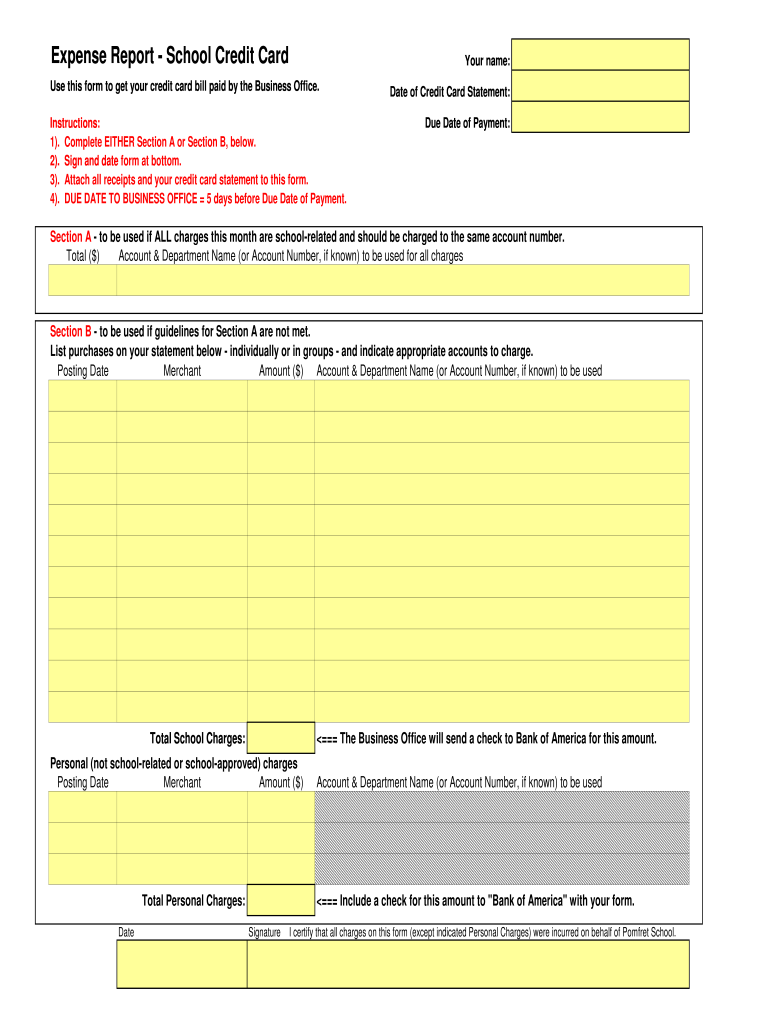

Credit Card Expense Report Pomfret School Form

Understanding the Credit Card Expense Report

The credit card expense report is a crucial document for businesses that need to track and manage expenses incurred through company credit cards. This report typically includes details such as the date of the transaction, the amount spent, the vendor, and the purpose of the expense. It serves as a record for financial accountability and is essential for accurate bookkeeping and tax reporting. By maintaining a clear and organized expense report, businesses can ensure compliance with internal policies and external regulations.

Key Elements of the Credit Card Expense Report

When filling out a credit card expense report, it is important to include several key elements to ensure accuracy and completeness. These include:

- Date: The date when the transaction occurred.

- Vendor Name: The name of the company or individual to whom the payment was made.

- Amount: The total amount charged to the credit card.

- Purpose: A brief description of the reason for the expense, such as travel, supplies, or meals.

- Receipt Attachment: A copy of the receipt or proof of purchase, which is often required for reimbursement.

Including these elements helps to create a comprehensive expense report that can be easily reviewed and processed.

Steps to Complete the Credit Card Expense Report

Completing a credit card expense report involves several straightforward steps:

- Gather all relevant receipts and transaction records associated with the credit card.

- Fill in the report with the necessary details, including date, vendor name, amount, and purpose.

- Attach copies of receipts to the report to substantiate each expense.

- Review the report for accuracy and completeness before submission.

- Submit the completed report to the appropriate department or individual for approval.

Following these steps ensures that the report is thorough and meets the requirements for processing.

Legal Use of the Credit Card Expense Report

The credit card expense report is not only a tool for internal tracking but also serves a legal purpose. Businesses are required to maintain accurate records of their expenses for tax purposes. Inaccurate or incomplete expense reports can lead to compliance issues with the Internal Revenue Service (IRS) and may result in penalties. Therefore, it is essential for businesses to use the credit card expense report to document all expenditures properly and retain supporting documentation.

Examples of Using the Credit Card Expense Report

There are various scenarios in which a credit card expense report is utilized. For instance:

- A sales representative may use the report to document travel expenses incurred while visiting clients.

- An employee may submit a report for expenses related to attending a professional conference.

- Office managers may track expenses for supplies purchased using a company credit card.

These examples illustrate the versatility of the credit card expense report in capturing a wide range of business-related expenditures.

Quick guide on how to complete credit card expense report pomfret school

Complete Credit Card Expense Report Pomfret School effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your files quickly without any holdups. Manage Credit Card Expense Report Pomfret School on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign Credit Card Expense Report Pomfret School without hassle

- Locate Credit Card Expense Report Pomfret School and click Get Form to begin.

- Use the tools available to complete your document.

- Emphasize key sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your updates.

- Choose your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Credit Card Expense Report Pomfret School and guarantee excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the credit card expense report pomfret school

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a credit card expense report template?

A credit card expense report template is a structured document that helps businesses track and manage expenses incurred through credit card transactions. It simplifies the process of recording expenses, ensuring accuracy and compliance with company policies. Using a template can save time and reduce errors in financial reporting.

-

How can I create a credit card expense report template using airSlate SignNow?

Creating a credit card expense report template with airSlate SignNow is straightforward. You can start by selecting a customizable template from our library or create one from scratch. Our user-friendly interface allows you to add fields for expenses, dates, and signatures, making it easy to tailor the report to your needs.

-

What are the benefits of using a credit card expense report template?

Using a credit card expense report template streamlines the expense reporting process, making it more efficient and organized. It helps ensure that all necessary information is captured, reducing the likelihood of missing receipts or incorrect entries. Additionally, it enhances transparency and accountability in financial management.

-

Is there a cost associated with using the credit card expense report template in airSlate SignNow?

airSlate SignNow offers various pricing plans, including options that allow access to the credit card expense report template. Depending on your business needs, you can choose a plan that fits your budget while providing the necessary features for effective expense management. Check our pricing page for detailed information.

-

Can I integrate the credit card expense report template with other software?

Yes, airSlate SignNow allows seamless integration with various accounting and financial software. This means you can easily sync your credit card expense report template with tools like QuickBooks, Xero, and others. Integrating these systems enhances data accuracy and simplifies your financial workflows.

-

How does airSlate SignNow ensure the security of my credit card expense report template?

Security is a top priority at airSlate SignNow. We implement advanced encryption protocols and secure cloud storage to protect your credit card expense report template and sensitive data. Additionally, our platform complies with industry standards to ensure that your information remains confidential and secure.

-

Can I customize the credit card expense report template to fit my business needs?

Absolutely! The credit card expense report template in airSlate SignNow is fully customizable. You can modify fields, add logos, and adjust layouts to align with your business branding and reporting requirements, ensuring that the template meets your specific needs.

Get more for Credit Card Expense Report Pomfret School

- Business rescue plan och 31 march 2016 optimumcoalbusinessrescue co form

- Cemetery bylaws for emmanuel lutheran church west columbia form

- Vtr 421 form

- Gold experience b1 tests form

- Short tem camp permit bairventuringbborgb form

- Electronic data release agreement azzule systems form

- Osha risk assessment 2016 oshaguard form

- The school district of osceola county florida form

Find out other Credit Card Expense Report Pomfret School

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple