Tax Assessor Gulfport Ms Form

Understanding the Tax Assessor in Gulfport, MS

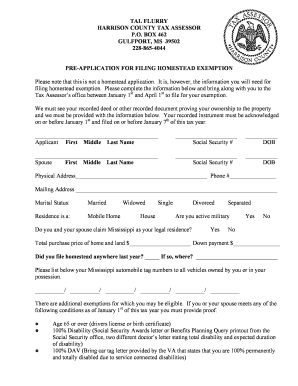

The tax assessor in Gulfport, Mississippi, plays a crucial role in determining property values for taxation purposes. This office is responsible for assessing real and personal property within the jurisdiction, ensuring property taxes are fairly levied based on accurate valuations. The Gulfport tax assessor also provides essential services to property owners, including guidance on property tax exemptions, such as the homestead exemption, which can significantly reduce tax liabilities for eligible homeowners.

Steps to Complete the Homestead Exemption Filing

Filing for a homestead exemption in Mississippi involves several key steps. First, homeowners must gather necessary documentation, including proof of residency, such as a driver's license or utility bill. Next, complete the homestead exemption application form, which can typically be obtained from the local tax assessor's office or their website. After filling out the form, submit it along with the required documents to the Gulfport tax assessor's office, either in person or by mail. It is important to file before the deadline to ensure eligibility for the exemption in the current tax year.

Required Documents for Filing Homestead Exemption

When applying for the homestead exemption in Mississippi, homeowners need to provide specific documents to support their application. These typically include:

- A completed homestead exemption application form.

- Proof of residency, such as a Mississippi driver's license or state-issued ID.

- Documentation of ownership, such as a deed or property tax statement.

- Any additional forms required by the Gulfport tax assessor's office.

Ensuring that all documents are accurate and complete will help facilitate a smoother application process.

Filing Deadlines for Homestead Exemption

Homeowners must be aware of specific deadlines when filing for the homestead exemption in Mississippi. Generally, applications must be submitted by April 1 of the tax year for which the exemption is sought. Late applications may not be considered until the following year, which can result in missed tax savings. It is advisable to check with the Gulfport tax assessor's office for any changes or updates to these deadlines.

Eligibility Criteria for Homestead Exemption

To qualify for the homestead exemption in Mississippi, homeowners must meet certain eligibility criteria. These include:

- Ownership of the property as the primary residence.

- Occupancy of the home as the principal place of residence.

- Meeting income requirements, if applicable, for certain types of exemptions.

- Filing the application by the established deadline.

Understanding these criteria is essential for homeowners to take advantage of the tax benefits associated with the homestead exemption.

How to Use the Gulfport Tax Assessor's Office

The Gulfport tax assessor's office is a valuable resource for property owners seeking information about property taxes, exemptions, and assessments. Homeowners can visit the office in person to ask questions, obtain forms, and receive assistance with the filing process. Additionally, many services may be available online, allowing for easier access to information and resources. Utilizing the tax assessor's office can help ensure that homeowners are informed and compliant with local tax regulations.

Quick guide on how to complete tax assessor gulfport ms

Complete Tax Assessor Gulfport Ms effortlessly on any gadget

Online document management has become increasingly favored by companies and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed paperwork, enabling you to find the necessary form and securely preserve it online. airSlate SignNow furnishes you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Manage Tax Assessor Gulfport Ms on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and eSign Tax Assessor Gulfport Ms with ease

- Find Tax Assessor Gulfport Ms and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to finalize your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Tax Assessor Gulfport Ms and guarantee superior communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax assessor gulfport ms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Mississippi filing homestead exemption?

The Mississippi filing homestead exemption is a tax benefit that allows homeowners to reduce their property taxes on their primary residence. By filing for this exemption, eligible homeowners can save money on their annual tax bills, making it an important financial consideration for residents.

-

How do I apply for the Mississippi filing homestead exemption?

To apply for the Mississippi filing homestead exemption, you need to complete the application form provided by your local tax assessor's office. Ensure you meet the eligibility requirements, such as residency and ownership, and submit your application before the deadline to benefit from the exemption.

-

What are the eligibility requirements for the Mississippi filing homestead exemption?

Eligibility for the Mississippi filing homestead exemption typically includes being a resident of Mississippi, owning the property, and using it as your primary residence. Additional criteria may apply, so it's essential to check with your local tax assessor for specific details.

-

What documents do I need for the Mississippi filing homestead exemption?

When applying for the Mississippi filing homestead exemption, you will generally need to provide proof of residency, such as a driver's license or utility bill, along with the completed application form. Additional documentation may be required based on your local jurisdiction.

-

How does the Mississippi filing homestead exemption affect my property taxes?

The Mississippi filing homestead exemption can signNowly reduce your property taxes by lowering the assessed value of your home. This reduction means you will pay less in taxes, which can lead to substantial savings over time, making it a valuable benefit for homeowners.

-

Can I file for the Mississippi homestead exemption online?

Many counties in Mississippi now offer online applications for the homestead exemption, making the process more convenient. Check with your local tax assessor's office to see if online filing is available and to access the necessary forms.

-

What is the deadline for the Mississippi filing homestead exemption?

The deadline for the Mississippi filing homestead exemption is typically April 1st of each year. It's crucial to submit your application by this date to ensure you receive the exemption for the current tax year.

Get more for Tax Assessor Gulfport Ms

- Quitclaim deed from corporation to two individuals massachusetts form

- Warranty deed from corporation to two individuals massachusetts form

- Warranty deed from individual to a trust massachusetts form

- Warranty deed from husband and wife to a trust massachusetts form

- Ma selling form

- Massachusetts note 497309568 form

- Massachusetts wife form

- Quitclaim deed from husband to himself and wife massachusetts form

Find out other Tax Assessor Gulfport Ms

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document