Ct Tr 1 Form

What is the Ct Tr 1

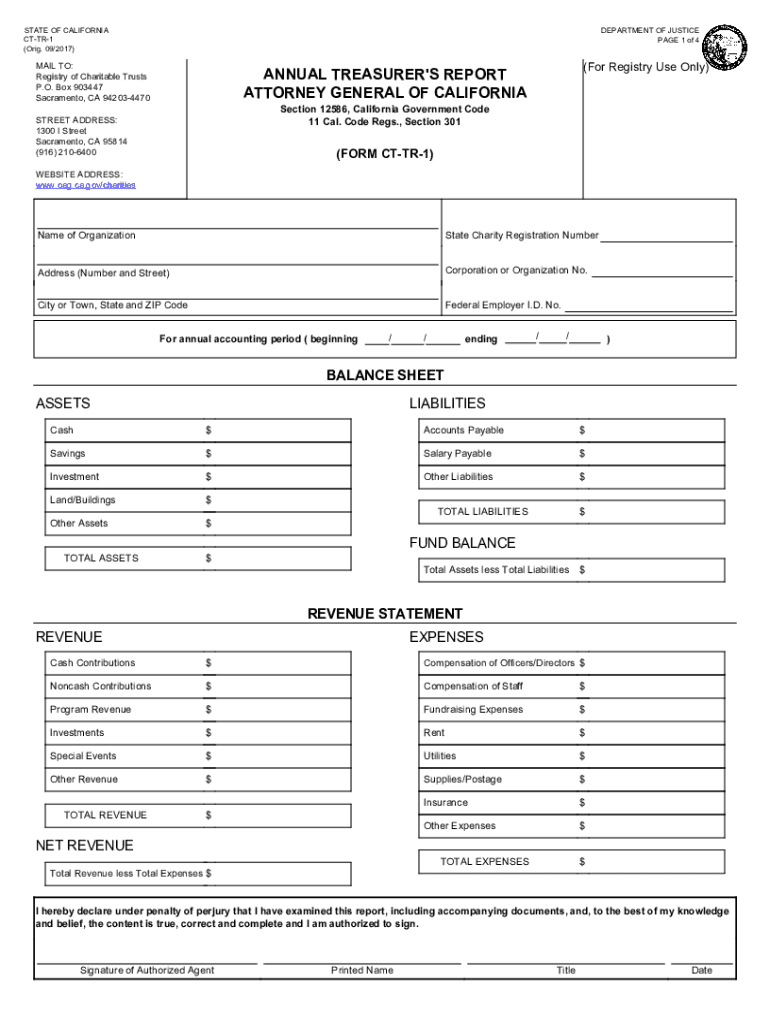

The Ct Tr 1 form, also known as the California Attorney General CT TR 1 form, is a document required for certain organizations in California to report their annual financial activities. This form is primarily used by charitable organizations to provide transparency regarding their financial status and operational activities. It serves as a tool for the California Attorney General’s office to monitor compliance with state regulations governing nonprofit organizations.

How to use the Ct Tr 1

Using the Ct Tr 1 form involves completing the required sections accurately to reflect the organization’s financial activities for the year. Organizations must gather relevant financial data, including income, expenses, and any assets held. Once the form is filled out, it must be submitted to the appropriate state office, ensuring that all information is truthful and complete to avoid penalties.

Steps to complete the Ct Tr 1

To successfully complete the Ct Tr 1 form, follow these steps:

- Gather financial records, including income statements and balance sheets.

- Fill out the form with accurate financial data, ensuring all sections are addressed.

- Review the completed form for accuracy and completeness.

- Submit the form either online or by mail, depending on the submission guidelines.

Legal use of the Ct Tr 1

The Ct Tr 1 form is legally mandated for specific organizations in California. Failure to file this form can result in penalties, including fines or loss of tax-exempt status. It is essential for organizations to understand their legal obligations regarding the completion and submission of this form to maintain compliance with state laws.

Key elements of the Ct Tr 1

Key elements of the Ct Tr 1 form include:

- Organization name and contact information.

- Financial summary, including total revenue and expenses.

- Details of programs and activities conducted during the reporting period.

- Signature of an authorized representative to validate the information provided.

Form Submission Methods

The Ct Tr 1 form can be submitted through various methods. Organizations may choose to file online via the California Attorney General’s website, which offers a streamlined process for electronic submissions. Alternatively, the form can be mailed to the appropriate office, or submitted in person, depending on the organization's preference and compliance requirements.

Quick guide on how to complete ct tr 1 535047772

Prepare Ct Tr 1 effortlessly on any device

Web-based document management has gained traction among companies and individuals. It offers a stellar eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the proper form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without hurdles. Handle Ct Tr 1 on any device using airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

How to alter and eSign Ct Tr 1 with ease

- Find Ct Tr 1 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that aim.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Decide how you would like to send your form, via email, text message (SMS), invite link, or download it to your computer.

Purge your worries about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements with just a few clicks from any device you choose. Alter and eSign Ct Tr 1 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct tr 1 535047772

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct tr 1 in relation to airSlate SignNow?

The term 'ct tr 1' refers to a specific feature within airSlate SignNow that enhances document management. This feature allows users to streamline their eSigning process, making it more efficient and user-friendly. By utilizing ct tr 1, businesses can ensure that their document workflows are optimized for speed and accuracy.

-

How does airSlate SignNow's ct tr 1 feature improve document signing?

The ct tr 1 feature in airSlate SignNow simplifies the document signing process by providing intuitive tools for both senders and signers. It reduces the time spent on manual tasks and minimizes errors, ensuring that documents are signed quickly and securely. This efficiency is crucial for businesses looking to enhance their operational workflows.

-

What are the pricing options for airSlate SignNow with ct tr 1?

airSlate SignNow offers competitive pricing plans that include access to the ct tr 1 feature. Depending on your business needs, you can choose from various subscription tiers that provide different levels of functionality. Each plan is designed to be cost-effective while delivering robust eSigning capabilities.

-

Can I integrate ct tr 1 with other software applications?

Yes, airSlate SignNow's ct tr 1 feature supports integrations with a variety of software applications. This allows businesses to connect their existing tools and streamline their workflows seamlessly. Popular integrations include CRM systems, project management tools, and cloud storage services.

-

What benefits does ct tr 1 provide for businesses?

The ct tr 1 feature offers numerous benefits, including increased efficiency, reduced turnaround times, and enhanced security for document transactions. By leveraging this feature, businesses can improve their overall productivity and ensure compliance with legal standards. Additionally, it helps in maintaining a professional image with clients.

-

Is training available for using ct tr 1 in airSlate SignNow?

Absolutely! airSlate SignNow provides comprehensive training resources for users to get acquainted with the ct tr 1 feature. These resources include tutorials, webinars, and customer support to ensure that you can maximize the benefits of this powerful tool. Training is designed to be user-friendly and accessible for all skill levels.

-

How secure is the ct tr 1 feature in airSlate SignNow?

The ct tr 1 feature is built with security in mind, employing advanced encryption and authentication protocols. This ensures that all documents signed through airSlate SignNow are protected against unauthorized access. Businesses can trust that their sensitive information remains confidential and secure throughout the signing process.

Get more for Ct Tr 1

- Petition for testing of form

- Michigan adult name change adult name change form

- Corporations act 213 public acts of 1982 limited partnerships or act 23 public acts of 1993 limited liability companies the form

- Multistate fixed rate note form 3200 pdf

- The scao garnishment form mc 13 request and writ for

- Form pc651 petition for appointment of guardian of minor

- Control number mi p004 pkg form

- Control number mi p005 pkg form

Find out other Ct Tr 1

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple