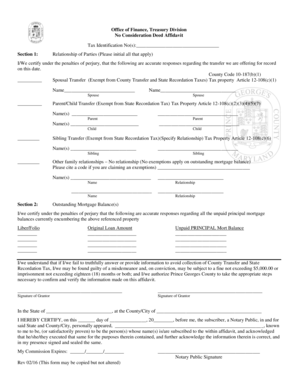

Office of Finance Treasury Division Princegeorgescountymd 2016-2026

Understanding the Baltimore City No Consideration Affidavit

The Baltimore City no consideration affidavit is a legal document used primarily in real estate transactions. This affidavit serves to confirm that no monetary consideration is exchanged between the parties involved in a property transfer. It is essential for ensuring that the transaction is recognized as a gift or transfer without financial compensation, which can have implications for tax assessments and legal ownership. Understanding the purpose of this affidavit is crucial for both buyers and sellers in Baltimore City.

Steps to Complete the Baltimore City No Consideration Affidavit

Completing the Baltimore City no consideration affidavit involves several key steps:

- Gather Required Information: Collect details about the property, including the address, the names of the parties involved, and any relevant property identification numbers.

- Fill Out the Affidavit: Accurately complete the affidavit form, ensuring that all information is correct and clearly stated.

- Sign the Affidavit: Both parties must sign the affidavit in the presence of a notary public to validate the document.

- Submit the Affidavit: File the signed affidavit with the appropriate local government office, typically the Baltimore City Department of Finance, to ensure it is officially recorded.

Legal Use of the Baltimore City No Consideration Affidavit

The legal use of the Baltimore City no consideration affidavit is primarily to document property transfers that do not involve any exchange of money. This affidavit can be crucial for tax purposes, as it may exempt the transaction from certain taxes that apply to sales involving financial consideration. It is important to understand the legal implications of the affidavit, as it can affect property tax assessments and ownership rights.

Required Documents for the Affidavit

When preparing to submit the Baltimore City no consideration affidavit, several documents may be required:

- Property Deed: A copy of the current deed for the property being transferred.

- Identification: Valid identification for all parties involved in the transaction.

- Notarization: Proof of notarization of the affidavit, as signatures must be verified by a notary public.

Filing Deadlines and Important Dates

It is essential to be aware of filing deadlines related to the Baltimore City no consideration affidavit. While specific deadlines may vary, it is generally advisable to submit the affidavit promptly following the property transfer to avoid any potential legal complications. Check with local authorities for any specific deadlines that may apply to your situation.

Who Issues the Baltimore City No Consideration Affidavit

The Baltimore City no consideration affidavit is typically issued by the Baltimore City Department of Finance. This office is responsible for overseeing property transactions and ensuring that all necessary documentation is filed correctly. It is advisable to consult with this department for guidance on the affidavit process and any additional requirements that may be necessary.

Quick guide on how to complete office of finance treasury division princegeorgescountymd

Effortlessly Prepare Office Of Finance Treasury Division Princegeorgescountymd on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the appropriate form and securely keep it online. airSlate SignNow provides all the tools necessary to create, amend, and eSign your documents swiftly without any holdups. Manage Office Of Finance Treasury Division Princegeorgescountymd on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The Easiest Way to Edit and eSign Office Of Finance Treasury Division Princegeorgescountymd Hassle-Free

- Locate Office Of Finance Treasury Division Princegeorgescountymd and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the details and then click the Done button to save your edits.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invite link, or download to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Office Of Finance Treasury Division Princegeorgescountymd to ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct office of finance treasury division princegeorgescountymd

Create this form in 5 minutes!

How to create an eSignature for the office of finance treasury division princegeorgescountymd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Baltimore City no consideration affidavit?

A Baltimore City no consideration affidavit is a legal document used to affirm that no monetary consideration was exchanged in a transaction. This affidavit is often required for certain property transfers and helps clarify the nature of the transaction for legal purposes.

-

How can airSlate SignNow help with Baltimore City no consideration affidavits?

airSlate SignNow provides a streamlined platform for creating, sending, and eSigning Baltimore City no consideration affidavits. Our user-friendly interface ensures that you can complete your documents quickly and efficiently, saving you time and effort.

-

What are the pricing options for using airSlate SignNow for affidavits?

airSlate SignNow offers flexible pricing plans that cater to different business needs. Whether you are a small business or a large enterprise, you can find a plan that allows you to manage your Baltimore City no consideration affidavits effectively without breaking the bank.

-

Are there any features specifically for managing affidavits?

Yes, airSlate SignNow includes features tailored for managing affidavits, including customizable templates, secure eSigning, and document tracking. These features ensure that your Baltimore City no consideration affidavits are handled with the utmost professionalism and security.

-

What are the benefits of using airSlate SignNow for legal documents?

Using airSlate SignNow for your legal documents, including Baltimore City no consideration affidavits, offers numerous benefits such as enhanced security, faster processing times, and reduced paperwork. Our platform simplifies the entire process, allowing you to focus on your core business activities.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to incorporate our eSigning solution into your existing workflows. This means you can seamlessly manage your Baltimore City no consideration affidavits alongside other business processes.

-

Is airSlate SignNow compliant with legal standards for affidavits?

Yes, airSlate SignNow is designed to comply with legal standards for electronic signatures and document management. This ensures that your Baltimore City no consideration affidavits are legally binding and recognized by authorities.

Get more for Office Of Finance Treasury Division Princegeorgescountymd

- When lease montgomery county form

- Tenant complaint sample form

- 2407770311 form

- Room rental transient tax return form montgomery county montgomerycountymd

- Texas association of realtors residential lease inventory and condition form 2020

- Mdrr form

- Township of old brige home old bridge nj form

- Town of southampton highway department southamptontownny form

Find out other Office Of Finance Treasury Division Princegeorgescountymd

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation