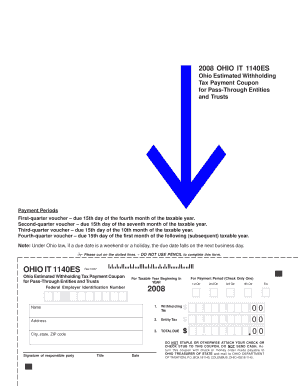

Ohio Estimated Withholding Tax Payment Coupon for Pass through Entities and Trusts Form

What is the Ohio Estimated Withholding Tax Payment Coupon For Pass Through Entities And Trusts

The Ohio Estimated Withholding Tax Payment Coupon for Pass Through Entities and Trusts is a form used by businesses and trusts to remit estimated withholding tax payments to the state of Ohio. This coupon is specifically designed for entities that pass income through to their owners, such as partnerships, S corporations, and certain trusts. It ensures that the state receives the appropriate tax revenue from these entities based on the income they distribute to their beneficiaries or partners.

How to use the Ohio Estimated Withholding Tax Payment Coupon For Pass Through Entities And Trusts

To use the Ohio Estimated Withholding Tax Payment Coupon, entities must first calculate their estimated tax liability based on the income expected to be distributed. After determining the amount, the entity fills out the coupon with necessary details such as the entity name, address, and the payment amount. The completed coupon should then be submitted along with the payment to the appropriate state tax authority by the specified due date to avoid penalties.

Steps to complete the Ohio Estimated Withholding Tax Payment Coupon For Pass Through Entities And Trusts

Completing the Ohio Estimated Withholding Tax Payment Coupon involves several key steps:

- Gather necessary information, including the entity's name, address, and federal employer identification number (EIN).

- Calculate the estimated withholding tax based on the expected income distributions.

- Fill out the coupon accurately, ensuring all required fields are completed.

- Review the information for accuracy before submitting.

- Submit the coupon along with the payment by the due date.

Legal use of the Ohio Estimated Withholding Tax Payment Coupon For Pass Through Entities And Trusts

The Ohio Estimated Withholding Tax Payment Coupon is legally recognized for remitting estimated tax payments. It is crucial for compliance with Ohio tax laws, as failure to use this coupon correctly can result in penalties or interest charges. Entities must ensure they adhere to the state's guidelines regarding the use of this coupon to maintain compliance and avoid legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Ohio Estimated Withholding Tax Payment Coupon are typically aligned with the state's tax calendar. Entities should be aware of the quarterly due dates for estimated payments, which usually fall on the fifteenth day of the month following the end of each quarter. Staying informed about these deadlines is essential to avoid late fees and ensure timely compliance.

Required Documents

To complete the Ohio Estimated Withholding Tax Payment Coupon, entities need to have specific documents on hand, including:

- Federal employer identification number (EIN).

- Financial records that detail expected income distributions.

- Previous tax returns, if applicable, to assist in estimating the current year's tax liability.

Penalties for Non-Compliance

Non-compliance with the Ohio Estimated Withholding Tax Payment requirements can lead to significant penalties. These may include late payment fees, interest on unpaid amounts, and potential legal action for continued non-compliance. It is important for entities to understand these consequences and ensure timely and accurate submissions to the state tax authority.

Quick guide on how to complete ohio estimated withholding tax payment coupon for pass through entities and trusts

Prepare [SKS] seamlessly on any device

Digital document management has become favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely keep it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly and without any hold-ups. Administer [SKS] on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-driven procedure today.

How to modify and eSign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet signature.

- Review the details and click the Done button to save your changes.

- Select how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious document searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Ohio Estimated Withholding Tax Payment Coupon For Pass Through Entities And Trusts

Create this form in 5 minutes!

How to create an eSignature for the ohio estimated withholding tax payment coupon for pass through entities and trusts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ohio Estimated Withholding Tax Payment Coupon For Pass Through Entities And Trusts?

The Ohio Estimated Withholding Tax Payment Coupon For Pass Through Entities And Trusts is a document that allows pass-through entities and trusts to remit their estimated withholding tax payments to the state of Ohio. This coupon simplifies the payment process, ensuring compliance with state tax regulations.

-

How can airSlate SignNow help with the Ohio Estimated Withholding Tax Payment Coupon For Pass Through Entities And Trusts?

airSlate SignNow provides an efficient platform for businesses to create, send, and eSign the Ohio Estimated Withholding Tax Payment Coupon For Pass Through Entities And Trusts. Our user-friendly interface streamlines the process, making it easy to manage tax documents securely and efficiently.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans include features that support the creation and management of the Ohio Estimated Withholding Tax Payment Coupon For Pass Through Entities And Trusts, ensuring you get the best value for your investment.

-

Are there any features specifically designed for tax compliance?

Yes, airSlate SignNow includes features that enhance tax compliance, such as templates for the Ohio Estimated Withholding Tax Payment Coupon For Pass Through Entities And Trusts. These features help ensure that your documents are accurate and meet state requirements, reducing the risk of errors.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow offers integrations with various accounting software, allowing you to seamlessly manage your financial documents, including the Ohio Estimated Withholding Tax Payment Coupon For Pass Through Entities And Trusts. This integration helps streamline your workflow and enhances productivity.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents, including the Ohio Estimated Withholding Tax Payment Coupon For Pass Through Entities And Trusts, provides numerous benefits such as increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and stored securely, making tax compliance easier.

-

Is airSlate SignNow suitable for small businesses?

Yes, airSlate SignNow is designed to cater to businesses of all sizes, including small businesses. Our cost-effective solution allows small businesses to manage their Ohio Estimated Withholding Tax Payment Coupon For Pass Through Entities And Trusts efficiently without breaking the bank.

Get more for Ohio Estimated Withholding Tax Payment Coupon For Pass Through Entities And Trusts

Find out other Ohio Estimated Withholding Tax Payment Coupon For Pass Through Entities And Trusts

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors