Chapter 6 How to Process VA Loans and Submit Them to VA HUD Form

Understanding VA Loans and Their Submission Process

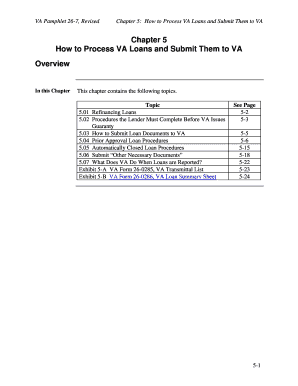

Chapter 6 outlines the essential steps for processing VA loans and submitting them to the VA and HUD. VA loans are government-backed mortgages designed to assist veterans, active-duty service members, and certain members of the National Guard and Reserves in obtaining home financing. This chapter provides a comprehensive overview of the necessary procedures, documentation, and compliance requirements involved in the VA loan process, ensuring that lenders and borrowers understand their responsibilities and the overall flow of the application.

Essential Steps for Completing VA Loan Applications

To successfully process a VA loan, follow these key steps:

- Gather necessary documentation, including proof of income, credit history, and military service.

- Complete the VA loan application form, ensuring all information is accurate and up-to-date.

- Submit the application to the lender for initial review and approval.

- Obtain a Certificate of Eligibility (COE) from the VA, confirming the borrower's eligibility for the loan.

- Finalize the loan details, including terms and conditions, before submitting to the VA and HUD.

Required Documentation for VA Loan Processing

When processing VA loans, specific documents are required to ensure compliance and facilitate a smooth application process. Key documents include:

- Certificate of Eligibility (COE): This document verifies the borrower's eligibility for a VA loan.

- Income Verification: Recent pay stubs, tax returns, and W-2 forms are needed to confirm income stability.

- Credit Report: A current credit report helps assess the borrower's creditworthiness.

- Property Appraisal: A VA-approved appraisal is necessary to determine the property's value.

Submission Methods for VA Loan Applications

VA loan applications can be submitted through various methods, each offering unique advantages:

- Online Submission: Many lenders provide digital platforms for submitting applications, making the process faster and more efficient.

- Mail Submission: Applications can be sent via postal service, though this may result in longer processing times.

- In-Person Submission: Meeting with a lender allows for direct communication and immediate feedback on the application.

Compliance and Legal Considerations for VA Loans

Understanding the legal framework surrounding VA loans is crucial for both lenders and borrowers. Compliance with federal regulations ensures that all parties are protected and that the loan process adheres to established guidelines. Key legal considerations include:

- Adhering to the VA's lending standards and guidelines.

- Maintaining accurate records of all transactions and communications.

- Understanding borrower rights and responsibilities under the VA loan program.

Eligibility Criteria for VA Loans

To qualify for a VA loan, borrowers must meet specific eligibility criteria, which include:

- Service requirements, typically involving a minimum period of active duty.

- Honorable discharge from military service.

- Meeting income and credit score standards set by lenders.

Examples of VA Loan Scenarios

Understanding practical examples of VA loan applications can help clarify the process. Common scenarios include:

- A first-time homebuyer who is a veteran looking to purchase a single-family home.

- A service member refinancing an existing mortgage to obtain better terms.

- A veteran using a VA loan to buy a multi-family property while living in one unit.

Quick guide on how to complete chapter 6 how to process va loans and submit them to va hud

Effortlessly prepare [SKS] on any device

Online document management has gained popularity among both organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

The simplest way to modify and eSign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive details with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors requiring new copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Chapter 6 How To Process VA Loans And Submit Them To VA HUD

Create this form in 5 minutes!

How to create an eSignature for the chapter 6 how to process va loans and submit them to va hud

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of Chapter 6 How To Process VA Loans And Submit Them To VA HUD?

Chapter 6 How To Process VA Loans And Submit Them To VA HUD is crucial for understanding the steps involved in processing VA loans. This chapter provides detailed guidance on the necessary documentation and procedures to ensure compliance with VA and HUD regulations, making it essential for lenders and borrowers alike.

-

How can airSlate SignNow assist in processing VA loans as outlined in Chapter 6?

airSlate SignNow streamlines the process of handling VA loans by providing an easy-to-use platform for eSigning and document management. By utilizing airSlate SignNow, users can efficiently manage the paperwork required in Chapter 6 How To Process VA Loans And Submit Them To VA HUD, reducing errors and saving time.

-

What features does airSlate SignNow offer for VA loan processing?

airSlate SignNow offers features such as customizable templates, secure eSigning, and automated workflows that are particularly beneficial for processing VA loans. These features align with the guidelines in Chapter 6 How To Process VA Loans And Submit Them To VA HUD, ensuring a smooth and compliant loan submission process.

-

Is airSlate SignNow cost-effective for businesses handling VA loans?

Yes, airSlate SignNow is a cost-effective solution for businesses managing VA loans. By simplifying the processes outlined in Chapter 6 How To Process VA Loans And Submit Them To VA HUD, companies can reduce operational costs while improving efficiency and compliance.

-

What integrations does airSlate SignNow support for VA loan processing?

airSlate SignNow integrates seamlessly with various CRM and document management systems, enhancing the workflow for VA loan processing. These integrations support the steps detailed in Chapter 6 How To Process VA Loans And Submit Them To VA HUD, allowing for a more cohesive and efficient operation.

-

How does airSlate SignNow ensure compliance with VA and HUD regulations?

airSlate SignNow ensures compliance with VA and HUD regulations by providing tools that help users adhere to the guidelines in Chapter 6 How To Process VA Loans And Submit Them To VA HUD. The platform includes features that facilitate accurate documentation and secure storage, which are essential for regulatory compliance.

-

Can airSlate SignNow help reduce processing time for VA loans?

Absolutely! By utilizing airSlate SignNow, businesses can signNowly reduce the processing time for VA loans. The platform's efficiency aligns with the practices outlined in Chapter 6 How To Process VA Loans And Submit Them To VA HUD, allowing for quicker turnaround times and improved customer satisfaction.

Get more for Chapter 6 How To Process VA Loans And Submit Them To VA HUD

- Verbal and written communications g w form

- Financial planning services promotional letter form

- Condolence office to employee form

- Pet sitting contract fill online printable fillable blank form

- Condolence death of employee to competitor form

- Enclosed please find an order for temporary relief relative to the above referenced matter form

- Amended loan agreement form

- Commercial lease agreement for building to be erected by lessor form

Find out other Chapter 6 How To Process VA Loans And Submit Them To VA HUD

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast