Will Be Used by the Nevada Department of Taxation, State and Federal Form

What is the Will Be Used By The Nevada Department Of Taxation, State And Federal

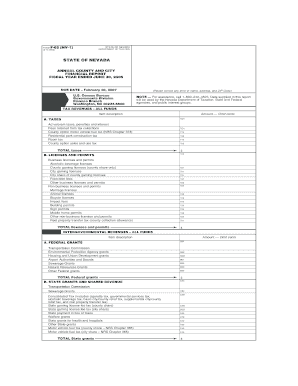

The form designated as "Will Be Used By The Nevada Department Of Taxation, State And Federal" serves as a critical document for tax-related processes in Nevada. This form is utilized by both state and federal authorities to gather necessary information from taxpayers. It is essential for ensuring compliance with tax regulations and for the accurate assessment of tax liabilities. The information collected may include personal identification details, income reporting, and other relevant financial data required by the tax authorities.

How to use the Will Be Used By The Nevada Department Of Taxation, State And Federal

To effectively use the form "Will Be Used By The Nevada Department Of Taxation, State And Federal," individuals should first ensure they have the correct version of the form. It is advisable to read the accompanying instructions carefully to understand the requirements. Users can fill out the form digitally or by hand, ensuring all sections are completed accurately. After filling out the form, it should be submitted according to the specified methods, which may include online submission, mailing, or in-person delivery to the appropriate tax office.

Steps to complete the Will Be Used By The Nevada Department Of Taxation, State And Federal

Completing the "Will Be Used By The Nevada Department Of Taxation, State And Federal" form involves several key steps:

- Gather all necessary documentation, including identification and financial records.

- Download or obtain the latest version of the form from the Nevada Department of Taxation.

- Carefully fill out each section, ensuring accuracy and completeness.

- Review the completed form for any errors or omissions.

- Submit the form through the designated method, ensuring it is sent to the correct address or online portal.

Legal use of the Will Be Used By The Nevada Department Of Taxation, State And Federal

The "Will Be Used By The Nevada Department Of Taxation, State And Federal" form has legal significance as it is mandated by tax laws. Proper use of this form is essential for compliance with both state and federal tax regulations. Failure to submit the form accurately or on time can result in penalties, including fines or additional scrutiny from tax authorities. It is important to understand the legal implications of the information provided in this form, as it may be used in audits or other legal proceedings related to tax compliance.

Required Documents

When preparing to complete the "Will Be Used By The Nevada Department Of Taxation, State And Federal," individuals should have the following documents ready:

- Social Security number or taxpayer identification number.

- Proof of income, such as W-2 forms or 1099 statements.

- Identification documents, such as a driver's license or state ID.

- Any previous tax returns that may be relevant.

- Documentation of deductions or credits being claimed.

Form Submission Methods (Online / Mail / In-Person)

The "Will Be Used By The Nevada Department Of Taxation, State And Federal" form can be submitted through various methods, depending on the preferences of the taxpayer and the requirements of the Nevada Department of Taxation. Options typically include:

- Online Submission: Many taxpayers prefer to submit forms electronically through the official tax portal.

- Mail: Completed forms can be mailed to the designated address provided by the tax authority.

- In-Person: Taxpayers may also choose to deliver their forms directly to local tax offices for immediate processing.

Quick guide on how to complete will be used by the nevada department of taxation state and federal

Prepare [SKS] effortlessly on any device

Online document management has gained signNow popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can access the necessary forms and securely store them online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents promptly without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The easiest way to edit and eSign [SKS] with ease

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you would like to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow accommodates your document management needs in just a few clicks from a device of your choosing. Modify and eSign [SKS] and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Will Be Used By The Nevada Department Of Taxation, State And Federal

Create this form in 5 minutes!

How to create an eSignature for the will be used by the nevada department of taxation state and federal

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how will it be used by the Nevada Department of Taxation, State and Federal?

airSlate SignNow is a digital signature solution that allows businesses to send and eSign documents efficiently. It will be used by the Nevada Department of Taxation, State and Federal to streamline their document management processes, ensuring compliance and enhancing operational efficiency.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various organizations. These plans are designed to provide cost-effective solutions for businesses, including those that will be used by the Nevada Department of Taxation, State and Federal, ensuring they can manage their documents without breaking the budget.

-

What features does airSlate SignNow offer?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage. These features will be used by the Nevada Department of Taxation, State and Federal to enhance their document workflows and ensure that all signatures are legally binding and secure.

-

How can airSlate SignNow benefit my business?

By using airSlate SignNow, businesses can signNowly reduce the time spent on document management and improve their overall efficiency. This solution will be used by the Nevada Department of Taxation, State and Federal to facilitate faster approvals and enhance collaboration among teams.

-

Is airSlate SignNow compliant with legal standards?

Yes, airSlate SignNow is compliant with various legal standards, including ESIGN and UETA. This compliance ensures that documents signed using the platform will be used by the Nevada Department of Taxation, State and Federal in accordance with state and federal regulations.

-

What integrations does airSlate SignNow support?

airSlate SignNow integrates seamlessly with various applications such as Google Drive, Salesforce, and Microsoft Office. These integrations will be used by the Nevada Department of Taxation, State and Federal to enhance their existing workflows and improve document accessibility.

-

Can I customize documents in airSlate SignNow?

Absolutely! airSlate SignNow allows users to create and customize documents according to their specific needs. This feature will be used by the Nevada Department of Taxation, State and Federal to ensure that all documents meet their unique requirements and standards.

Get more for Will Be Used By The Nevada Department Of Taxation, State And Federal

- Public school verification form

- Waiver updated 8 16 form

- Waiver form city of san jose sanjoseca

- Florida construction contract cost plus or fixed fee form

- Shawnee peak ski area programschool name multi we form

- Hoa bylaw amendment template form

- Cas home health care application for website docx cashomehealth form

- Www nysed govoasoffice of audit servicesnew york state education department form

Find out other Will Be Used By The Nevada Department Of Taxation, State And Federal

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement