.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the IT1040 form. The available methods include:

- Online Submission: Filing electronically through the Ohio Department of Taxation's website or approved tax software.

- Mail: Sending a completed paper form to the designated address provided in the instructions.

- In-Person: Visiting local tax offices for assistance and submitting forms directly.

Quick guide on how to complete it1040 instructions ohio department of taxation

Accomplish [SKS] effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, alter, and electronically sign your documents promptly without any holdups. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to alter and eSign [SKS] effortlessly

- Locate [SKS] and click on Get Form to begin.

- Make use of the tools we offer to finish your document.

- Emphasize pertinent sections of the documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to share your form, via email, text (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searching, or errors that necessitate reproducing document copies. airSlate SignNow accommodates all your document management needs in just a few clicks from any device of your preference. Modify and eSign [SKS] and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to IT1040 Instructions Ohio Department Of Taxation

Create this form in 5 minutes!

How to create an eSignature for the it1040 instructions ohio department of taxation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the IT1040 Instructions Ohio Department Of Taxation?

The IT1040 Instructions Ohio Department Of Taxation provide detailed guidelines for individuals filing their income tax returns in Ohio. These instructions cover eligibility, required forms, and important deadlines to ensure compliance with state tax laws.

-

How can airSlate SignNow help with IT1040 Instructions Ohio Department Of Taxation?

airSlate SignNow simplifies the process of signing and submitting documents related to the IT1040 Instructions Ohio Department Of Taxation. With our platform, you can easily eSign your tax forms and securely send them to the Ohio Department of Taxation, ensuring a hassle-free filing experience.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents like the IT1040 Instructions Ohio Department Of Taxation. These tools help streamline the filing process and enhance organization.

-

Is airSlate SignNow cost-effective for small businesses handling IT1040 Instructions Ohio Department Of Taxation?

Yes, airSlate SignNow is a cost-effective solution for small businesses managing IT1040 Instructions Ohio Department Of Taxation. Our pricing plans are designed to fit various budgets, allowing businesses to efficiently handle their tax documentation without breaking the bank.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various tax preparation software, enhancing your workflow when dealing with IT1040 Instructions Ohio Department Of Taxation. This integration allows for easy document sharing and collaboration, making tax season less stressful.

-

What are the benefits of using airSlate SignNow for tax filing?

Using airSlate SignNow for tax filing offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security for sensitive documents like the IT1040 Instructions Ohio Department Of Taxation. Our platform ensures that your documents are signed and submitted quickly and safely.

-

How secure is airSlate SignNow for handling sensitive tax documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive tax documents, including those related to IT1040 Instructions Ohio Department Of Taxation. You can trust that your information is safe while using our platform.

Get more for IT1040 Instructions Ohio Department Of Taxation

- Cl8 5 19 mandatory 7 19 form

- Cl8 9 12 mandatory 1 13 form

- Iowa notary acknowledgments form

- Dupage juvenile data sheet hand written format

- Marriage license nb form

- How to get our marriage licenses in new brunswick form

- Instructions centrepay the easy way to pay your bills centrepay is a direct bill paying service available to customers who form

- Imm 5349 form

Find out other IT1040 Instructions Ohio Department Of Taxation

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast