IL 1120 ST Schedule F Income Tax Business Small Business Tax Illinois Form

What is the IL 1120 ST Schedule F Income Tax Business Small Business Tax Illinois

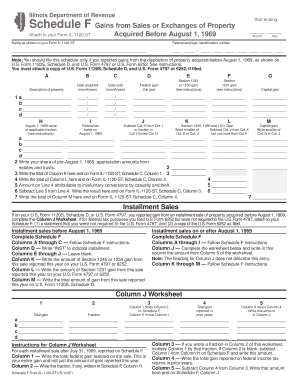

The IL 1120 ST Schedule F is a tax form specifically designed for small businesses operating in Illinois. This form is used to report income and calculate tax liability for corporations that qualify for the Small Business Corporation Election. It is essential for businesses to accurately complete this form to ensure compliance with state tax laws and to take advantage of any applicable tax benefits.

Steps to complete the IL 1120 ST Schedule F Income Tax Business Small Business Tax Illinois

Completing the IL 1120 ST Schedule F involves several key steps. First, gather all necessary financial documents, including income statements and expense records. Next, begin filling out the form by entering your business's gross income, followed by allowable deductions. Ensure that all calculations are accurate to avoid potential penalties. After completing the form, review it thoroughly for any errors before submission.

How to obtain the IL 1120 ST Schedule F Income Tax Business Small Business Tax Illinois

The IL 1120 ST Schedule F can be obtained from the Illinois Department of Revenue's website. The form is available for download in PDF format, allowing businesses to print it for completion. Additionally, it may be available at local tax offices or through tax preparation software that supports Illinois tax forms.

Filing Deadlines / Important Dates

For the IL 1120 ST Schedule F, the filing deadline typically aligns with the federal tax return due date, which is usually April fifteenth. However, businesses may need to check for any specific extensions or changes that may apply in a given tax year. It is crucial to file on time to avoid late fees and penalties.

Required Documents

When preparing to file the IL 1120 ST Schedule F, businesses should have several documents on hand. These include financial statements, receipts for deductible expenses, and any prior year tax returns. Keeping organized records will facilitate the completion of the form and ensure all necessary information is readily available.

Penalties for Non-Compliance

Failure to file the IL 1120 ST Schedule F on time or inaccuracies in reporting can result in penalties imposed by the Illinois Department of Revenue. These penalties may include fines and interest on unpaid taxes. To avoid these consequences, it is important for businesses to ensure timely and accurate submissions of their tax forms.

Quick guide on how to complete il 1120 st schedule f income tax business small business tax illinois

Prepare [SKS] effortlessly on any device

Web-based document management has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and safely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The easiest way to modify and eSign [SKS] with minimal effort

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you want to distribute your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] while ensuring exceptional communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to IL 1120 ST Schedule F Income Tax Business Small Business Tax Illinois

Create this form in 5 minutes!

How to create an eSignature for the il 1120 st schedule f income tax business small business tax illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IL 1120 ST Schedule F Income Tax for small businesses in Illinois?

The IL 1120 ST Schedule F Income Tax is a specific form used by small businesses in Illinois to report income and calculate tax liabilities. It is essential for compliance with state tax regulations and helps ensure that businesses accurately report their earnings. Understanding this form is crucial for effective tax planning and management.

-

How can airSlate SignNow help with the IL 1120 ST Schedule F Income Tax process?

airSlate SignNow streamlines the process of preparing and submitting the IL 1120 ST Schedule F Income Tax by allowing businesses to easily send and eSign necessary documents. Our platform simplifies document management, ensuring that all tax-related paperwork is organized and accessible. This efficiency can save time and reduce errors during tax season.

-

What are the pricing options for using airSlate SignNow for small business tax needs?

airSlate SignNow offers flexible pricing plans tailored for small businesses, making it an affordable solution for managing the IL 1120 ST Schedule F Income Tax. Our plans include various features that cater to different business sizes and needs, ensuring you only pay for what you use. You can choose a plan that fits your budget while benefiting from our comprehensive eSigning capabilities.

-

What features does airSlate SignNow provide for managing tax documents?

airSlate SignNow provides a range of features designed to assist with managing tax documents, including templates for the IL 1120 ST Schedule F Income Tax, secure eSigning, and document tracking. These features enhance collaboration and ensure that all parties involved can easily access and sign documents. Additionally, our platform integrates with various accounting software to streamline your tax preparation process.

-

Is airSlate SignNow compliant with Illinois tax regulations?

Yes, airSlate SignNow is compliant with Illinois tax regulations, ensuring that your use of our platform for the IL 1120 ST Schedule F Income Tax adheres to state requirements. We prioritize security and compliance, providing businesses with peace of mind when managing sensitive tax documents. Our commitment to regulatory standards helps you focus on your business without worrying about compliance issues.

-

Can airSlate SignNow integrate with other accounting software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easier for small businesses to manage their IL 1120 ST Schedule F Income Tax. This integration allows for automatic data transfer, reducing manual entry errors and saving time during tax preparation. By connecting your tools, you can streamline your entire tax process.

-

What benefits does airSlate SignNow offer for small businesses during tax season?

During tax season, airSlate SignNow offers small businesses signNow benefits, including time savings, enhanced organization, and improved accuracy when preparing the IL 1120 ST Schedule F Income Tax. Our platform simplifies document management and eSigning, allowing you to focus on your business operations. Additionally, our user-friendly interface ensures that even those with limited tech experience can navigate the process easily.

Get more for IL 1120 ST Schedule F Income Tax Business Small Business Tax Illinois

- Release and cancellation of contract for sale and realty3000 inc form

- Dl 739 form

- Casino licence application 5420 aglc aglc ab form

- Pacfa license application colorado form

- M v a fill in the blencs ans form

- Auxiliary claims us coast guard d11s form

- Personal injury questionnaire schofield chiropractic training form

- Aesthetic consent form

Find out other IL 1120 ST Schedule F Income Tax Business Small Business Tax Illinois

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online