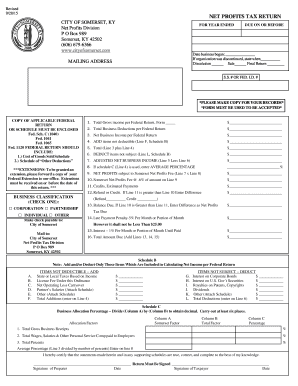

Net BProfitb Tax Return City of Somerset Form

What is the ky net profits tax return?

The ky net profits tax return is a tax form used by businesses operating in Kentucky to report their net profits. This form is essential for determining the amount of tax owed to the state based on the business's earnings. The net profits tax is imposed on various business entities, including corporations and limited liability companies (LLCs). Understanding this form is crucial for compliance with state tax laws.

Key elements of the ky net profits tax return

Several key elements are included in the ky net profits tax return. These elements typically encompass:

- Business Identification: Information about the business entity, including name, address, and federal identification number.

- Income Reporting: A section to report total income, including gross receipts and any other income sources.

- Deduction Clauses: Areas to claim allowable deductions that reduce taxable income, such as operating expenses.

- Tax Calculation: A formula to calculate the tax owed based on net profits.

- Signature Section: A requirement for authorized individuals to sign and date the form, affirming the accuracy of the information provided.

Steps to complete the ky net profits tax return

Completing the ky net profits tax return involves several steps to ensure accuracy and compliance:

- Gather necessary financial documents, including income statements and expense records.

- Fill out the business identification section with accurate details.

- Report total income and allowable deductions in the respective sections.

- Calculate the net profits and determine the tax owed using the provided formulas.

- Review the completed form for accuracy and ensure all required signatures are included.

- Submit the form by the designated deadline through the chosen submission method.

Filing deadlines and important dates

Filing deadlines for the ky net profits tax return are crucial for compliance. Typically, the return must be filed by the fifteenth day of the fourth month following the end of the business's fiscal year. For businesses operating on a calendar year, this means the return is due by April 15. It is advisable to keep track of any changes in deadlines or extensions that may apply.

Form submission methods

The ky net profits tax return can be submitted through various methods to accommodate different preferences:

- Online Submission: Many businesses opt to file electronically through the Kentucky Department of Revenue's online portal.

- Mail: The completed form can be printed and mailed to the appropriate tax office address.

- In-Person: Businesses may also choose to deliver the form in person at designated tax offices.

Penalties for non-compliance

Failure to file the ky net profits tax return on time can result in penalties. These penalties may include fines based on the amount of tax owed and interest on any unpaid taxes. It is essential for businesses to adhere to filing requirements to avoid these financial repercussions.

Quick guide on how to complete net bprofitb tax return city of somerset

Complete Net BProfitb Tax Return City Of Somerset effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can acquire the accurate form and securely maintain it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Net BProfitb Tax Return City Of Somerset on any device using airSlate SignNow Android or iOS applications and streamline your document-related tasks today.

How to alter and eSign Net BProfitb Tax Return City Of Somerset effortlessly

- Locate Net BProfitb Tax Return City Of Somerset and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to store your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious searches, or errors that require new document copies to be printed. airSlate SignNow meets your document management needs with just a few clicks from your preferred device. Edit and eSign Net BProfitb Tax Return City Of Somerset to ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the net bprofitb tax return city of somerset

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a KY net profits tax return?

A KY net profits tax return is a tax document that businesses in Kentucky must file to report their net profits. This return is essential for determining the amount of tax owed to the state based on the business's earnings. Understanding how to accurately complete this return can help businesses avoid penalties and ensure compliance.

-

How can airSlate SignNow help with KY net profits tax returns?

airSlate SignNow streamlines the process of preparing and submitting KY net profits tax returns by allowing businesses to easily eSign and send documents. Our platform ensures that all necessary forms are completed accurately and securely. This efficiency can save time and reduce the stress associated with tax season.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing KY net profits tax returns. These tools help businesses maintain organization and ensure that all tax documents are completed and submitted on time. Additionally, our platform is user-friendly, making it accessible for all team members.

-

Is airSlate SignNow cost-effective for small businesses filing KY net profits tax returns?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses managing KY net profits tax returns. Our pricing plans are flexible and cater to various business sizes, ensuring that you only pay for what you need. This affordability allows small businesses to access essential tools without breaking the bank.

-

Can I integrate airSlate SignNow with my accounting software for KY net profits tax returns?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting software, making it easier to manage your KY net profits tax returns. This integration allows for automatic data transfer, reducing the risk of errors and saving time during the tax preparation process. You can focus on your business while we handle the paperwork.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including KY net profits tax returns, provides numerous benefits such as enhanced security, improved efficiency, and easy collaboration. Our platform ensures that your documents are securely stored and accessible only to authorized users. Additionally, the ability to collaborate in real-time can expedite the tax filing process.

-

How does airSlate SignNow ensure the security of my KY net profits tax return?

airSlate SignNow prioritizes the security of your KY net profits tax return by employing advanced encryption and secure cloud storage. We adhere to industry standards to protect sensitive information and ensure that your documents are safe from unauthorized access. You can trust that your tax information is handled with the utmost care.

Get more for Net BProfitb Tax Return City Of Somerset

- Non foreign affidavit under irc 1445 indiana form

- Owners or sellers affidavit of no liens indiana form

- Indiana occupancy form

- Complex will with credit shelter marital trust for large estates indiana form

- Marital legal separation and property settlement agreement for persons with no children no joint property or debts where 497307031 form

- Marital legal separation and property settlement agreement minor children no joint property or debts where divorce action filed 497307032 form

- Marital legal separation and property settlement agreement minor children no joint property or debts effective immediately 497307033 form

- Marital legal separation and property settlement agreement minor children parties may have joint property or debts where 497307034 form

Find out other Net BProfitb Tax Return City Of Somerset

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online