March 31, Freddie Mac Form

What is the March 31, Freddie Mac

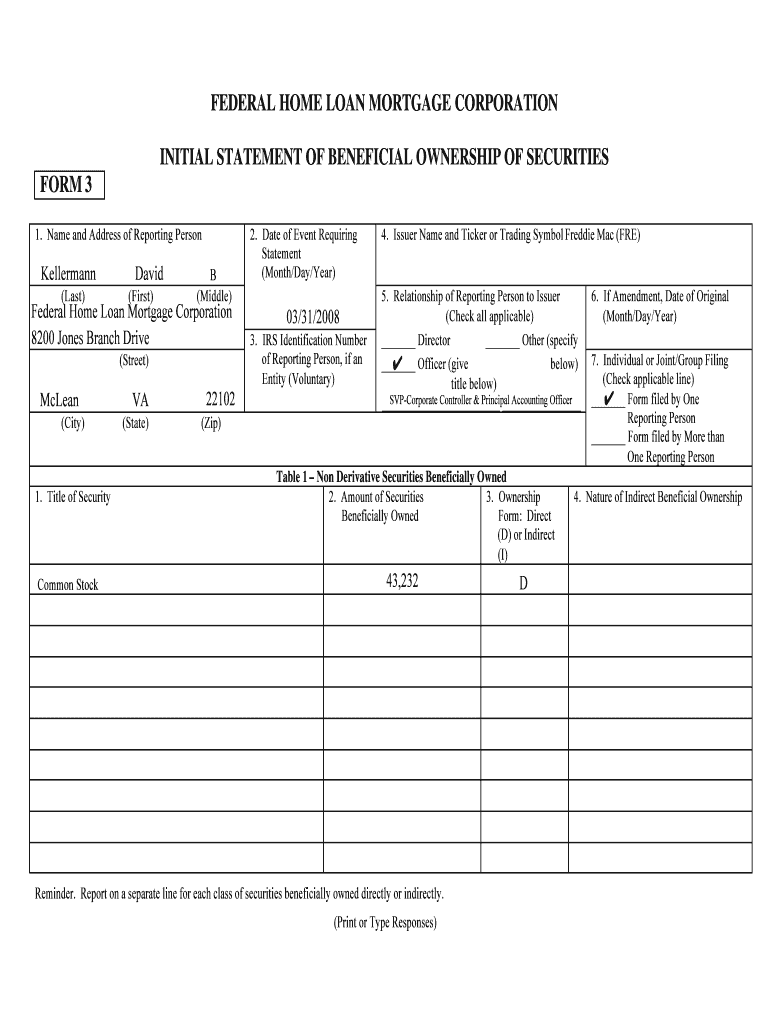

The March 31, Freddie Mac form is a critical document used in the mortgage industry, particularly for reporting and compliance purposes. It is primarily associated with Freddie Mac, a government-sponsored enterprise that plays a significant role in the U.S. housing finance system. This form is essential for lenders and financial institutions that work with Freddie Mac to ensure they meet specific regulatory requirements and guidelines.

This form typically includes detailed information about loan performance, borrower demographics, and other relevant data that helps Freddie Mac assess the risk and stability of its mortgage portfolio. Understanding this form is vital for stakeholders involved in the mortgage market, including lenders, investors, and regulators.

How to use the March 31, Freddie Mac

To effectively use the March 31, Freddie Mac form, stakeholders must first gather the necessary data related to their mortgage portfolios. This includes information on loan origination, payment history, and borrower details. Once the data is collected, it must be accurately entered into the form, adhering to Freddie Mac's guidelines.

After completing the form, it is essential to review it for accuracy and completeness. Any discrepancies can lead to compliance issues or penalties. Once verified, the form should be submitted to Freddie Mac by the specified deadline, typically aligned with quarterly reporting requirements. Utilizing digital tools can streamline this process, making it easier to fill out and submit the form efficiently.

Steps to complete the March 31, Freddie Mac

Completing the March 31, Freddie Mac form involves several key steps:

- Gather necessary data from your mortgage portfolio, including loan performance metrics and borrower information.

- Access the form through Freddie Mac's official channels or authorized platforms.

- Input the collected data into the designated fields of the form, ensuring accuracy.

- Review the completed form for any errors or omissions.

- Submit the form by the March 31 deadline, either electronically or via mail, as per Freddie Mac's submission guidelines.

Legal use of the March 31, Freddie Mac

The March 31, Freddie Mac form must be used in accordance with federal regulations and Freddie Mac's specific guidelines. Legal compliance is crucial, as failure to adhere to these requirements can result in penalties or other consequences for lenders and financial institutions. Understanding the legal implications of the data reported on this form is essential for maintaining good standing with regulatory bodies.

Stakeholders should also be aware of the importance of data privacy and security when handling borrower information. Compliance with the Fair Housing Act and other relevant laws is necessary to ensure that all practices surrounding the use of this form are lawful and ethical.

Required Documents

To complete the March 31, Freddie Mac form accurately, several documents are typically required:

- Loan origination documents, including applications and credit reports.

- Payment history records for each loan in the portfolio.

- Borrower demographic information, which may include income and employment details.

- Any relevant correspondence with Freddie Mac regarding previous submissions or compliance issues.

Having these documents readily available can facilitate a smoother completion process and help ensure that all required information is accurately reported.

Filing Deadlines / Important Dates

The March 31, Freddie Mac form is subject to specific filing deadlines that stakeholders must adhere to. Typically, the form must be submitted by the end of the first quarter, which is March 31. It is essential for lenders and financial institutions to stay informed about these deadlines to avoid potential penalties for late submissions.

Additionally, stakeholders should be aware of any changes to deadlines that may occur due to regulatory updates or changes in Freddie Mac's reporting requirements. Keeping a calendar of important dates can help ensure timely compliance.

Quick guide on how to complete march 31 freddie mac

Prepare [SKS] effortlessly on any device

Web-based document management has surged in popularity among businesses and individuals alike. It offers an excellent eco-conscious alternative to traditional printed and signed paperwork, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to edit and electronically sign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or mask sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, and mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to March 31, Freddie Mac

Create this form in 5 minutes!

How to create an eSignature for the march 31 freddie mac

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of March 31, Freddie Mac in the context of eSigning?

March 31, Freddie Mac is a crucial deadline for many businesses involved in real estate transactions. By utilizing airSlate SignNow, you can ensure that all necessary documents are eSigned and submitted on time, helping you meet this important date efficiently.

-

How does airSlate SignNow help with compliance related to March 31, Freddie Mac?

airSlate SignNow provides a secure platform that ensures all eSigned documents comply with Freddie Mac's regulations. This is particularly important as March 31 approaches, allowing businesses to maintain compliance while streamlining their document processes.

-

What features does airSlate SignNow offer to facilitate eSigning before March 31, Freddie Mac?

airSlate SignNow offers features such as customizable templates, bulk sending, and real-time tracking of document status. These tools are especially beneficial as March 31, Freddie Mac approaches, ensuring that your documents are processed quickly and efficiently.

-

Is airSlate SignNow cost-effective for businesses preparing for March 31, Freddie Mac?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. With flexible pricing plans, you can choose the option that best fits your needs as you prepare for the March 31, Freddie Mac deadline.

-

Can I integrate airSlate SignNow with other tools for managing March 31, Freddie Mac documents?

Absolutely! airSlate SignNow integrates seamlessly with various CRM and document management systems. This integration is particularly useful for managing documents related to March 31, Freddie Mac, allowing for a smoother workflow.

-

What benefits does airSlate SignNow provide for remote teams working towards March 31, Freddie Mac?

For remote teams, airSlate SignNow offers a collaborative platform that allows multiple users to eSign documents from anywhere. This is especially beneficial as March 31, Freddie Mac approaches, ensuring that all team members can contribute to the signing process without delays.

-

How does airSlate SignNow ensure the security of documents related to March 31, Freddie Mac?

airSlate SignNow employs advanced security measures, including encryption and secure access controls, to protect your documents. This is crucial for sensitive transactions related to March 31, Freddie Mac, giving you peace of mind as you eSign important documents.

Get more for March 31, Freddie Mac

Find out other March 31, Freddie Mac

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure