Ohio Estate Tax Return and Instructions for Dates of Death on or After July 1, Form

Understanding the Ohio Estate Tax Return and Instructions for Dates of Death On or After July 1

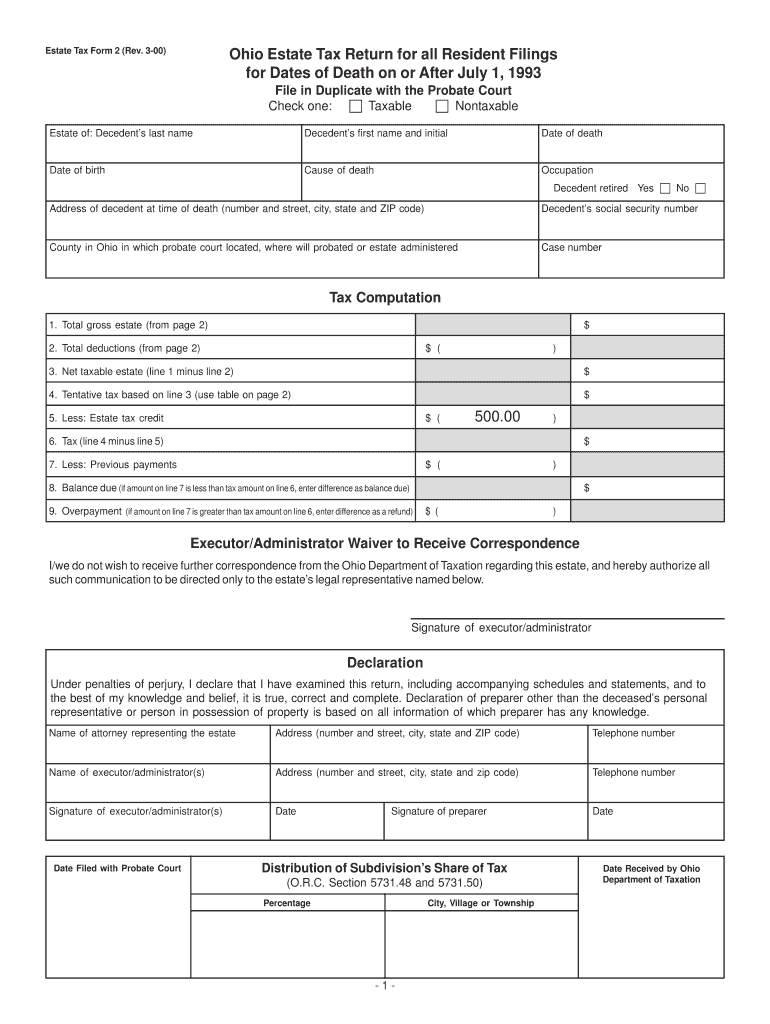

The Ohio Estate Tax Return is a crucial document for the estates of individuals who pass away on or after July 1. This form is designed to report the value of the decedent's estate and calculate any estate tax owed to the state of Ohio. The return must be filed by the estate's executor or administrator. It is essential to understand the specific requirements and instructions associated with this form to ensure compliance with state regulations.

Steps to Complete the Ohio Estate Tax Return

Completing the Ohio Estate Tax Return involves several key steps. First, gather all necessary documentation, including the decedent's financial records, property deeds, and any outstanding debts. Next, determine the gross value of the estate by listing all assets, such as real estate, bank accounts, and personal property. After calculating the total value, apply any allowable deductions, such as funeral expenses and debts. Finally, complete the return by accurately filling in all required fields and reviewing the document for accuracy before submission.

Filing Deadlines and Important Dates

It is critical to be aware of the filing deadlines for the Ohio Estate Tax Return. Generally, the return must be filed within nine months of the date of death. However, extensions may be available under certain circumstances. Failure to file on time can result in penalties and interest on any taxes owed. Executors should mark their calendars to ensure they meet all deadlines associated with the estate tax process.

Required Documents for the Ohio Estate Tax Return

When preparing the Ohio Estate Tax Return, several documents are required to support the information provided. These documents typically include the death certificate, a detailed inventory of the estate's assets, appraisals for real estate and valuable items, and any relevant financial statements. Additionally, documentation of debts and expenses incurred by the estate should be included to accurately calculate the net taxable estate.

Legal Use of the Ohio Estate Tax Return

The Ohio Estate Tax Return serves a legal purpose in the administration of estates. It is used to ensure that the state collects the appropriate taxes owed on the transfer of wealth upon death. Executors and administrators must use this form to comply with Ohio law and fulfill their fiduciary duties. Properly filing the return can help avoid legal complications and ensure a smooth transition of assets to beneficiaries.

Obtaining the Ohio Estate Tax Return

The Ohio Estate Tax Return can be obtained from the Ohio Department of Taxation's website or through local county auditor's offices. It is important to ensure that you are using the most current version of the form, as regulations and requirements may change. Executors should also familiarize themselves with any accompanying instructions to ensure accurate completion of the return.

Quick guide on how to complete ohio estate tax return and instructions for dates of death on or after july 1

Complete [SKS] seamlessly on any device

Online document management has become increasingly favored by companies and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your papers quickly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and streamline any document-oriented task today.

The easiest method to modify and electronically sign [SKS] effortlessly

- Obtain [SKS] and click Get Form to initiate.

- Utilize the tools provided to complete your form.

- Emphasize key sections of the documents or redact sensitive data with the tools available through airSlate SignNow specifically for such tasks.

- Generate your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to record your updates.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] to ensure outstanding communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Ohio Estate Tax Return And Instructions For Dates Of Death On Or After July 1,

Create this form in 5 minutes!

How to create an eSignature for the ohio estate tax return and instructions for dates of death on or after july 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ohio Estate Tax Return And Instructions For Dates Of Death On Or After July 1,?

The Ohio Estate Tax Return And Instructions For Dates Of Death On Or After July 1, is a document required for filing estate taxes in Ohio for individuals who passed away on or after July 1. This return outlines the necessary information and calculations needed to determine the estate tax owed. Understanding this process is crucial for executors and beneficiaries to ensure compliance with state tax laws.

-

How can airSlate SignNow assist with the Ohio Estate Tax Return And Instructions For Dates Of Death On Or After July 1,?

airSlate SignNow provides an efficient platform for preparing and eSigning the Ohio Estate Tax Return And Instructions For Dates Of Death On Or After July 1,. Our user-friendly interface simplifies document management, allowing users to easily fill out, sign, and send necessary forms securely. This streamlines the process, saving time and reducing the risk of errors.

-

What are the pricing options for using airSlate SignNow for estate tax documents?

airSlate SignNow offers flexible pricing plans tailored to meet various needs, including options for individuals and businesses. Users can choose from monthly or annual subscriptions, which provide access to features that facilitate the completion of the Ohio Estate Tax Return And Instructions For Dates Of Death On Or After July 1,. This ensures that you only pay for what you need while benefiting from a cost-effective solution.

-

Are there any integrations available with airSlate SignNow for estate tax filing?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms, enhancing your workflow for the Ohio Estate Tax Return And Instructions For Dates Of Death On Or After July 1,. These integrations allow users to connect with popular tools like Google Drive, Dropbox, and more, making it easier to manage documents and collaborate with others involved in the estate process.

-

What features does airSlate SignNow offer for completing the Ohio Estate Tax Return?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time collaboration, all designed to simplify the completion of the Ohio Estate Tax Return And Instructions For Dates Of Death On Or After July 1,. These tools help ensure that all necessary information is accurately captured and that the document is legally binding, providing peace of mind during the filing process.

-

How does airSlate SignNow ensure the security of my estate tax documents?

Security is a top priority for airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your documents, including the Ohio Estate Tax Return And Instructions For Dates Of Death On Or After July 1,. This ensures that sensitive information remains confidential and is only accessible to authorized users, giving you confidence in the safety of your data.

-

Can I access my documents from multiple devices using airSlate SignNow?

Absolutely! airSlate SignNow is designed to be accessible from any device with internet connectivity. Whether you are using a computer, tablet, or smartphone, you can easily access, edit, and eSign your Ohio Estate Tax Return And Instructions For Dates Of Death On Or After July 1,. This flexibility allows you to manage your estate documents on the go.

Get more for Ohio Estate Tax Return And Instructions For Dates Of Death On Or After July 1,

Find out other Ohio Estate Tax Return And Instructions For Dates Of Death On Or After July 1,

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document