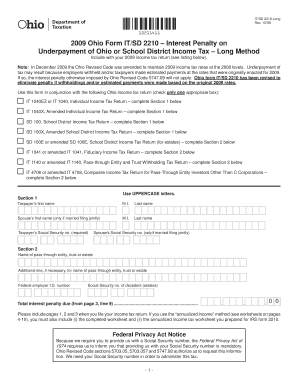

Interest Penalty on Underpayment of Ohio or School District Income Tax Long Method Form

What is the interest penalty on underpayment of Ohio or school district income tax long method

The interest penalty on underpayment of Ohio or school district income tax using the long method is a calculation designed to determine the amount of interest owed when taxpayers do not pay the correct amount of tax by the due date. This penalty is assessed to encourage timely payment and compliance with tax obligations. The calculation considers the amount of underpayment, the duration of the underpayment, and the interest rate set by the state. Understanding this penalty is crucial for taxpayers to avoid additional financial burdens.

How to use the interest penalty on underpayment of Ohio or school district income tax long method

Using the long method to calculate the interest penalty on underpayment involves several steps. First, taxpayers need to determine their total tax liability for the year. Next, they must identify the amount paid by the due date. The difference between these two amounts represents the underpayment. Taxpayers then apply the interest rate, which is updated periodically by the state, to the underpayment amount for the duration it remained unpaid. This calculation will yield the total interest penalty owed.

Steps to complete the interest penalty on underpayment of Ohio or school district income tax long method

Completing the long method for the interest penalty involves a systematic approach:

- Calculate total tax liability for the tax year.

- Determine the amount paid by the original due date.

- Subtract the paid amount from the total tax liability to find the underpayment.

- Identify the applicable interest rate for the period of underpayment.

- Multiply the underpayment amount by the interest rate and the number of days the payment was late.

- Sum up any additional penalties if applicable.

Key elements of the interest penalty on underpayment of Ohio or school district income tax long method

Several key elements define the interest penalty on underpayment. These include:

- The tax year in question, as rates may change annually.

- The total tax liability, which is the starting point for calculations.

- The amount of tax paid by the due date, which directly impacts the penalty.

- The interest rate, which is determined by the Ohio Department of Taxation and can vary.

- The duration of the underpayment, as interest accrues over time.

Examples of using the interest penalty on underpayment of Ohio or school district income tax long method

To illustrate the application of the interest penalty, consider a taxpayer with a total tax liability of $1,000. If they paid only $800 by the due date, the underpayment is $200. If the interest rate is five percent and the payment was late by 30 days, the calculation would be:

Underpayment: $200

Interest for 30 days: $200 x 0.05 x (30/365) = $8.22

Total interest penalty: $8.22

Filing deadlines / important dates

Filing deadlines for Ohio or school district income tax are crucial for avoiding penalties. Typically, individual income tax returns are due on April 15. If this date falls on a weekend or holiday, the deadline may extend to the next business day. Taxpayers should also be aware of any extensions that may apply to their specific situations, as these can affect the timing of payments and potential penalties.

Quick guide on how to complete interest penalty on underpayment of ohio or school district income tax long method

Effortlessly prepare [SKS] on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the essential tools to craft, modify, and eSign your documents quickly and without hassle. Manage [SKS] on any device using the airSlate SignNow apps for Android or iOS and enhance any document-centered workflow today.

The easiest method to modify and eSign [SKS] effortlessly

- Find [SKS] and then click Get Form to begin.

- Utilize the features we provide to complete your document.

- Emphasize key sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Choose your preferred delivery method for your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Alter and eSign [SKS] to ensure superior communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Interest Penalty On Underpayment Of Ohio Or School District Income Tax Long Method

Create this form in 5 minutes!

How to create an eSignature for the interest penalty on underpayment of ohio or school district income tax long method

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Interest Penalty On Underpayment Of Ohio Or School District Income Tax Long Method?

The Interest Penalty On Underpayment Of Ohio Or School District Income Tax Long Method refers to the additional charges incurred when taxpayers fail to pay the correct amount of income tax owed. This penalty is calculated based on the amount of underpayment and the duration of the underpayment period. Understanding this penalty is crucial for taxpayers to avoid unnecessary costs.

-

How can airSlate SignNow help with managing tax documents related to the Interest Penalty On Underpayment Of Ohio Or School District Income Tax Long Method?

airSlate SignNow provides a streamlined platform for sending and eSigning tax documents, making it easier to manage your tax obligations. By using our solution, you can ensure that all necessary documents are completed and submitted on time, reducing the risk of incurring the Interest Penalty On Underpayment Of Ohio Or School District Income Tax Long Method.

-

What features does airSlate SignNow offer to assist with tax compliance?

airSlate SignNow offers features such as document templates, automated reminders, and secure eSigning to help ensure tax compliance. These tools can help you stay organized and timely in your tax submissions, minimizing the chances of facing the Interest Penalty On Underpayment Of Ohio Or School District Income Tax Long Method.

-

Is there a cost associated with using airSlate SignNow for tax-related documents?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solution provides excellent value, especially when considering the potential savings from avoiding the Interest Penalty On Underpayment Of Ohio Or School District Income Tax Long Method through timely document management.

-

Can airSlate SignNow integrate with other accounting software?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and financial software, enhancing your workflow. This integration can help you keep track of your tax documents and payments, further reducing the risk of incurring the Interest Penalty On Underpayment Of Ohio Or School District Income Tax Long Method.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. By streamlining your document processes, you can focus on compliance and avoid the Interest Penalty On Underpayment Of Ohio Or School District Income Tax Long Method.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your documents with advanced encryption and secure storage solutions. This ensures that your sensitive tax information is protected, allowing you to manage your documents confidently and avoid issues like the Interest Penalty On Underpayment Of Ohio Or School District Income Tax Long Method.

Get more for Interest Penalty On Underpayment Of Ohio Or School District Income Tax Long Method

- Province document general ontario form 4 land registration

- Release of information form pine rest

- Transcript request form john

- Handtekening signture kommissaris van ede form

- Nasfund online withdrawal form

- Png declaration form

- State of florida health care surrogate will to live form

- Military graves record form carroll county iowa co carroll ia

Find out other Interest Penalty On Underpayment Of Ohio Or School District Income Tax Long Method

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors