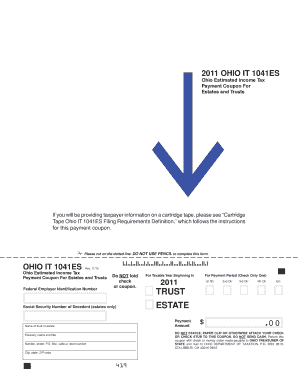

OHIO it 1041ES Ohio Estimated Income Tax Payment Coupon for Estates and Trusts If You Will Be Providing Taxpayer Information on

Understanding the 1041ES Form for Estates and Trusts

The 1041ES form, officially known as the Ohio Estimated Income Tax Payment Coupon for Estates and Trusts, is a crucial document for managing estimated tax payments for estates and trusts in Ohio. This form is specifically designed for fiduciaries who are responsible for filing income tax on behalf of an estate or trust. It allows for the prepayment of tax liabilities, ensuring compliance with state tax regulations. Understanding its purpose is essential for maintaining financial responsibility and avoiding penalties.

Steps to Complete the 1041ES Form

Completing the 1041ES form involves several key steps to ensure accuracy and compliance:

- Gather relevant financial information for the estate or trust, including income sources and deductions.

- Calculate the estimated tax liability based on projected income for the tax year.

- Fill out the 1041ES form with the required taxpayer information, ensuring all fields are accurately completed.

- Review the form for any errors or omissions before submission.

- Submit the form along with the estimated payment by the due date to avoid penalties.

Legal Use of the 1041ES Form

The 1041ES form is legally recognized as a valid method for estates and trusts to make estimated tax payments in Ohio. Proper use of this form ensures that fiduciaries comply with state tax laws, thus avoiding potential legal issues. It is important to adhere to all regulations regarding the form's usage, including timely submissions and accurate reporting of income.

Filing Deadlines for the 1041ES Form

Timely filing of the 1041ES form is critical to avoid penalties. The estimated tax payments are typically due on specific dates throughout the year, aligning with the state’s tax calendar. Fiduciaries should be aware of these deadlines to ensure that payments are made on time. Missing a deadline can result in interest charges and penalties, impacting the overall financial health of the estate or trust.

Required Documents for the 1041ES Form

When preparing to fill out the 1041ES form, certain documents and information are necessary:

- Financial statements detailing income and expenses of the estate or trust.

- Previous tax returns, if applicable, to assist in estimating current tax liabilities.

- Any relevant documentation regarding deductions or credits that may apply.

Having these documents ready will streamline the process of completing the form and ensure accuracy in reporting.

Submission Methods for the 1041ES Form

The 1041ES form can be submitted through various methods, providing flexibility for fiduciaries. Options include:

- Mailing the completed form and payment to the appropriate state tax office.

- Submitting the form electronically through designated state tax portals, if available.

- In-person delivery to local tax offices for immediate processing.

Choosing the right submission method can help ensure that payments are processed efficiently and on time.

Quick guide on how to complete 1041es

Effortlessly Prepare 1041es on Any Device

The use of online document management has surged in popularity among businesses and individuals alike. It presents an ideal eco-friendly alternative to traditional printed and signed documents, allowing users to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly and without delays. Manage 1041es on any platform using the airSlate SignNow apps for Android or iOS and simplify your document-related tasks today.

How to Edit and eSign 1041es with Ease

- Obtain 1041es and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your changes.

- Select your preferred method of sending your form, whether by email, SMS, invite link, or download it to your PC.

Eliminate concerns over lost or misplaced documents, tedious form searching, or the need to print new copies due to errors. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign 1041es and ensure outstanding communication at any point during the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 1041es

Create this form in 5 minutes!

How to create an eSignature for the 1041es

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask 1041es

-

What are 1041es and how do they work with airSlate SignNow?

1041es are specific forms used for reporting income and expenses for estates and trusts. With airSlate SignNow, you can easily eSign and send these documents securely, ensuring compliance and accuracy in your filings.

-

How can airSlate SignNow help me manage my 1041es efficiently?

airSlate SignNow streamlines the process of managing 1041es by allowing you to create, edit, and eSign documents online. This eliminates the need for physical paperwork, saving you time and reducing errors in your submissions.

-

What pricing plans does airSlate SignNow offer for handling 1041es?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those specifically for managing 1041es. You can choose a plan that fits your budget while enjoying features that enhance your document management process.

-

Are there any integrations available for 1041es with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage your 1041es. These integrations help streamline your workflow and ensure that your documents are always up-to-date.

-

What are the benefits of using airSlate SignNow for 1041es?

Using airSlate SignNow for your 1041es offers numerous benefits, including enhanced security, faster processing times, and improved collaboration. You can eSign documents from anywhere, making it a convenient solution for busy professionals.

-

Is airSlate SignNow compliant with regulations for 1041es?

Absolutely! airSlate SignNow is designed to comply with all relevant regulations for handling 1041es. This ensures that your documents are legally binding and meet the necessary standards for submission.

-

Can I track the status of my 1041es with airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your 1041es. You will receive notifications when documents are viewed, signed, or completed, keeping you informed throughout the process.

Get more for 1041es

Find out other 1041es

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple