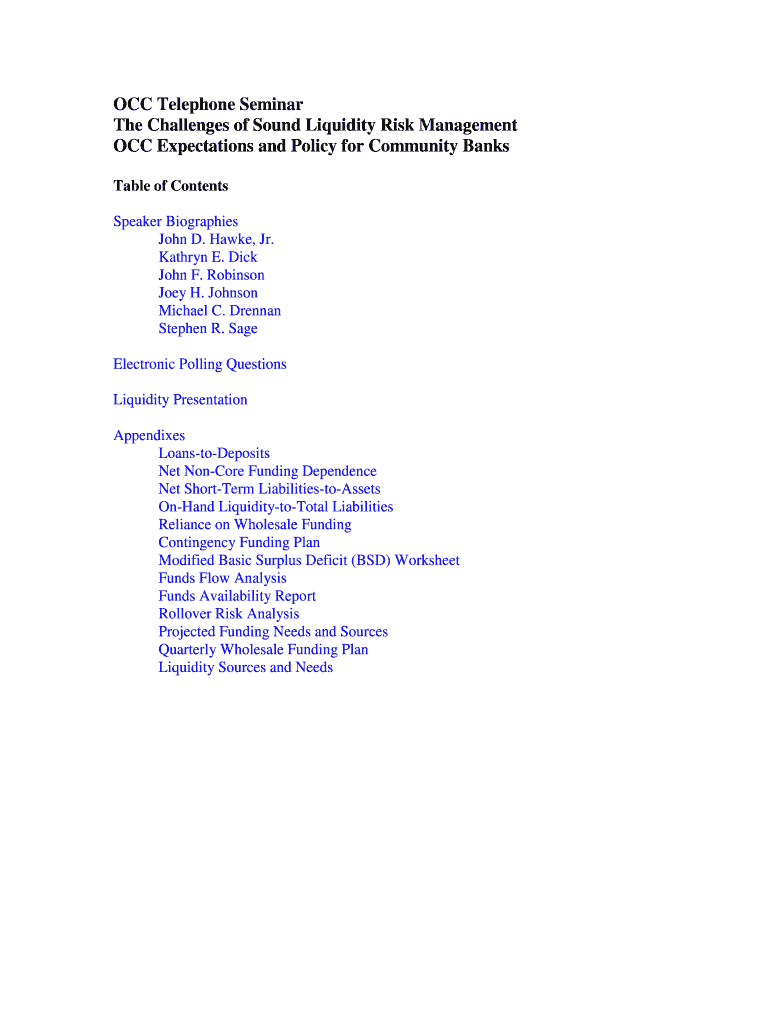

The Challenges of Sound Liquidity Risk Management OCC Expectations and Policy for Community Banks OCC Telephone Seminar Occ Form

Understanding the Challenges of Sound Liquidity Risk Management

The Challenges of Sound Liquidity Risk Management focuses on the complexities community banks face in maintaining adequate liquidity. This involves ensuring that banks can meet their financial obligations without incurring unacceptable losses. Key factors include understanding the sources of liquidity, the timing of cash flows, and the potential impact of market conditions. Community banks must develop strategies that align with the Office of the Comptroller of the Currency (OCC) expectations to manage liquidity effectively.

Key Elements of OCC Expectations and Policy

The OCC outlines specific expectations for community banks regarding liquidity risk management. These include maintaining a robust liquidity risk management framework, conducting regular stress testing, and ensuring that liquidity policies are comprehensive and well-documented. Banks are also expected to monitor their liquidity position continuously and have contingency funding plans in place to address potential liquidity shortfalls.

Steps to Implement Effective Liquidity Risk Management

Implementing effective liquidity risk management involves several critical steps:

- Assessing current liquidity levels and identifying potential vulnerabilities.

- Developing a liquidity risk management policy that aligns with OCC guidelines.

- Establishing a framework for regular monitoring and reporting of liquidity positions.

- Conducting stress tests to evaluate the impact of adverse scenarios on liquidity.

- Creating contingency funding plans to address unexpected liquidity needs.

Legal Use of Liquidity Risk Management Policies

Community banks must ensure that their liquidity risk management policies comply with federal regulations and OCC guidelines. This includes adhering to the requirements for documentation, reporting, and governance. Legal compliance not only protects the bank from regulatory penalties but also enhances its reputation and operational stability.

Examples of Effective Liquidity Management Practices

Effective liquidity management practices can vary among community banks but often include:

- Utilizing a diversified funding base to reduce reliance on any single source of liquidity.

- Maintaining a liquidity buffer of high-quality liquid assets that can be readily converted to cash.

- Engaging in proactive communication with stakeholders regarding liquidity positions and strategies.

- Regularly reviewing and updating liquidity policies to reflect changing market conditions and regulatory expectations.

Obtaining Resources for Liquidity Risk Management

Community banks can access various resources to enhance their liquidity risk management practices. These include guidance documents from the OCC, industry best practices, and training seminars. Engaging with professional organizations and attending workshops can also provide valuable insights into effective liquidity management strategies.

Quick guide on how to complete the challenges of sound liquidity risk management occ expectations and policy for community banks occ telephone seminar occ

Complete [SKS] seamlessly on any device

Online document management has gained traction with businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents quickly and without hold-ups. Manage [SKS] on any platform using airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools available to complete your form.

- Highlight essential sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as an ink signature.

- Review the information and click the Done button to save your updates.

- Choose your preferred method to deliver your form, whether by email, SMS, or invite link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and eSign [SKS] to maintain exceptional communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to The Challenges Of Sound Liquidity Risk Management OCC Expectations And Policy For Community Banks OCC Telephone Seminar Occ

Create this form in 5 minutes!

How to create an eSignature for the the challenges of sound liquidity risk management occ expectations and policy for community banks occ telephone seminar occ

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of The Challenges Of Sound Liquidity Risk Management OCC Expectations And Policy For Community Banks OCC Telephone Seminar?

The Challenges Of Sound Liquidity Risk Management OCC Expectations And Policy For Community Banks OCC Telephone Seminar is crucial for community banks to understand regulatory expectations. It provides insights into effective liquidity risk management practices, helping banks align with OCC guidelines and enhance their operational resilience.

-

How can airSlate SignNow assist in managing liquidity risk documentation?

airSlate SignNow streamlines the documentation process related to The Challenges Of Sound Liquidity Risk Management OCC Expectations And Policy For Community Banks OCC Telephone Seminar. With its eSigning capabilities, banks can quickly send, sign, and store important documents, ensuring compliance and efficient record-keeping.

-

What features does airSlate SignNow offer for community banks?

airSlate SignNow offers features such as customizable templates, secure eSigning, and real-time tracking, all of which are essential for addressing The Challenges Of Sound Liquidity Risk Management OCC Expectations And Policy For Community Banks OCC Telephone Seminar. These tools help banks manage their liquidity risk documentation effectively and efficiently.

-

Is airSlate SignNow cost-effective for community banks?

Yes, airSlate SignNow is designed to be a cost-effective solution for community banks facing The Challenges Of Sound Liquidity Risk Management OCC Expectations And Policy For Community Banks OCC Telephone Seminar. With flexible pricing plans, banks can choose a package that fits their budget while still accessing essential features.

-

Can airSlate SignNow integrate with other banking software?

Absolutely! airSlate SignNow offers seamless integrations with various banking software, which is vital for addressing The Challenges Of Sound Liquidity Risk Management OCC Expectations And Policy For Community Banks OCC Telephone Seminar. This ensures that banks can maintain a cohesive workflow and enhance their operational efficiency.

-

What are the benefits of using airSlate SignNow for liquidity risk management?

Using airSlate SignNow for liquidity risk management provides numerous benefits, including improved compliance with The Challenges Of Sound Liquidity Risk Management OCC Expectations And Policy For Community Banks OCC Telephone Seminar. The platform enhances document security, reduces turnaround times, and simplifies the signing process, allowing banks to focus on their core operations.

-

How does airSlate SignNow ensure document security?

airSlate SignNow prioritizes document security, which is essential for managing The Challenges Of Sound Liquidity Risk Management OCC Expectations And Policy For Community Banks OCC Telephone Seminar. The platform employs advanced encryption and authentication measures to protect sensitive information, ensuring that all transactions are secure and compliant.

Get more for The Challenges Of Sound Liquidity Risk Management OCC Expectations And Policy For Community Banks OCC Telephone Seminar Occ

Find out other The Challenges Of Sound Liquidity Risk Management OCC Expectations And Policy For Community Banks OCC Telephone Seminar Occ

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form