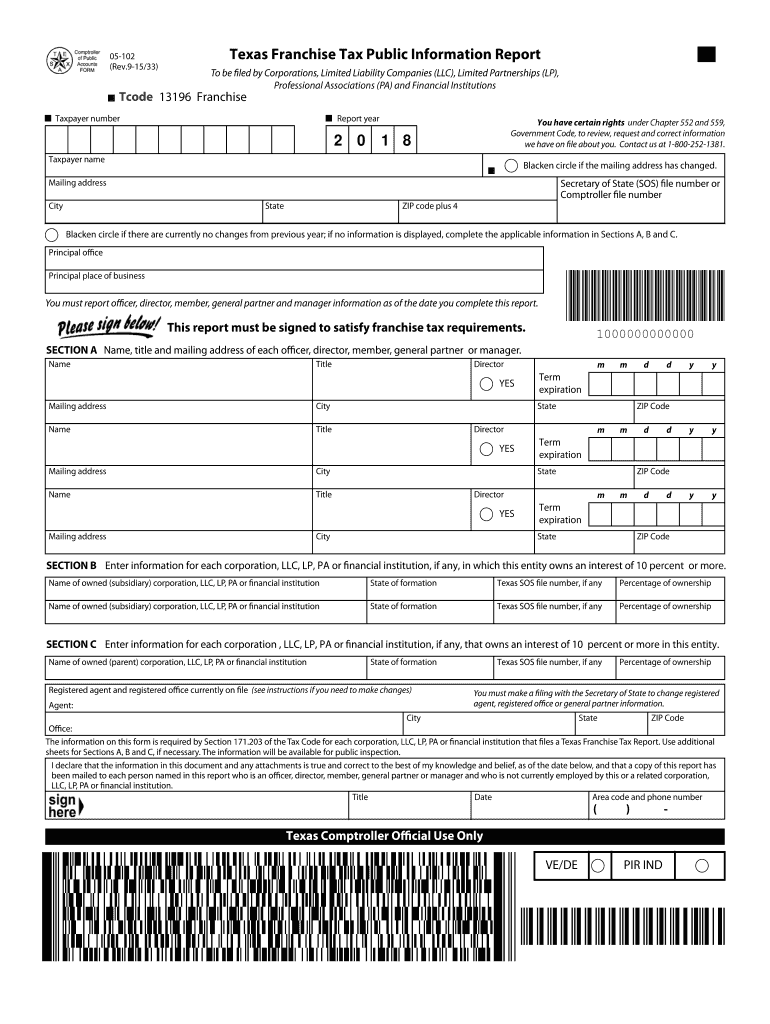

102 Form 2018

What is the 102 Form

The 102 Form is a tax-related document used primarily for reporting specific income types to the Internal Revenue Service (IRS). This form is essential for individuals and businesses to accurately disclose their earnings and ensure compliance with federal tax regulations. By providing necessary information, the 102 Form helps determine tax liabilities and facilitates the processing of tax returns.

How to use the 102 Form

Using the 102 Form involves several key steps to ensure accurate completion. First, gather all relevant financial documents, including income statements and expense records. Next, fill out the form with precise information regarding your income sources, deductions, and any applicable credits. Once completed, review the form for accuracy before submitting it to the IRS. Utilizing an electronic signature solution can streamline this process, making it easier to submit your form securely and efficiently.

Steps to complete the 102 Form

Completing the 102 Form requires careful attention to detail. Follow these steps for successful completion:

- Gather all necessary financial documents, such as W-2s or 1099s.

- Ensure you have the correct version of the 102 Form for the tax year.

- Fill in your personal information, including your name, address, and Social Security number.

- Report all income accurately, listing each source as required.

- Include any deductions or credits you qualify for.

- Review the completed form for any errors or omissions.

- Sign and date the form before submission.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the 102 Form. It is crucial to adhere to these guidelines to avoid penalties. Ensure that you are using the latest version of the form, as tax laws and requirements may change annually. Additionally, the IRS has outlined acceptable methods for submitting the form, including electronic filing options that enhance security and efficiency.

Form Submission Methods

The 102 Form can be submitted through various methods, accommodating different preferences and situations. Options include:

- Online Submission: Utilize IRS e-file services or authorized e-filing software for a quick and secure submission.

- Mail: Print the completed form and send it to the appropriate IRS address based on your location and tax situation.

- In-Person: Visit a local IRS office if you require assistance or prefer to submit your form directly.

Required Documents

To complete the 102 Form accurately, certain documents are necessary. These typically include:

- Income statements such as W-2s or 1099s.

- Records of any deductions or credits you plan to claim.

- Previous tax returns for reference, if applicable.

Having these documents on hand will facilitate a smoother completion process and help ensure accuracy.

Quick guide on how to complete 102 form 2018 2019

Your assistance manual on how to prepare your 102 Form

If you’re looking to learn how to create and send your 102 Form, here are some straightforward instructions on how to simplify tax submission.

To begin, all you need is to set up your airSlate SignNow account to transform your online document management. airSlate SignNow is an intuitive and robust document solution that enables you to modify, create, and complete your tax forms with ease. Utilizing its editor, you can alternate between text, checkboxes, and eSignatures and revisit to revise responses when necessary. Streamline your tax administration with advanced PDF editing, eSigning, and convenient sharing.

Follow the instructions below to complete your 102 Form in just a few minutes:

- Create your account and start working on PDFs shortly.

- Browse our catalog to obtain any IRS tax document; look through different versions and schedules.

- Click Get form to access your 102 Form in our editor.

- Fill in the required fields with your information (text, numbers, checkmarks).

- Utilize the Sign Tool to add your legally-binding eSignature (if necessary).

- Examine your document and rectify any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Please be aware that filing on paper can lead to return issues and delay refunds. Before e-filing your taxes, check the IRS website for declaration regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct 102 form 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How do I fill out the Form 102 (ICAI) for an articleship? Can anyone provide a sample format?

Form 102 serves as a contract between you and your Principal at work. It becomes binding only when its Franked.Franking is nothing but converting it into a Non Judicial Paper. So u'll be filling in your name, your articleship period and other details and you and your boss(principal) will sign it on each page and at the end. It need not be sent to the institute , one copy is for you and another for your Principal .Nothin to worry..And while filling the form if you have any query , just see the form filled by old articles. The record will be with your Principal or ask your seniors.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

Create this form in 5 minutes!

How to create an eSignature for the 102 form 2018 2019

How to create an eSignature for the 102 Form 2018 2019 online

How to create an electronic signature for your 102 Form 2018 2019 in Chrome

How to create an eSignature for signing the 102 Form 2018 2019 in Gmail

How to create an electronic signature for the 102 Form 2018 2019 from your smartphone

How to create an eSignature for the 102 Form 2018 2019 on iOS devices

How to make an electronic signature for the 102 Form 2018 2019 on Android devices

People also ask

-

What is a 102 Form and how can airSlate SignNow help with it?

A 102 Form typically refers to a specific type of document that may require electronic signatures for faster processing. With airSlate SignNow, you can easily upload, send, and eSign your 102 Form securely and efficiently, ensuring compliance and speeding up the approval process.

-

Is there a cost to use airSlate SignNow for managing a 102 Form?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. You can choose a plan that suits your volume of 102 Form transactions, with options for individual users as well as teams, making it a flexible choice for all.

-

What features does airSlate SignNow offer for 102 Form processing?

airSlate SignNow provides a range of features for 102 Form processing, including customizable templates, automated workflows, and secure cloud storage. These features streamline the signing process, allowing you to manage your documents efficiently.

-

Can I integrate airSlate SignNow with other software to manage my 102 Form?

Absolutely! airSlate SignNow integrates seamlessly with many popular software applications such as CRM systems, document management tools, and cloud storage services. This means you can easily incorporate your 102 Form workflows into your existing systems.

-

How secure is airSlate SignNow when handling my 102 Form?

Security is a top priority at airSlate SignNow. All data, including your 102 Form, is encrypted during transmission and storage, and we comply with industry-standard security protocols to protect sensitive information.

-

Can multiple users collaborate on a 102 Form in airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on a 102 Form. You can invite team members to review and sign documents, ensuring everyone involved in the process can contribute effectively and efficiently.

-

How does airSlate SignNow improve the efficiency of processing a 102 Form?

airSlate SignNow signNowly enhances the efficiency of processing a 102 Form by automating key steps in the signing process. With features like reminders and real-time tracking, you can minimize delays and ensure timely completion of your documents.

Get more for 102 Form

Find out other 102 Form

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe