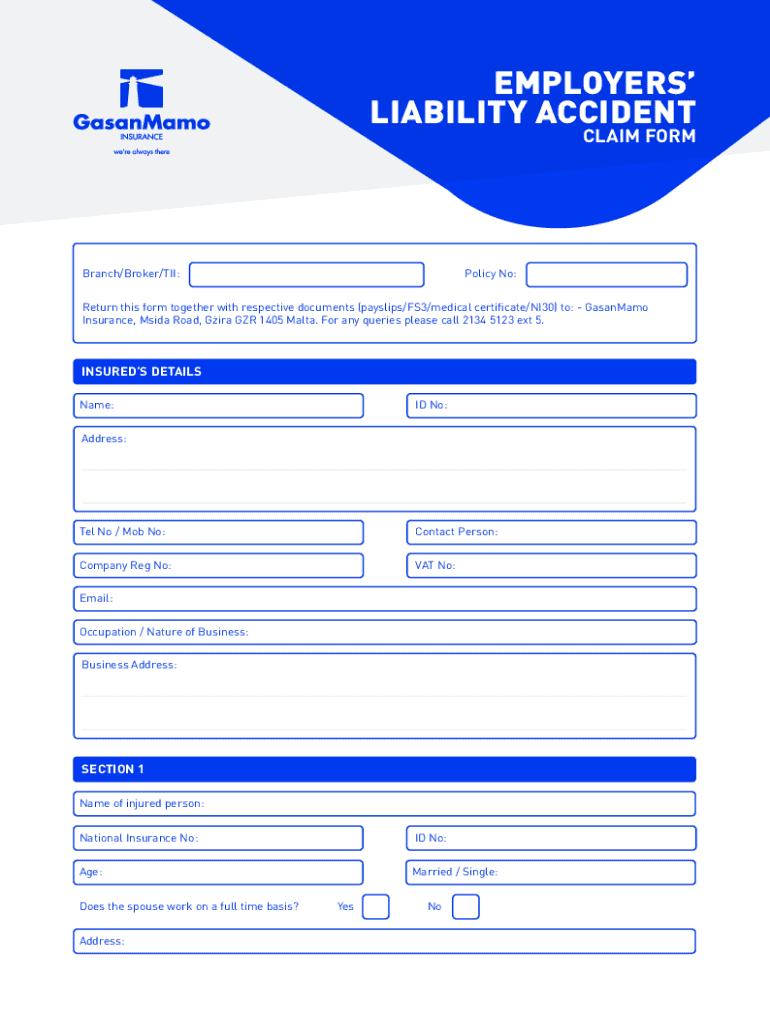

EMPLOYERS LIABILITY ACCIDENT CLAIM FORM BranchBro

Understanding the FS3 Fillable Malta Form

The FS3 fillable Malta form is essential for employers in Malta to report employee earnings and tax deductions. It serves as a formal declaration of an employee's income and the taxes withheld during a specific financial year. This form is crucial for both employers and employees, as it ensures compliance with local tax regulations and provides employees with the necessary documentation for their personal tax filings.

Steps to Complete the FS3 Fillable Malta Form

Completing the FS3 fillable Malta form involves several straightforward steps:

- Gather Employee Information: Collect all relevant details, including the employee's name, identification number, and address.

- Report Earnings: Accurately input the total earnings for the reporting period, including any bonuses or additional compensation.

- Detail Tax Deductions: Include the amounts withheld for taxes, social security, and any other deductions applicable to the employee.

- Review and Verify: Double-check all entries for accuracy to avoid potential issues with tax authorities.

- Submit the Form: Once completed, submit the FS3 form to the relevant tax office as per local guidelines.

Legal Use of the FS3 Fillable Malta Form

The FS3 fillable Malta form is legally required for employers to declare employee earnings and tax withholdings. Failure to submit this form accurately and on time can result in penalties for the employer. It is important for employers to understand their obligations under Maltese tax law and ensure that they comply with all reporting requirements.

Required Documents for FS3 Submission

When preparing to submit the FS3 fillable Malta form, employers should have the following documents ready:

- Employee identification documents

- Payroll records for the reporting period

- Any relevant tax withholding documentation

Having these documents organized will facilitate a smoother completion and submission process.

Examples of Using the FS3 Fillable Malta Form

Employers may encounter various scenarios when using the FS3 fillable Malta form:

- Reporting annual earnings for full-time employees.

- Documenting part-time or temporary worker earnings.

- Adjusting reported figures for employees who received bonuses or commissions.

Each of these scenarios requires careful attention to detail to ensure compliance and accuracy in reporting.

Submission Methods for the FS3 Fillable Malta Form

Employers can submit the FS3 fillable Malta form through various methods:

- Online Submission: Many employers prefer to submit the form electronically through the Maltese tax authority's online portal.

- Mail: The form can also be printed and mailed to the appropriate tax office.

- In-Person Submission: Employers may choose to deliver the form directly to their local tax office.

Choosing the right submission method can enhance efficiency and ensure timely compliance with reporting deadlines.

Quick guide on how to complete employersliability accidentclaim form branchbro

Complete EMPLOYERS LIABILITY ACCIDENT CLAIM FORM BranchBro effortlessly on any gadget

Digital document management has become well-liked among companies and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage EMPLOYERS LIABILITY ACCIDENT CLAIM FORM BranchBro on any gadget using the airSlate SignNow Android or iOS applications and enhance any document-focused task today.

The simplest method to adjust and eSign EMPLOYERS LIABILITY ACCIDENT CLAIM FORM BranchBro without hassle

- Locate EMPLOYERS LIABILITY ACCIDENT CLAIM FORM BranchBro and then hit Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you would like to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device you prefer. Modify and eSign EMPLOYERS LIABILITY ACCIDENT CLAIM FORM BranchBro and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the employersliability accidentclaim form branchbro

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is fs3 fillable malta?

fs3 fillable malta refers to a feature within airSlate SignNow that allows users to create and manage fillable forms specifically tailored for the Malta region. This functionality enables businesses to streamline their document workflows by making forms easy to fill out and sign electronically.

-

How much does fs3 fillable malta cost?

The pricing for fs3 fillable malta varies based on the subscription plan you choose. airSlate SignNow offers flexible pricing options that cater to different business needs, ensuring that you can find a cost-effective solution that fits your budget.

-

What are the key features of fs3 fillable malta?

fs3 fillable malta includes features such as customizable templates, electronic signatures, and real-time tracking of document status. These features enhance the efficiency of document management and ensure that your business can operate smoothly.

-

How can fs3 fillable malta benefit my business?

By using fs3 fillable malta, your business can save time and reduce paperwork. The ability to create fillable forms and obtain electronic signatures simplifies the process of document handling, allowing you to focus on more important tasks.

-

Is fs3 fillable malta easy to integrate with other tools?

Yes, fs3 fillable malta is designed to integrate seamlessly with various business applications. This ensures that you can connect your existing tools and workflows, enhancing productivity and collaboration across your organization.

-

Can I customize my fs3 fillable malta forms?

Absolutely! With fs3 fillable malta, you can easily customize your forms to meet your specific requirements. This includes adding your branding, adjusting fields, and setting up conditional logic to create a tailored experience for your users.

-

What types of documents can I create with fs3 fillable malta?

You can create a wide range of documents with fs3 fillable malta, including contracts, agreements, and surveys. This versatility allows businesses in Malta to utilize the platform for various purposes, enhancing overall efficiency.

Get more for EMPLOYERS LIABILITY ACCIDENT CLAIM FORM BranchBro

Find out other EMPLOYERS LIABILITY ACCIDENT CLAIM FORM BranchBro

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF