Form AU 67411 Tax NY Gov

What is the Form AU 67411 Tax NY gov

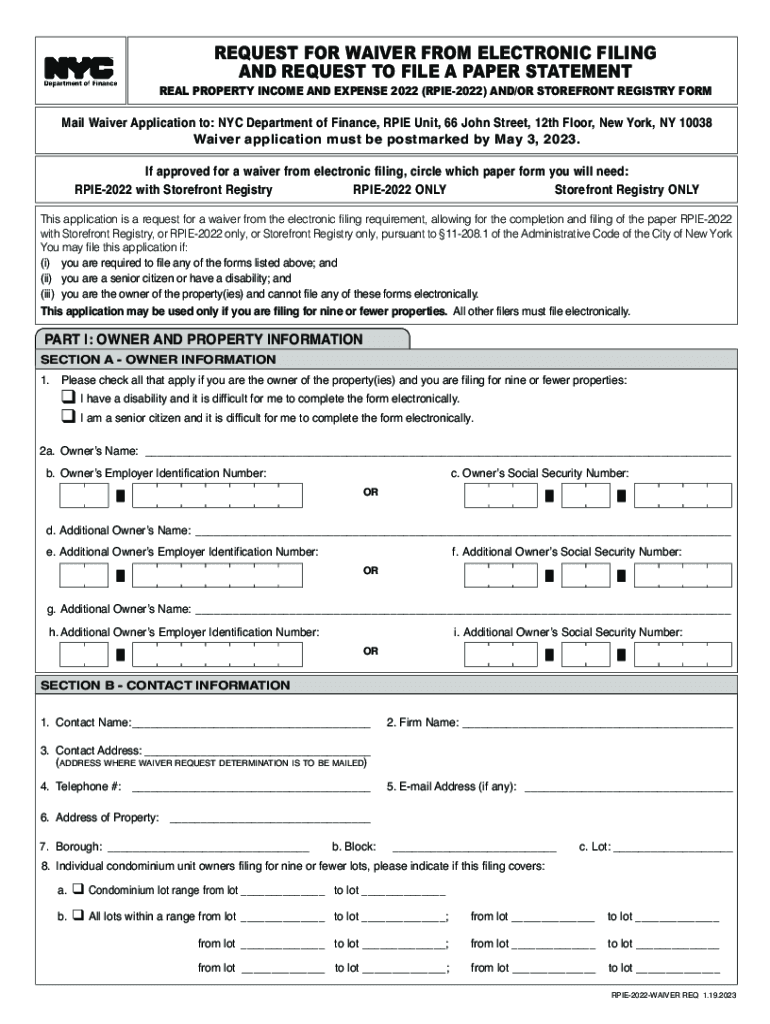

The Form AU 67411 is a tax document used by the state of New York for specific tax-related purposes. It serves to collect information necessary for the administration of state taxes. This form is essential for ensuring compliance with New York tax laws and regulations. Individuals and businesses may need to complete this form as part of their tax filing obligations or to report certain financial activities to the state. Understanding the purpose of this form is crucial for accurate tax reporting and compliance.

How to obtain the Form AU 67411 Tax NY gov

The Form AU 67411 can be obtained through the official New York State government website or by contacting the New York State Department of Taxation and Finance directly. It is typically available in a downloadable PDF format, which allows users to print and fill it out manually. Additionally, some tax preparation software may include this form, making it accessible for electronic filing. Ensuring you have the most current version of the form is important, as tax regulations may change over time.

Steps to complete the Form AU 67411 Tax NY gov

Completing the Form AU 67411 involves several key steps. First, gather all necessary documentation, such as income statements and previous tax returns. Next, carefully read the instructions provided with the form to understand what information is required. Fill out the form accurately, ensuring all fields are completed as instructed. Double-check your entries for any errors or omissions. Finally, sign and date the form before submitting it according to the specified submission methods. Following these steps helps ensure a smooth filing process.

Key elements of the Form AU 67411 Tax NY gov

The Form AU 67411 includes several key elements that must be completed for proper filing. These elements typically consist of personal identification information, financial details relevant to the tax being reported, and any applicable deductions or credits. It may also require specific information regarding the taxpayer's business activities if applicable. Understanding these elements is vital for accurate completion and to avoid potential issues with the tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Form AU 67411 are established by the New York State Department of Taxation and Finance. It is essential to be aware of these deadlines to avoid penalties and interest on any unpaid taxes. Generally, tax forms must be submitted by a specific date each year, often aligning with the federal tax filing deadline. Staying informed about these important dates ensures timely compliance and helps maintain good standing with state tax authorities.

Form Submission Methods (Online / Mail / In-Person)

The Form AU 67411 can be submitted through various methods, depending on the preferences of the taxpayer. Options typically include online submission through the New York State Department of Taxation and Finance website, mailing a completed paper form, or submitting it in person at designated tax offices. Each method has its own requirements and processing times, so it is advisable to choose the one that best fits your situation for efficient processing.

Penalties for Non-Compliance

Failure to file the Form AU 67411 or inaccuracies in the submitted information can result in penalties imposed by the New York State Department of Taxation and Finance. These penalties may include fines, interest on unpaid taxes, and potential legal action. Understanding the consequences of non-compliance highlights the importance of timely and accurate filing. Taxpayers are encouraged to seek assistance if they encounter difficulties in completing the form to avoid these penalties.

Quick guide on how to complete form au 67411 tax ny gov

Complete Form AU 67411 Tax NY gov effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the right form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Handle Form AU 67411 Tax NY gov on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

How to modify and eSign Form AU 67411 Tax NY gov with ease

- Obtain Form AU 67411 Tax NY gov and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a standard wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing additional document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Form AU 67411 Tax NY gov to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form au 67411 tax ny gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form AU 67411 Tax NY gov?

Form AU 67411 Tax NY gov is a tax form used by businesses in New York to report specific tax information. It is essential for compliance with state tax regulations and ensures that businesses fulfill their tax obligations accurately.

-

How can airSlate SignNow help with Form AU 67411 Tax NY gov?

airSlate SignNow provides an efficient platform for businesses to electronically sign and send Form AU 67411 Tax NY gov. Our solution simplifies the document management process, ensuring that your tax forms are completed and submitted on time.

-

Is there a cost associated with using airSlate SignNow for Form AU 67411 Tax NY gov?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions ensure that you can manage Form AU 67411 Tax NY gov without breaking the bank, providing excellent value for your investment.

-

What features does airSlate SignNow offer for managing Form AU 67411 Tax NY gov?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which enhance the management of Form AU 67411 Tax NY gov. These tools streamline the process, making it easier for businesses to handle their tax documentation.

-

Can I integrate airSlate SignNow with other software for Form AU 67411 Tax NY gov?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage Form AU 67411 Tax NY gov alongside your existing tools. This flexibility enhances productivity and ensures a smooth workflow.

-

What are the benefits of using airSlate SignNow for Form AU 67411 Tax NY gov?

Using airSlate SignNow for Form AU 67411 Tax NY gov provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your tax documents are handled professionally and securely.

-

How secure is airSlate SignNow when handling Form AU 67411 Tax NY gov?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure storage solutions to protect your Form AU 67411 Tax NY gov and other sensitive documents, ensuring that your information remains confidential.

Get more for Form AU 67411 Tax NY gov

- New patient registration forms laser spine institute

- Patient information form mdpainnet

- Jdf 1104 2016 2019 form

- Crw13 application for employment vcrew form

- Individualized education program iep mississippi mde k12 ms form

- Chapter 1 assistive technology assessment bcsbc form

- Arkansas contractors notice to owner individual form

- Non drivers application for employment prairie form

Find out other Form AU 67411 Tax NY gov

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy