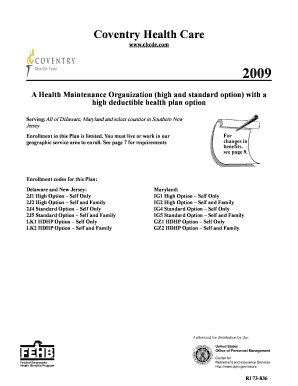

High Deductible Health Plan Option Opm Form

What is the High Deductible Health Plan Option OPM

The High Deductible Health Plan Option OPM is a health insurance plan designed for federal employees and retirees. This plan typically features lower premiums and higher deductibles compared to traditional health plans. It allows members to save money on monthly costs while providing coverage for essential health services once the deductible is met. This option is particularly beneficial for individuals who do not anticipate frequent medical expenses and prefer to manage their healthcare costs more directly.

How to use the High Deductible Health Plan Option OPM

Using the High Deductible Health Plan Option OPM involves understanding the coverage details and how to access services. Members must first pay the deductible before the plan begins to cover eligible medical expenses. To utilize this plan effectively, it is important to keep track of all medical expenses and ensure that providers are within the network to avoid higher out-of-pocket costs. Additionally, members can set up a Health Savings Account (HSA) to help manage costs associated with the deductible.

Eligibility Criteria

To be eligible for the High Deductible Health Plan Option OPM, individuals must be federal employees or retirees. Eligibility also extends to certain family members, including spouses and dependent children. It is essential to review specific enrollment periods and requirements, as these can vary based on employment status and other factors. Understanding these criteria helps ensure that applicants can take full advantage of the benefits offered by this health plan.

Steps to complete the High Deductible Health Plan Option OPM

Completing the application for the High Deductible Health Plan Option OPM involves several key steps:

- Review eligibility requirements to ensure qualification.

- Gather necessary documentation, including proof of employment and dependent information.

- Complete the enrollment form accurately, providing all required details.

- Submit the application during the designated enrollment period.

- Receive confirmation of enrollment and review the plan details to understand coverage.

Required Documents

When applying for the High Deductible Health Plan Option OPM, certain documents are typically required. These may include:

- Proof of federal employment or retirement status.

- Identification documents for dependents, if applicable.

- Previous health insurance information, if transitioning from another plan.

Having these documents ready can streamline the application process and reduce delays in enrollment.

IRS Guidelines

The Internal Revenue Service (IRS) provides guidelines for individuals enrolled in high deductible health plans, particularly regarding Health Savings Accounts (HSAs). Contributions to an HSA can be tax-deductible, and funds can be used for qualified medical expenses without incurring taxes. It is important for members to stay informed about annual contribution limits and eligible expenses to maximize their tax benefits while enrolled in the High Deductible Health Plan Option OPM.

Examples of using the High Deductible Health Plan Option OPM

Examples of utilizing the High Deductible Health Plan Option OPM can illustrate its benefits. For instance, a healthy individual might choose this plan to save on monthly premiums, using the savings to contribute to an HSA. In the event of an unexpected medical issue, such as a minor surgery, the individual would pay the deductible before the plan covers further costs. Another example could involve a family who anticipates regular medical visits for a child’s ongoing treatment, allowing them to budget for the deductible while benefiting from lower premiums overall.

Quick guide on how to complete high deductible health plan option opm

Complete [SKS] seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an excellent eco-friendly substitute to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any platform using airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

How to edit and eSign [SKS] effortlessly

- Obtain [SKS] and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Select pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your chosen device. Modify and eSign [SKS] and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to High Deductible Health Plan Option Opm

Create this form in 5 minutes!

How to create an eSignature for the high deductible health plan option opm

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a High Deductible Health Plan Option Opm?

A High Deductible Health Plan Option Opm is a type of health insurance plan that features higher deductibles and lower premiums. This plan is designed to provide individuals with a cost-effective way to manage their healthcare expenses while still offering essential coverage. It is particularly beneficial for those who do not anticipate frequent medical visits.

-

What are the benefits of choosing a High Deductible Health Plan Option Opm?

The primary benefits of a High Deductible Health Plan Option Opm include lower monthly premiums and the ability to contribute to a Health Savings Account (HSA). This allows individuals to save money tax-free for medical expenses. Additionally, these plans often cover preventive services at no cost, promoting proactive health management.

-

How does the pricing work for a High Deductible Health Plan Option Opm?

Pricing for a High Deductible Health Plan Option Opm typically involves lower monthly premiums compared to traditional plans, but higher out-of-pocket costs when accessing care. It's essential to evaluate your healthcare needs and budget to determine if this plan is the right fit. Understanding the deductible and out-of-pocket maximums is crucial for effective financial planning.

-

Are there any specific features of the High Deductible Health Plan Option Opm?

Yes, the High Deductible Health Plan Option Opm often includes features such as access to a wide network of healthcare providers, preventive care coverage, and the option to use an HSA. These features make it easier for individuals to manage their healthcare costs while still receiving necessary medical services. Additionally, many plans offer telehealth services for added convenience.

-

Can I integrate a High Deductible Health Plan Option Opm with other insurance plans?

Yes, you can integrate a High Deductible Health Plan Option Opm with other insurance plans, such as supplemental insurance or specific health coverage. This can provide additional financial protection and enhance your overall healthcare strategy. It's advisable to consult with an insurance expert to ensure compatibility and maximize benefits.

-

What types of healthcare services are covered under a High Deductible Health Plan Option Opm?

A High Deductible Health Plan Option Opm typically covers a range of healthcare services, including preventive care, hospitalization, and emergency services. However, it's important to review the specific plan details to understand what is included and any limitations that may apply. Most plans will cover preventive services at no cost, encouraging regular health check-ups.

-

How can I determine if a High Deductible Health Plan Option Opm is right for me?

To determine if a High Deductible Health Plan Option Opm is right for you, consider your healthcare needs, financial situation, and risk tolerance. If you are generally healthy and do not require frequent medical care, this plan may save you money. However, if you have ongoing health issues, it may be beneficial to explore other options with lower deductibles.

Get more for High Deductible Health Plan Option Opm

Find out other High Deductible Health Plan Option Opm

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT