Form 3F Pub

What is the Form 3F pub

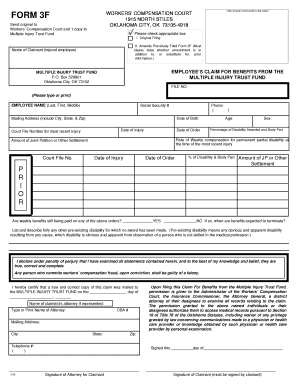

The Form 3F pub is a specific document used in the United States for reporting certain financial activities related to public entities. It is essential for ensuring compliance with various regulatory requirements. This form typically involves disclosures that help maintain transparency in financial dealings and is often required by state or local governments. Understanding the purpose and requirements of the Form 3F pub is crucial for individuals and organizations involved in public finance.

How to obtain the Form 3F pub

To obtain the Form 3F pub, individuals and organizations can typically download it from the official state or local government websites that oversee public finance. Many jurisdictions provide the form in a PDF format, which can be easily printed. It is also possible to request a physical copy by contacting the relevant government office directly. Ensuring that you have the most current version of the form is important, as regulations and requirements can change.

Steps to complete the Form 3F pub

Completing the Form 3F pub involves several key steps:

- Gather all necessary financial documents and information that pertain to the reporting period.

- Fill out the form accurately, ensuring that all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form according to the guidelines provided by the issuing authority, either online or via mail.

Each of these steps is vital to ensure that the form is processed correctly and in a timely manner.

Legal use of the Form 3F pub

The legal use of the Form 3F pub is governed by state and local laws that dictate how public financial information must be reported. Failure to comply with these regulations can result in penalties or legal repercussions. It is important for users to familiarize themselves with the specific legal requirements applicable in their jurisdiction to ensure that they are using the form correctly and fulfilling their obligations.

Filing Deadlines / Important Dates

Filing deadlines for the Form 3F pub can vary by state or local jurisdiction. Generally, these deadlines align with specific reporting periods, such as quarterly or annual financial disclosures. It is essential to check with the relevant authority to confirm the exact dates and ensure timely submission. Missing a deadline may lead to fines or other compliance issues.

Form Submission Methods (Online / Mail / In-Person)

The Form 3F pub can typically be submitted through various methods, depending on the regulations of the issuing authority. Common submission methods include:

- Online submission via the official government website, which may offer a secure portal for electronic filing.

- Mailing a printed copy of the completed form to the designated office.

- In-person submission at local government offices, where assistance may be available if needed.

Choosing the appropriate submission method is important for ensuring that the form is received and processed correctly.

Quick guide on how to complete form 3f pub

Manage [SKS] effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly without delays. Handle [SKS] from any device using airSlate SignNow's Android or iOS applications and streamline your document-driven processes today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your changes.

- Choose your preferred method for transmitting your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate worries about lost or mislaid documents, the hassle of searching for forms, or mistakes that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3f pub

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 3F pub and how does it work?

The Form 3F pub is a digital document that allows users to collect signatures electronically. With airSlate SignNow, you can easily create, send, and eSign the Form 3F pub, streamlining your document management process. This solution is designed to be user-friendly, ensuring that anyone can navigate it without technical expertise.

-

What are the pricing options for using the Form 3F pub with airSlate SignNow?

airSlate SignNow offers various pricing plans that cater to different business needs when using the Form 3F pub. You can choose from monthly or annual subscriptions, with options that provide additional features as your business grows. Visit our pricing page for detailed information on the plans available.

-

What features does airSlate SignNow offer for the Form 3F pub?

When using the Form 3F pub with airSlate SignNow, you gain access to features like customizable templates, real-time tracking, and secure cloud storage. These features enhance the efficiency of your document workflows and ensure that your data is protected. Additionally, you can integrate with other tools to further streamline your processes.

-

How can the Form 3F pub benefit my business?

Utilizing the Form 3F pub with airSlate SignNow can signNowly reduce the time spent on document management. By enabling electronic signatures, you can expedite approvals and enhance collaboration among team members. This not only improves productivity but also contributes to a more sustainable business model by reducing paper usage.

-

Is the Form 3F pub compliant with legal standards?

Yes, the Form 3F pub created and signed through airSlate SignNow complies with legal standards for electronic signatures. Our platform adheres to regulations such as the ESIGN Act and UETA, ensuring that your signed documents are legally binding. This compliance provides peace of mind for businesses and their clients.

-

Can I integrate the Form 3F pub with other software?

Absolutely! airSlate SignNow allows for seamless integration of the Form 3F pub with various software applications, including CRM systems and cloud storage services. This integration capability enhances your workflow by allowing you to manage documents across different platforms efficiently.

-

What support options are available for users of the Form 3F pub?

airSlate SignNow provides comprehensive support for users of the Form 3F pub, including a detailed knowledge base, video tutorials, and customer service assistance. Whether you have questions about features or need help troubleshooting, our support team is ready to assist you. You can signNow out via chat, email, or phone.

Get more for Form 3F pub

- Authorization for usedisclosure of protected health information

- Dss form 16150

- Samsung claim form

- Slpc 504 email notifications for all loans v1 sba form

- Engine generator inspection checklist form

- Eastbay return print form

- Nonresident decedent affidavit of domicile rev 1737 1 formspublications

- Medical records release form ssm health care st louis

Find out other Form 3F pub

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free