State and Federal Laws Require All Employers to Report Each New and Form

Understanding the State and Federal Reporting Requirements for Employers

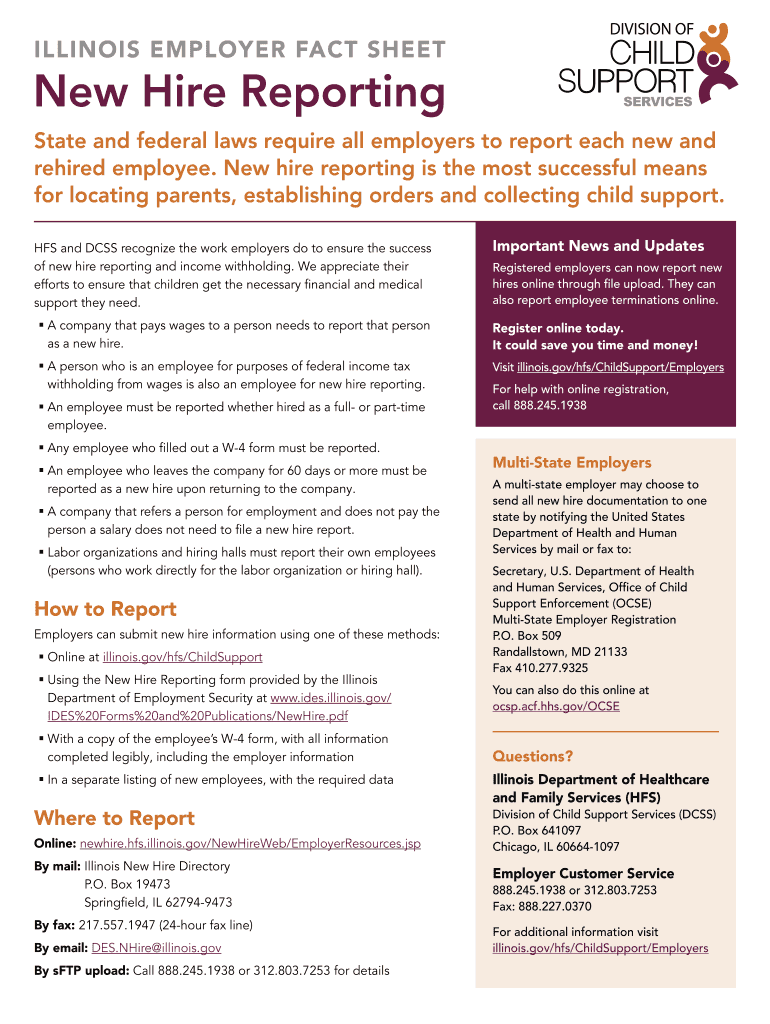

The State and Federal Laws require all employers to report each new hire to designated authorities. This process ensures that the government can track employment for various purposes, including tax collection and child support enforcement. Employers must be aware of the specific laws that govern these reporting requirements, which can vary by state. Each state has its own guidelines in addition to federal mandates, making it essential for businesses to stay informed about their obligations.

Steps to Report New Hires

To comply with the State and Federal reporting requirements, employers should follow these steps:

- Gather necessary information about the new employee, including their name, address, Social Security number, and date of hire.

- Complete the required reporting form, which may vary by state. Ensure all information is accurate and complete.

- Submit the form to the appropriate state agency, typically the state’s department of labor or workforce development.

- Retain a copy of the submission for your records, as well as any confirmation of receipt from the state agency.

Key Elements of the Reporting Process

Understanding the key elements of the reporting process is vital for compliance:

- Timeliness: Employers must report new hires within a specific timeframe, usually within twenty days of the hire date.

- Accuracy: Providing accurate information is crucial to avoid penalties and ensure proper processing.

- Confidentiality: Employers must handle employee information with care, adhering to privacy laws and regulations.

Penalties for Non-Compliance

Failure to comply with State and Federal reporting requirements can result in significant penalties. Employers may face fines, and repeated violations could lead to more severe consequences, including legal action. It is essential for businesses to prioritize compliance to avoid these risks.

State-Specific Reporting Rules

Each state has specific rules regarding the reporting of new hires. Employers should familiarize themselves with their state’s requirements, as these can include different forms, submission methods, and deadlines. Some states may also have additional reporting obligations, such as notifying local agencies.

Obtaining the Required Forms

Employers can obtain the necessary forms for reporting new hires from their state’s labor department website or office. Many states provide these forms online, making it easier for employers to access and complete them. It is important to use the most current version of the form to ensure compliance with the latest regulations.

Quick guide on how to complete state and federal laws require all employers to report each new and

Complete [SKS] effortlessly on any gadget

Digital document management has become favored among enterprises and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, adjust, and electronically sign your documents promptly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent portions of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Adjust and eSign [SKS] and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to State And Federal Laws Require All Employers To Report Each New And

Create this form in 5 minutes!

How to create an eSignature for the state and federal laws require all employers to report each new and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow related to compliance with state and federal laws?

airSlate SignNow offers features that ensure compliance with state and federal laws that require all employers to report each new hire. Our platform provides secure eSigning, document tracking, and automated workflows, making it easier for businesses to stay compliant while managing their hiring processes efficiently.

-

How does airSlate SignNow help businesses comply with reporting requirements?

With airSlate SignNow, businesses can streamline their new hire reporting processes, ensuring they meet the state and federal laws that require all employers to report each new and rehired employee. Our solution allows for quick document preparation and submission, reducing the risk of non-compliance.

-

What is the pricing structure for airSlate SignNow?

airSlate SignNow offers flexible pricing plans designed to accommodate businesses of all sizes. Our cost-effective solution ensures that you can meet the requirements of state and federal laws that require all employers to report each new and without breaking your budget.

-

Can airSlate SignNow integrate with other HR systems?

Yes, airSlate SignNow seamlessly integrates with various HR systems and software, allowing for efficient data transfer and compliance with state and federal laws that require all employers to report each new hire. This integration helps streamline your HR processes and maintain accurate records.

-

What benefits does airSlate SignNow provide for new hire documentation?

airSlate SignNow simplifies the new hire documentation process, ensuring compliance with state and federal laws that require all employers to report each new and. Our platform enhances efficiency, reduces paperwork, and provides a secure environment for sensitive employee information.

-

Is airSlate SignNow user-friendly for non-technical users?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for non-technical users to navigate and utilize its features. This user-friendly interface helps businesses comply with state and federal laws that require all employers to report each new and without the need for extensive training.

-

How does airSlate SignNow ensure document security?

airSlate SignNow prioritizes document security by employing advanced encryption and secure storage solutions. This commitment to security helps businesses comply with state and federal laws that require all employers to report each new hire while protecting sensitive information.

Get more for State And Federal Laws Require All Employers To Report Each New And

- Certification of sales under special conditions certification of sales under special conditions tn form

- Illinois notice lien form

- Tenant rental application rental forms

- Pony club feed chart form

- 2006 ct23 short form corporations tax 2006 ct23 short form corporations tax forms ssb gov on

- Phv 203 2013 2019 form

- Phv106 variation application form pdf 195kb transport for london tfl gov

- Cfs24784 developmental checklist 4 year oldindd form

Find out other State And Federal Laws Require All Employers To Report Each New And

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple