Rbfcu Home Equity Loan Form

What is the Rbfcu Home Equity Loan

The Rbfcu home equity loan allows homeowners to borrow against the equity they have built in their property. This type of loan is secured by the home itself, meaning the property serves as collateral. Home equity loans are typically used for significant expenses such as home renovations, debt consolidation, or major purchases. Borrowers can access a lump sum of money at a fixed interest rate, making it easier to plan monthly payments.

How to Obtain the Rbfcu Home Equity Loan

To obtain the Rbfcu home equity loan, potential borrowers should start by assessing their home equity, which is the difference between the home’s current market value and any outstanding mortgage balance. Next, they should gather necessary documentation, including proof of income, credit history, and information about the property. After preparing the required documents, applicants can apply through Rbfcu’s website or in person at a local branch.

Steps to Complete the Rbfcu Home Equity Loan

The process of completing an Rbfcu home equity loan typically involves several key steps:

- Determine your home equity by evaluating your property’s value and existing mortgage.

- Gather necessary documentation such as income verification and property details.

- Submit your application online or at a branch, providing all required information.

- Await approval, which may involve a credit check and property appraisal.

- Review the loan terms and conditions before signing the agreement.

- Receive your funds and begin making payments according to the agreed schedule.

Key Elements of the Rbfcu Home Equity Loan

Several key elements define the Rbfcu home equity loan:

- Loan Amount: The amount you can borrow typically depends on your home equity and lender policies.

- Interest Rate: Home equity loans generally have fixed interest rates, providing predictable monthly payments.

- Repayment Terms: Borrowers can expect various repayment periods, often ranging from five to thirty years.

- Fees: Be aware of any associated fees, such as closing costs or application fees, that may apply.

Eligibility Criteria

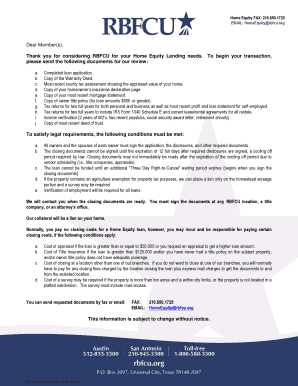

Eligibility for the Rbfcu home equity loan generally includes the following criteria:

- Homeownership: You must own the property you are borrowing against.

- Equity: Sufficient equity in your home is required to qualify for the loan.

- Credit Score: A minimum credit score may be necessary, depending on lender policies.

- Income Verification: Proof of stable income is typically required to assess repayment ability.

Required Documents

When applying for the Rbfcu home equity loan, applicants should prepare the following documents:

- Proof of income, such as pay stubs, tax returns, or bank statements.

- Details about any existing mortgage, including the current balance and lender information.

- Property information, including the address and any recent appraisals.

- Identification documents, such as a driver’s license or passport.

Quick guide on how to complete rbfcu home equity loan

Complete Rbfcu Home Equity Loan effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Rbfcu Home Equity Loan on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The simplest way to alter and eSign Rbfcu Home Equity Loan seamlessly

- Locate Rbfcu Home Equity Loan and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the information and then click the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow meets your needs in document management in just a few clicks from any device you choose. Modify and eSign Rbfcu Home Equity Loan and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rbfcu home equity loan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an RBFcu home equity loan?

An RBFcu home equity loan allows homeowners to borrow against the equity in their property. This type of loan can be used for various purposes, such as home improvements, debt consolidation, or major purchases. With competitive rates and flexible terms, the RBFcu home equity loan is designed to meet your financial needs.

-

What are the benefits of an RBFcu home equity loan?

The RBFcu home equity loan offers several benefits, including lower interest rates compared to personal loans and credit cards. Additionally, the interest paid on the loan may be tax-deductible, providing further financial advantages. This loan can also provide a lump sum of cash for signNow expenses.

-

How do I apply for an RBFcu home equity loan?

To apply for an RBFcu home equity loan, you can start by visiting their website or contacting a loan officer. The application process typically involves providing information about your income, credit history, and the value of your home. Once submitted, RBFcu will review your application and guide you through the next steps.

-

What are the interest rates for RBFcu home equity loans?

Interest rates for RBFcu home equity loans vary based on factors such as your credit score and the amount of equity in your home. Generally, RBFcu offers competitive rates that can help you save money over the life of the loan. It's best to check their website or contact a representative for the most current rates.

-

Can I use an RBFcu home equity loan for any purpose?

Yes, you can use an RBFcu home equity loan for a variety of purposes, including home renovations, education expenses, or consolidating high-interest debt. This flexibility allows you to leverage your home’s equity to meet your financial goals. However, it's important to use the funds wisely to avoid potential financial strain.

-

What are the repayment terms for an RBFcu home equity loan?

Repayment terms for an RBFcu home equity loan can vary, typically ranging from 5 to 30 years. This flexibility allows borrowers to choose a term that fits their budget and financial situation. It's essential to review the terms carefully to understand your monthly payment obligations.

-

Is there a fee to apply for an RBFcu home equity loan?

There may be fees associated with applying for an RBFcu home equity loan, such as appraisal fees or closing costs. However, RBFcu often provides transparent information about any potential fees during the application process. It's advisable to inquire about all costs upfront to avoid surprises.

Get more for Rbfcu Home Equity Loan

- Standard consulting services agreement form

- What is an independent contractor vs employee crosner form

- Sample independent contractor contract form

- Independent contractor operating agreement form

- Chapter 23 employment tax internal revenue service form

- Sample authorization for prior employer to release information

- Authorization of release of information agreement to whom

- My boss found out im job huntingask a manager form

Find out other Rbfcu Home Equity Loan

- Sign California Apply for Lead Pastor Easy

- Sign Rhode Island Certeficate of Insurance Request Free

- Sign Hawaii Life-Insurance Quote Form Fast

- Sign Indiana Life-Insurance Quote Form Free

- Sign Maryland Church Donation Giving Form Later

- Can I Sign New Jersey Life-Insurance Quote Form

- Can I Sign Pennsylvania Church Donation Giving Form

- Sign Oklahoma Life-Insurance Quote Form Later

- Can I Sign Texas Life-Insurance Quote Form

- Sign Texas Life-Insurance Quote Form Fast

- How To Sign Washington Life-Insurance Quote Form

- Can I Sign Wisconsin Life-Insurance Quote Form

- eSign Missouri Work Order Computer

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service