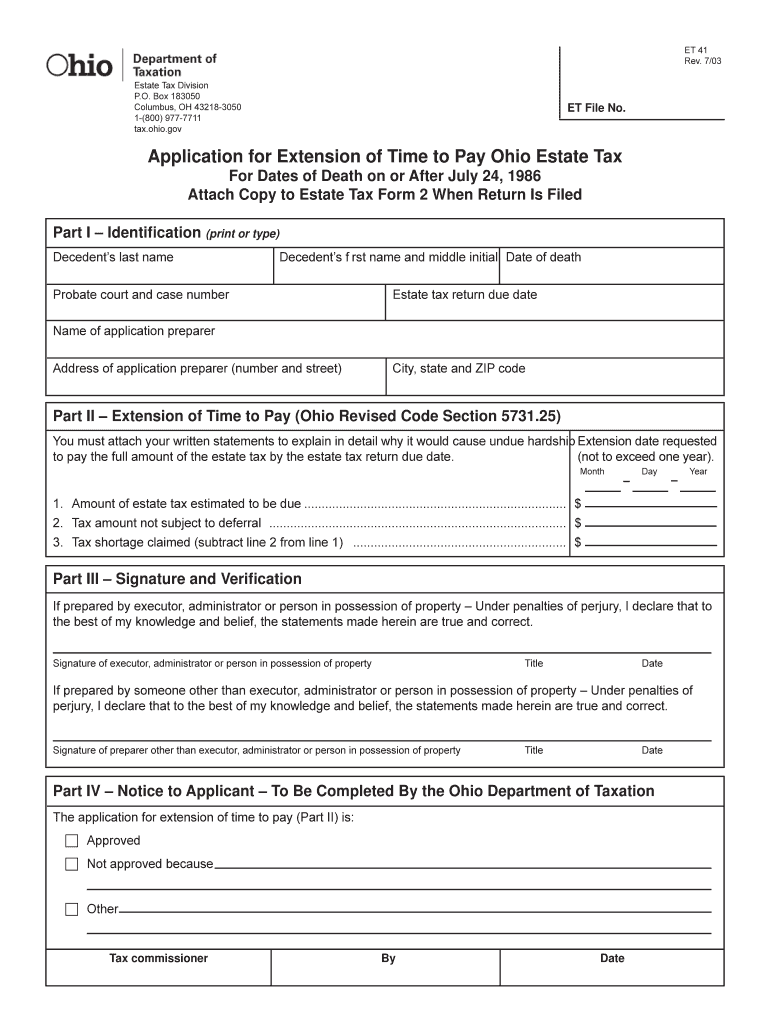

Application for Extension of Time to Pay Ohio Estate Tax Form

What is the Application For Extension Of Time To Pay Ohio Estate Tax

The Application For Extension Of Time To Pay Ohio Estate Tax is a formal request that allows individuals or entities to extend the deadline for paying estate taxes in Ohio. This application is particularly useful for estates that may require additional time to liquidate assets or gather funds necessary to meet tax obligations. By submitting this application, taxpayers can avoid penalties associated with late payments while ensuring compliance with state tax laws.

Steps to complete the Application For Extension Of Time To Pay Ohio Estate Tax

Completing the Application For Extension Of Time To Pay Ohio Estate Tax involves several key steps:

- Gather necessary information, including the estate's value and details about the deceased.

- Obtain the application form from the Ohio Department of Taxation website or relevant offices.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the application for any errors or omissions before submission.

- Submit the completed application by the specified deadline to avoid penalties.

Required Documents

When applying for an extension of time to pay Ohio estate tax, certain documents may be necessary to support your application. These typically include:

- A copy of the death certificate of the deceased individual.

- Documentation of the estate’s assets and liabilities.

- Any previous tax returns or filings related to the estate.

- Proof of identity for the executor or administrator of the estate.

Form Submission Methods

The Application For Extension Of Time To Pay Ohio Estate Tax can be submitted through various methods. Taxpayers can choose to:

- Submit the application online via the Ohio Department of Taxation's digital services.

- Mail the completed application to the appropriate state tax office.

- Deliver the application in person at designated tax offices for immediate processing.

Eligibility Criteria

To be eligible for the Application For Extension Of Time To Pay Ohio Estate Tax, the applicant must meet specific criteria. Generally, this includes:

- The estate must be subject to Ohio estate tax regulations.

- The applicant must be the executor or administrator of the estate.

- The application must be submitted before the original payment due date.

Penalties for Non-Compliance

Failing to submit the Application For Extension Of Time To Pay Ohio Estate Tax by the deadline can result in significant penalties. These may include:

- Interest charges on the unpaid tax amount.

- Additional penalties for late payment, which can increase the total tax liability.

- Potential legal actions to collect overdue taxes.

Application Process & Approval Time

The application process for the extension typically involves submitting the completed form along with any required documentation. Once submitted, the approval time can vary, but generally, applicants can expect a response within a few weeks. It is advisable to monitor the status of the application to ensure timely compliance with tax obligations.

Quick guide on how to complete application for extension of time to pay ohio estate tax

Accomplish [SKS] seamlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents swiftly without interruptions. Process [SKS] on any gadget using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest method to modify and eSign [SKS] effortlessly

- Locate [SKS] and click Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or conceal sensitive details with the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Put an end to lost or mislaid documents, tedious form navigation, or mistakes that necessitate printing fresh document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Alter and eSign [SKS] and achieve outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Application For Extension Of Time To Pay Ohio Estate Tax

Create this form in 5 minutes!

How to create an eSignature for the application for extension of time to pay ohio estate tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Application For Extension Of Time To Pay Ohio Estate Tax?

The Application For Extension Of Time To Pay Ohio Estate Tax is a formal request that allows individuals or estates to extend the deadline for paying their estate taxes in Ohio. This application is crucial for those who need additional time to gather funds or complete necessary paperwork. By submitting this application, you can avoid penalties and ensure compliance with Ohio tax laws.

-

How can airSlate SignNow help with the Application For Extension Of Time To Pay Ohio Estate Tax?

airSlate SignNow simplifies the process of completing and submitting the Application For Extension Of Time To Pay Ohio Estate Tax. Our platform allows you to easily fill out the necessary forms, eSign them, and send them directly to the appropriate tax authorities. This streamlines the process, saving you time and reducing the risk of errors.

-

What are the costs associated with using airSlate SignNow for the Application For Extension Of Time To Pay Ohio Estate Tax?

airSlate SignNow offers a cost-effective solution for managing documents, including the Application For Extension Of Time To Pay Ohio Estate Tax. Our pricing plans are designed to fit various budgets, with options for individuals and businesses. You can choose a plan that best suits your needs, ensuring you get the most value for your investment.

-

Is airSlate SignNow secure for submitting the Application For Extension Of Time To Pay Ohio Estate Tax?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for submitting the Application For Extension Of Time To Pay Ohio Estate Tax. Our platform uses advanced encryption and security protocols to protect your sensitive information. You can confidently eSign and send your documents knowing they are secure.

-

Can I track the status of my Application For Extension Of Time To Pay Ohio Estate Tax with airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your Application For Extension Of Time To Pay Ohio Estate Tax. You will receive notifications when your document is viewed and signed, ensuring you stay informed throughout the process. This feature enhances transparency and helps you manage your submissions effectively.

-

What features does airSlate SignNow offer for the Application For Extension Of Time To Pay Ohio Estate Tax?

airSlate SignNow offers a range of features to assist with the Application For Extension Of Time To Pay Ohio Estate Tax, including customizable templates, eSigning capabilities, and document storage. These features make it easy to create, sign, and manage your tax documents efficiently. Additionally, our user-friendly interface ensures a smooth experience for all users.

-

Are there any integrations available with airSlate SignNow for the Application For Extension Of Time To Pay Ohio Estate Tax?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms, enhancing your ability to manage the Application For Extension Of Time To Pay Ohio Estate Tax. You can connect with popular tools like Google Drive, Dropbox, and more, allowing for easy document access and sharing. These integrations streamline your workflow and improve productivity.

Get more for Application For Extension Of Time To Pay Ohio Estate Tax

- Transcript verification request form

- Bowie state university registrarpdffillercom 2014 form

- Smma fund student application form smmafund

- Transcript request form trinity valley community college tvcc

- Kps transcript form kent place school

- Transcript request form plaza college plazacollege

- Tyler junior college transcript request form

- Cbtf 11 order form obtamembersblog com

Find out other Application For Extension Of Time To Pay Ohio Estate Tax

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free