Form CG 213 I New York State Department of Taxation and Finance Tax Ny 2023

Understanding Form CG 213 I

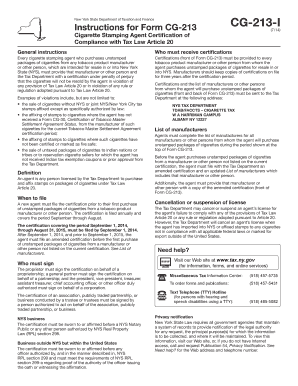

Form CG 213 I is a document issued by the New York State Department of Taxation and Finance. This form is primarily used for tax purposes, allowing individuals and businesses to report specific tax information to the state. It is essential for ensuring compliance with New York tax laws and regulations. Understanding this form is crucial for accurate tax reporting and avoiding potential penalties.

Steps to Complete Form CG 213 I

Completing Form CG 213 I involves several key steps:

- Gather necessary information, including personal identification details and financial records.

- Carefully read the instructions provided with the form to understand the requirements.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the completed form for any errors or omissions.

- Submit the form by the specified deadline to avoid penalties.

Obtaining Form CG 213 I

Form CG 213 I can be obtained directly from the New York State Department of Taxation and Finance website. It is available for download in a printable format, allowing users to fill it out by hand or digitally. Additionally, copies of the form may be available at local tax offices or through authorized tax professionals.

Legal Use of Form CG 213 I

Form CG 213 I serves a legal purpose within the framework of New York tax law. It is used to report specific tax information, which is essential for maintaining compliance with state regulations. Failure to use this form correctly can result in legal repercussions, including fines or audits by the tax authority.

Key Elements of Form CG 213 I

Key elements of Form CG 213 I include:

- Identification section for the taxpayer, including name and address.

- Financial information relevant to the tax being reported.

- Signature line to certify the accuracy of the information provided.

- Instructions for submission, including deadlines and acceptable methods.

Filing Deadlines for Form CG 213 I

Filing deadlines for Form CG 213 I vary based on the type of tax being reported. It is crucial to be aware of these deadlines to ensure timely submission. Typically, the form must be filed by the due date of the associated tax return. Late submissions may incur penalties or interest charges.

Quick guide on how to complete form cg 213 i new york state department of taxation and finance tax ny

Complete Form CG 213 I New York State Department Of Taxation And Finance Tax Ny effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the required forms and securely store them online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without any hold-ups. Manage Form CG 213 I New York State Department Of Taxation And Finance Tax Ny on any device with airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to edit and eSign Form CG 213 I New York State Department Of Taxation And Finance Tax Ny with ease

- Locate Form CG 213 I New York State Department Of Taxation And Finance Tax Ny and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, SMS, shared link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Form CG 213 I New York State Department Of Taxation And Finance Tax Ny and ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form cg 213 i new york state department of taxation and finance tax ny

Create this form in 5 minutes!

How to create an eSignature for the form cg 213 i new york state department of taxation and finance tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form CG 213 I from the New York State Department of Taxation and Finance?

Form CG 213 I is a document required by the New York State Department of Taxation and Finance for specific tax-related purposes. It is essential for individuals and businesses to understand its requirements to ensure compliance with state tax regulations. Using airSlate SignNow can simplify the process of completing and submitting Form CG 213 I efficiently.

-

How can airSlate SignNow help with Form CG 213 I?

airSlate SignNow provides an easy-to-use platform for filling out and eSigning Form CG 213 I. With its intuitive interface, users can quickly complete the form and ensure that all necessary information is accurately provided. This streamlines the submission process to the New York State Department of Taxation and Finance.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for individuals and teams. Each plan provides access to features that facilitate the completion of documents like Form CG 213 I. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as eSigning, document templates, and real-time collaboration. These tools make it easier to manage documents like Form CG 213 I, ensuring that all stakeholders can contribute efficiently. The platform also offers secure storage and tracking for all signed documents.

-

Is airSlate SignNow compliant with New York State regulations?

Yes, airSlate SignNow is designed to comply with New York State regulations, including those related to Form CG 213 I. The platform ensures that all electronic signatures and document submissions meet legal standards, providing peace of mind for users. This compliance is crucial for businesses operating in New York.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing its functionality. This allows users to connect their existing tools with the platform, making it easier to manage documents like Form CG 213 I alongside other business processes.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents, including Form CG 213 I, offers numerous benefits such as increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick eSigning and easy document sharing, which can save time and reduce errors in tax submissions. This is particularly valuable during tax season.

Get more for Form CG 213 I New York State Department Of Taxation And Finance Tax Ny

- Formatted king county open data

- Rule 1300 form

- Ps 519 f1 application for request to enroll nonresident student bcps form

- Form m r 2015

- Ubs letter of authorization form

- Minnesota probate forms

- Receipt template for distribution of decedent minnesota form

- State of minnesota county of judicial minnesota cle minncle form

Find out other Form CG 213 I New York State Department Of Taxation And Finance Tax Ny

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template

- eSign Arkansas IT Consulting Agreement Computer

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template

- eSign Hawaii Web Hosting Agreement Now