Forms 494 and 495 XLS

What is the Forms 494 And 495 xls

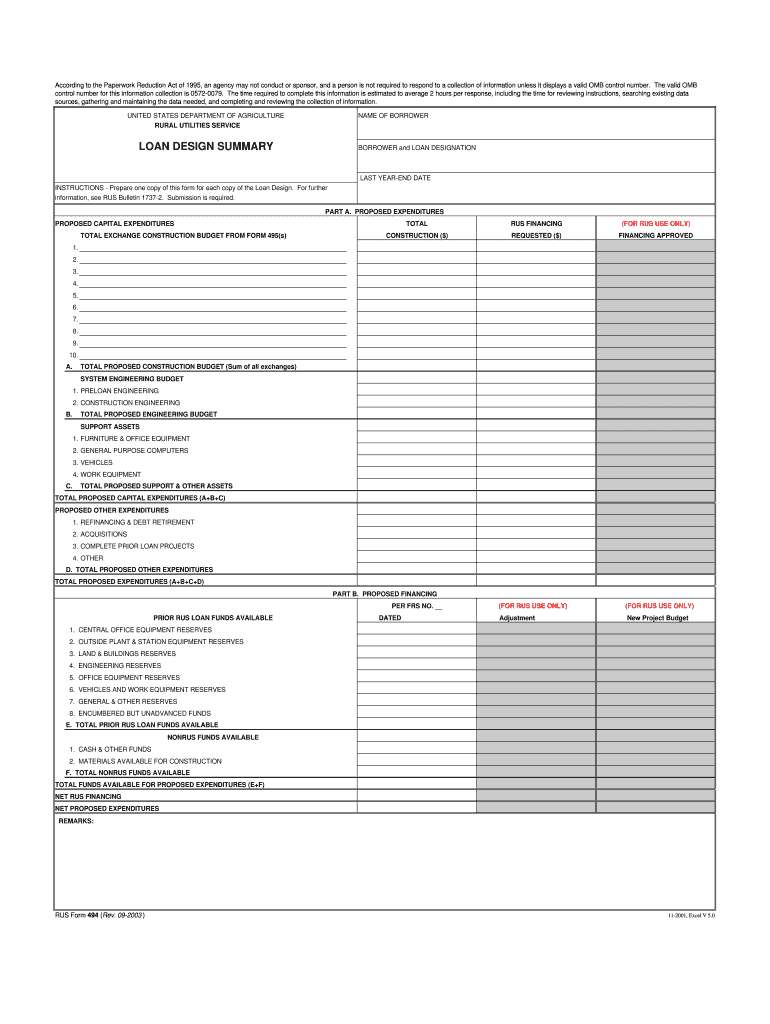

Forms 494 and 495 are essential documents used primarily for reporting specific information related to financial transactions and compliance standards. These forms are designed to assist businesses and individuals in fulfilling their tax obligations accurately. Form 494 typically pertains to income reporting, while Form 495 focuses on deductions and credits. Both forms are crucial for maintaining transparency in financial dealings and ensuring adherence to IRS regulations.

How to use the Forms 494 And 495 xls

Using Forms 494 and 495 involves several steps to ensure accurate completion and submission. First, download the forms in XLS format from a reliable source. Open the file using spreadsheet software that supports XLS files. Carefully fill in the required fields, ensuring that all information is accurate and complete. Double-check your entries for any errors before saving the document. Once completed, you can print the forms for mailing or follow the electronic submission guidelines if applicable.

Steps to complete the Forms 494 And 495 xls

Completing Forms 494 and 495 requires attention to detail. Begin by gathering all necessary documentation, such as income statements and receipts for deductions. Follow these steps:

- Open the XLS file using compatible software.

- Fill in personal or business information accurately in the designated fields.

- Input financial data, ensuring all figures are correct.

- Review the completed form for accuracy.

- Save the document in the appropriate format for submission.

Legal use of the Forms 494 And 495 xls

Forms 494 and 495 must be used in accordance with IRS guidelines to ensure legal compliance. These forms are legally binding documents that must reflect truthful and accurate information. Misrepresentation or errors can lead to penalties or legal repercussions. It is crucial to familiarize yourself with the specific regulations governing these forms to avoid any compliance issues.

Filing Deadlines / Important Dates

Timely filing of Forms 494 and 495 is essential to avoid penalties. The IRS typically sets specific deadlines for submission, which can vary based on the type of form and the taxpayer's situation. Generally, these forms are due on or before the tax filing deadline, which is usually April fifteenth for most taxpayers. It is advisable to check the IRS website for any updates or changes to these deadlines.

Who Issues the Form

Forms 494 and 495 are issued by the Internal Revenue Service (IRS), the U.S. government agency responsible for tax collection and enforcement. The IRS provides guidelines and instructions for completing these forms, ensuring that taxpayers understand their obligations. It is important to refer to the official IRS resources for the most accurate and up-to-date information regarding these forms.

Quick guide on how to complete forms 494 and 495 xls

Complete [SKS] effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed papers, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign [SKS] without hassle

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize essential sections of the documents or redact confidential information with tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to submit your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and eSign [SKS] and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the forms 494 and 495 xls

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Forms 494 And 495 xls used for?

Forms 494 And 495 xls are essential documents for businesses that need to report specific financial information. These forms help ensure compliance with regulatory requirements and streamline the reporting process. Utilizing airSlate SignNow, you can easily manage and eSign these forms, making your workflow more efficient.

-

How can airSlate SignNow help with Forms 494 And 495 xls?

airSlate SignNow provides a user-friendly platform to create, send, and eSign Forms 494 And 495 xls. With its intuitive interface, you can quickly fill out these forms and obtain necessary signatures, reducing the time spent on paperwork. This solution enhances productivity and ensures that your documents are securely managed.

-

What pricing options are available for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, including options for small teams and larger enterprises. Each plan includes features that support the management of Forms 494 And 495 xls, ensuring you get the best value for your investment. You can choose a plan that fits your budget while still accessing essential functionalities.

-

Are there any integrations available for Forms 494 And 495 xls?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your ability to manage Forms 494 And 495 xls. These integrations allow you to connect with popular tools like Google Drive, Dropbox, and CRM systems, streamlining your document workflow. This connectivity ensures that your data is always accessible and organized.

-

What are the benefits of using airSlate SignNow for Forms 494 And 495 xls?

Using airSlate SignNow for Forms 494 And 495 xls offers numerous benefits, including increased efficiency, reduced errors, and enhanced security. The platform allows for quick eSigning and document tracking, ensuring that you stay compliant with deadlines. Additionally, the cost-effective solution helps businesses save on printing and mailing costs.

-

Is airSlate SignNow secure for handling Forms 494 And 495 xls?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect your Forms 494 And 495 xls. This ensures that your sensitive information remains confidential and secure throughout the signing process. You can trust that your documents are safe with airSlate SignNow.

-

Can I customize Forms 494 And 495 xls in airSlate SignNow?

Yes, airSlate SignNow allows you to customize Forms 494 And 495 xls to meet your specific needs. You can add fields, logos, and other branding elements to ensure that your documents reflect your company's identity. This customization enhances professionalism and helps maintain consistency across your business communications.

Get more for Forms 494 And 495 xls

- Letter landlord demand sample 497316913 form

- Letter tenant landlord notice template 497316914 form

- Nc demand form

- Letter tenant form 497316916

- North carolina letter demand form

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles north carolina form

- Letter from tenant to landlord about landlords failure to make repairs north carolina form

- Nc landlord rent form

Find out other Forms 494 And 495 xls

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online