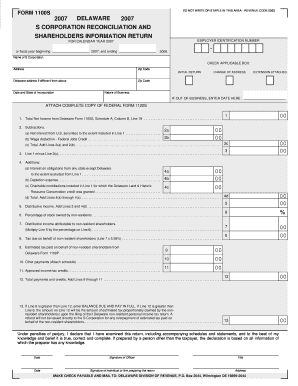

DELAWARE S CORPORATION RECONCILIATION and Revenue Delaware Form

Understanding the Delaware S Corporation Reconciliation and Revenue

The Delaware S Corporation Reconciliation and Revenue form is essential for businesses operating as S corporations in Delaware. This form is used to reconcile income and expenses reported on the federal tax return with those reported on the state tax return. It ensures that the income attributed to the S corporation aligns with Delaware state tax regulations. This reconciliation is crucial for maintaining compliance with state tax laws and for accurate financial reporting.

Steps to Complete the Delaware S Corporation Reconciliation and Revenue

Completing the Delaware S Corporation Reconciliation and Revenue form involves several key steps:

- Gather all relevant financial documents, including federal tax returns and state income statements.

- Review the income and deductions reported on your federal tax return to ensure accuracy.

- Fill out the Delaware S Corporation Reconciliation form, ensuring that all figures are consistent with your federal filings.

- Double-check all calculations and ensure that any adjustments for state-specific rules are accurately reflected.

- Submit the completed form by the designated filing deadline to avoid penalties.

Legal Use of the Delaware S Corporation Reconciliation and Revenue

The Delaware S Corporation Reconciliation and Revenue form serves a legal purpose by ensuring that S corporations comply with state tax laws. Filing this form accurately helps prevent legal issues related to tax discrepancies. It is important for businesses to understand that failure to file or inaccuracies in the form can lead to penalties, interest, and potential audits from the state tax authority.

Key Elements of the Delaware S Corporation Reconciliation and Revenue

Several key elements must be included in the Delaware S Corporation Reconciliation and Revenue form:

- Identification of the S corporation, including its name and federal employer identification number (EIN).

- Details of income, deductions, and credits as reported on the federal return.

- Adjustments made for Delaware-specific tax regulations.

- Signature of an authorized officer of the corporation.

Filing Deadlines for the Delaware S Corporation Reconciliation and Revenue

It is crucial for businesses to be aware of the filing deadlines for the Delaware S Corporation Reconciliation and Revenue form. Typically, the form must be filed by the 15th day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is March 15. Missing this deadline can result in penalties and interest on any unpaid taxes.

Required Documents for the Delaware S Corporation Reconciliation and Revenue

To complete the Delaware S Corporation Reconciliation and Revenue form, businesses will need the following documents:

- Federal tax return (Form 1120S) for the S corporation.

- State income statements and any supporting documentation for income and deductions.

- Records of any adjustments made for Delaware tax purposes.

Form Submission Methods for the Delaware S Corporation Reconciliation and Revenue

The Delaware S Corporation Reconciliation and Revenue form can be submitted through various methods, including:

- Online submission via the Delaware Division of Revenue's electronic filing system.

- Mailing a paper copy of the completed form to the appropriate state tax office.

- In-person submission at designated state tax offices, if applicable.

Quick guide on how to complete delaware s corporation reconciliation and revenue delaware

Effortlessly prepare [SKS] on any device

Digital document management has surged in popularity among businesses and individuals. It serves as an excellent environmentally friendly substitute for conventional printed and signed documents, as you can find the right form and securely save it online. airSlate SignNow offers you all the tools you need to create, modify, and electronically sign your documents quickly and without delays. Manage [SKS] on any platform with the airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to alter and electronically sign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive details with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign feature, which takes only seconds and holds the same legal validity as a conventional ink signature.

- Review all information and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign [SKS] and guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to DELAWARE S CORPORATION RECONCILIATION AND Revenue Delaware

Create this form in 5 minutes!

How to create an eSignature for the delaware s corporation reconciliation and revenue delaware

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is DELAWARE S CORPORATION RECONCILIATION AND Revenue Delaware?

DELAWARE S CORPORATION RECONCILIATION AND Revenue Delaware refers to the process of aligning financial records for S Corporations in Delaware with state revenue requirements. This ensures compliance and accurate reporting of income, deductions, and credits. Understanding this process is crucial for maintaining good standing with the Delaware Division of Revenue.

-

How can airSlate SignNow assist with DELAWARE S CORPORATION RECONCILIATION AND Revenue Delaware?

airSlate SignNow provides a streamlined platform for managing documents related to DELAWARE S CORPORATION RECONCILIATION AND Revenue Delaware. With features like eSigning and document sharing, businesses can efficiently handle their reconciliation paperwork. This not only saves time but also reduces the risk of errors in important financial documents.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses handling DELAWARE S CORPORATION RECONCILIATION AND Revenue Delaware. Plans vary based on features and user requirements, ensuring that you only pay for what you need. Additionally, there are options for monthly or annual subscriptions, providing cost-effective solutions for all business sizes.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes a variety of features designed to simplify document management for DELAWARE S CORPORATION RECONCILIATION AND Revenue Delaware. Key features include customizable templates, secure eSigning, and real-time tracking of document status. These tools enhance efficiency and ensure that all documents are compliant with state regulations.

-

Is airSlate SignNow suitable for small businesses handling DELAWARE S CORPORATION RECONCILIATION AND Revenue Delaware?

Yes, airSlate SignNow is particularly beneficial for small businesses managing DELAWARE S CORPORATION RECONCILIATION AND Revenue Delaware. The platform is user-friendly and cost-effective, making it accessible for businesses with limited resources. Small businesses can leverage its features to streamline their reconciliation processes without incurring high costs.

-

Can airSlate SignNow integrate with other software for DELAWARE S CORPORATION RECONCILIATION AND Revenue Delaware?

Absolutely! airSlate SignNow offers integrations with various accounting and financial software that can assist with DELAWARE S CORPORATION RECONCILIATION AND Revenue Delaware. This allows businesses to synchronize their data and enhance their workflow, ensuring that all financial records are accurate and up-to-date.

-

What are the benefits of using airSlate SignNow for DELAWARE S CORPORATION RECONCILIATION AND Revenue Delaware?

Using airSlate SignNow for DELAWARE S CORPORATION RECONCILIATION AND Revenue Delaware provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. The platform's ease of use allows businesses to focus on their core operations while ensuring that all necessary documents are properly managed. Additionally, the secure eSigning feature protects sensitive information.

Get more for DELAWARE S CORPORATION RECONCILIATION AND Revenue Delaware

- Hjb 888 form

- How to request de transcript from germanna 2009 form

- Mag 10 01 statement of claim georgia form georgia gwinnett county magistrate court civil law forms

- A35 rental lease form

- Dd form 372 request verification birth

- Authorization for usedisclosure of protected health information

- Dss form 16150

- Samsung claim form

Find out other DELAWARE S CORPORATION RECONCILIATION AND Revenue Delaware

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney