F 29UT 4 Form

What is the F 29UT 4

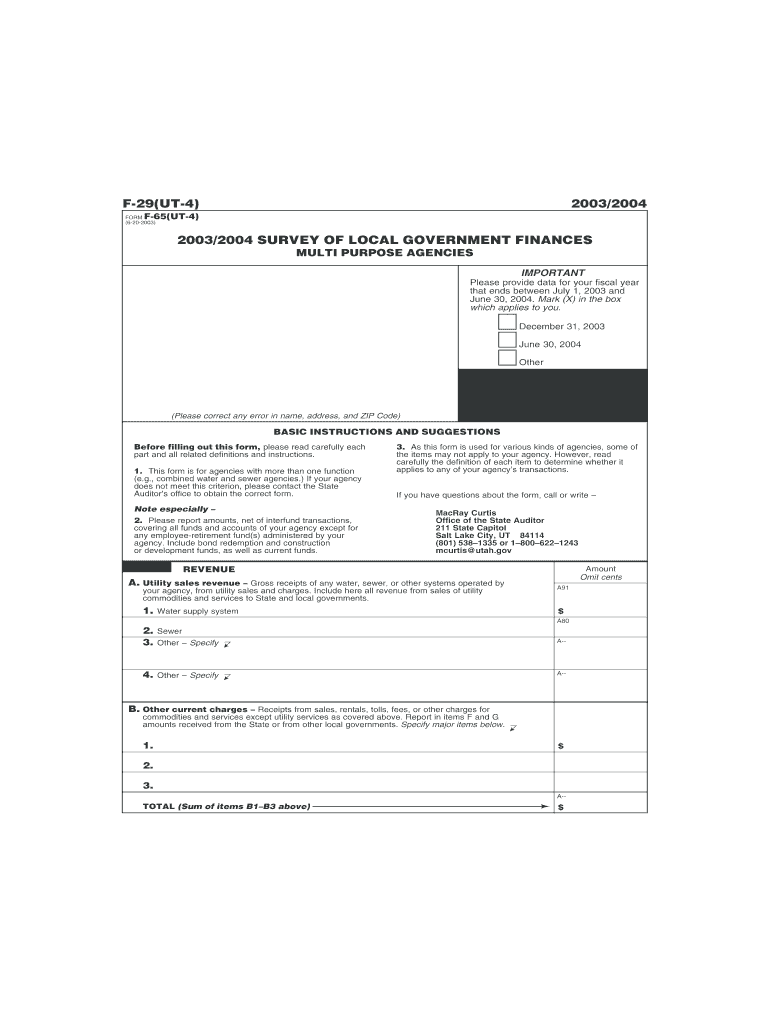

The F 29UT 4 is a specific form utilized for tax purposes in the United States. It is primarily designed for reporting certain financial information to the Internal Revenue Service (IRS). This form is essential for individuals and businesses that need to disclose income, deductions, and credits accurately. Understanding the purpose of the F 29UT 4 is crucial for ensuring compliance with federal tax regulations.

How to use the F 29UT 4

Using the F 29UT 4 involves several key steps. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, fill out the form accurately, ensuring that all information is complete and truthful. It is important to follow the instructions provided with the form carefully, as errors can lead to processing delays or penalties. Once completed, submit the form according to the specified guidelines, either electronically or by mail.

Steps to complete the F 29UT 4

Completing the F 29UT 4 requires careful attention to detail. Start by entering your personal information, including your name, address, and Social Security number. Next, report your income sources, detailing each type of income received. After that, list any deductions you are eligible for, ensuring you have supporting documentation. Finally, review the form for accuracy before submitting it to the IRS. Double-checking your entries can help avoid common mistakes that could result in delays or audits.

Legal use of the F 29UT 4

The F 29UT 4 must be used in accordance with IRS regulations. It is legally required for individuals and businesses that meet specific criteria to report their financial information accurately. Failing to use the form correctly can lead to legal repercussions, including fines or audits. It is essential to understand the legal obligations associated with this form to ensure compliance and avoid potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the F 29UT 4 are critical to adhere to in order to avoid penalties. Generally, the form must be submitted by April fifteenth of each year for the previous tax year. However, extensions may be available under certain circumstances. It is advisable to keep track of these important dates to ensure timely submission and compliance with IRS regulations.

Required Documents

To complete the F 29UT 4, several documents are typically required. These may include W-2 forms from employers, 1099 forms for freelance or contract work, and receipts for any deductible expenses. Having these documents organized and accessible will facilitate the completion of the form and help ensure that all necessary information is reported accurately.

Who Issues the Form

The F 29UT 4 is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. The IRS provides the necessary guidelines and instructions for completing the form, ensuring that taxpayers understand their obligations. It is important to refer to the IRS website or official publications for the most current information regarding the F 29UT 4.

Quick guide on how to complete f 29ut 4

Complete [SKS] seamlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily access the correct form and securely save it online. airSlate SignNow provides you with all the resources you need to create, edit, and eSign your documents swiftly without any hold-ups. Manage [SKS] on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign [SKS] effortlessly

- Find [SKS] and click Get Form to commence.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools provided specifically for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and facilitate exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to F 29UT 4

Create this form in 5 minutes!

How to create an eSignature for the f 29ut 4

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is F 29UT 4 and how does it relate to airSlate SignNow?

F 29UT 4 is a unique identifier for a specific feature set within airSlate SignNow. This feature enhances document management and eSigning capabilities, making it easier for businesses to streamline their workflows. By utilizing F 29UT 4, users can experience a more efficient document signing process.

-

What are the pricing options for airSlate SignNow with F 29UT 4?

airSlate SignNow offers competitive pricing plans that include access to F 29UT 4 features. Depending on your business needs, you can choose from various subscription tiers that provide different levels of access and functionality. This ensures that you only pay for what you need while benefiting from the F 29UT 4 capabilities.

-

What features does F 29UT 4 offer?

F 29UT 4 includes a range of features designed to enhance the eSigning experience. These features encompass customizable templates, real-time tracking, and secure cloud storage. By leveraging F 29UT 4, users can signNowly improve their document workflow efficiency.

-

How can F 29UT 4 benefit my business?

Implementing F 29UT 4 can lead to increased productivity and reduced turnaround times for document signing. Businesses can save time and resources by automating their eSigning processes. Additionally, F 29UT 4 ensures compliance and security, which are critical for any organization.

-

Does airSlate SignNow with F 29UT 4 integrate with other software?

Yes, airSlate SignNow with F 29UT 4 seamlessly integrates with various third-party applications. This includes popular CRM systems, cloud storage services, and productivity tools. These integrations allow businesses to create a cohesive workflow that enhances overall efficiency.

-

Is F 29UT 4 suitable for small businesses?

Absolutely! F 29UT 4 is designed to cater to businesses of all sizes, including small enterprises. Its cost-effective solution allows small businesses to access powerful eSigning features without breaking the bank, making it an ideal choice for budget-conscious organizations.

-

What security measures are in place for F 29UT 4?

F 29UT 4 incorporates robust security measures to protect sensitive documents. This includes encryption, secure access controls, and compliance with industry standards. Users can trust that their data is safe while using airSlate SignNow with F 29UT 4.

Get more for F 29UT 4

- Informed consent for medication f 24277sp spanish

- A dades del centre educatiu datos del centro form

- Este documento del comit espaol de representantes de personas con discapacidad form

- Conselleria deducaci universitats i ocupaci form

- Model de sollicitud dinscripci o renovaci form

- M 1 a modelo de solicitud de inscripcin o renovacin form

- Certificado de instalacin individual de gas form

- Declaracin responsable de los tcnicos sede valencia form

Find out other F 29UT 4

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word