Housing Tax Credit Basics FAQs 2020-2026

Understanding Housing Tax Credits

The Housing Tax Credit program, also known as the Low-Income Housing Tax Credit (LIHTC), is a federal initiative designed to encourage the development of affordable rental housing. It provides tax incentives to developers who build or rehabilitate low-income housing. The credits are allocated to states, which then distribute them to eligible projects. This program plays a crucial role in addressing the housing needs of low-income families across the United States.

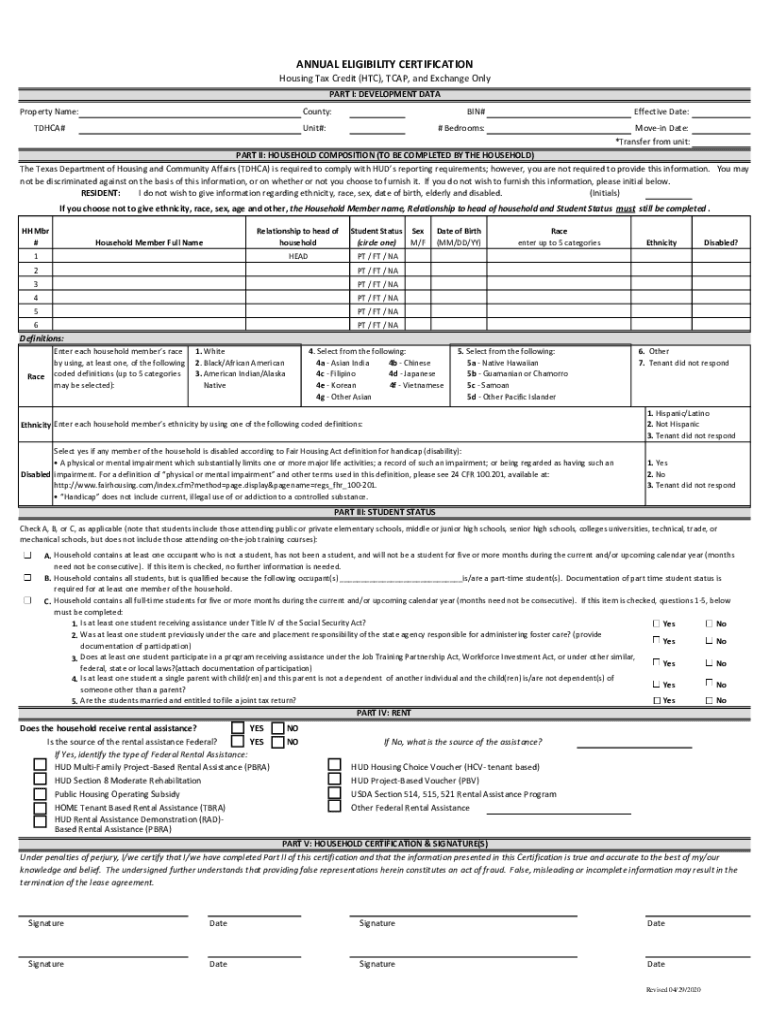

Eligibility Criteria for Housing Tax Credits

To qualify for the Housing Tax Credit, certain criteria must be met. Primarily, the project must serve low-income tenants, typically defined as those earning no more than sixty percent of the area median income. Additionally, the property must remain affordable for a specified period, usually between fifteen to thirty years. Developers must also adhere to specific state and local regulations, which may vary based on location.

Application Process for Housing Tax Credits

The application process for obtaining Housing Tax Credits involves several steps. First, developers must submit a proposal to the state housing agency, detailing the project scope, budget, and expected benefits. After initial review, the agency may request additional information or modifications. Once approved, the credits are allocated, allowing the developer to claim them on their federal tax returns over a ten-year period.

Required Documentation for Housing Tax Credit Applications

When applying for Housing Tax Credits, developers need to prepare and submit various documents. Key documents typically include:

- Project plans and specifications

- Financial projections and funding sources

- Evidence of site control

- Letters of support from local government or community organizations

Providing comprehensive and accurate documentation is essential for a successful application.

IRS Guidelines for Housing Tax Credits

The Internal Revenue Service (IRS) outlines specific guidelines for the Housing Tax Credit program. These guidelines include compliance with income limits, rent restrictions, and maintenance of tenant records. Developers must also ensure that properties meet minimum quality standards to qualify for the credits. Regular audits may be conducted to ensure adherence to these requirements.

Penalties for Non-Compliance with Housing Tax Credit Regulations

Failure to comply with the Housing Tax Credit regulations can result in significant penalties. Non-compliance may lead to the recapture of tax credits, which means that the developer must repay the credits already claimed. Additionally, there may be fines or restrictions on future participation in the program. It is crucial for developers to maintain compliance throughout the affordability period to avoid these consequences.

Quick guide on how to complete housing tax credit basics faqs

Easily Prepare Housing Tax Credit Basics FAQs on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers a sustainable alternative to traditional printed and signed paperwork, enabling you to locate the right form and securely maintain it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents promptly without delays. Handle Housing Tax Credit Basics FAQs on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to Edit and eSign Housing Tax Credit Basics FAQs Effortlessly

- Locate Housing Tax Credit Basics FAQs and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact confidential information using tools specifically designed by airSlate SignNow for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your updates.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate issues of lost or misplaced files, frustrating form searches, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Edit and eSign Housing Tax Credit Basics FAQs and ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct housing tax credit basics faqs

Create this form in 5 minutes!

How to create an eSignature for the housing tax credit basics faqs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Housing Tax Credit Basics?

Housing Tax Credit Basics refer to the fundamental principles and guidelines surrounding tax credits available for housing projects. These credits are designed to incentivize the development of affordable housing. Understanding these basics is crucial for developers and investors looking to maximize their benefits.

-

How can airSlate SignNow help with Housing Tax Credit documentation?

airSlate SignNow streamlines the process of sending and eSigning documents related to Housing Tax Credit applications. Our platform ensures that all necessary paperwork is completed efficiently and securely. This can signNowly reduce the time spent on administrative tasks, allowing you to focus on your housing projects.

-

What features does airSlate SignNow offer for managing Housing Tax Credit documents?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure cloud storage for managing Housing Tax Credit documents. These tools help ensure compliance and organization throughout the application process. With our user-friendly interface, you can easily navigate and manage your documentation.

-

Is airSlate SignNow cost-effective for Housing Tax Credit projects?

Yes, airSlate SignNow is a cost-effective solution for managing Housing Tax Credit projects. Our pricing plans are designed to fit various budgets, making it accessible for businesses of all sizes. By reducing paperwork and streamlining processes, you can save both time and money.

-

What are the benefits of using airSlate SignNow for Housing Tax Credit applications?

Using airSlate SignNow for Housing Tax Credit applications offers numerous benefits, including increased efficiency, enhanced security, and improved collaboration. Our platform allows multiple stakeholders to review and sign documents quickly, ensuring that your applications are submitted on time. This can lead to faster approvals and project initiation.

-

Can airSlate SignNow integrate with other tools for Housing Tax Credit management?

Absolutely! airSlate SignNow integrates seamlessly with various tools and platforms commonly used in Housing Tax Credit management. This includes project management software and accounting systems, allowing for a more cohesive workflow. These integrations help streamline processes and improve overall efficiency.

-

How does airSlate SignNow ensure the security of Housing Tax Credit documents?

airSlate SignNow prioritizes the security of your Housing Tax Credit documents through advanced encryption and secure access controls. Our platform complies with industry standards to protect sensitive information. You can trust that your documents are safe while being processed and stored.

Get more for Housing Tax Credit Basics FAQs

Find out other Housing Tax Credit Basics FAQs

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form