Schedule CR Income Tax Individual Form

What is the Schedule CR Income Tax Individual

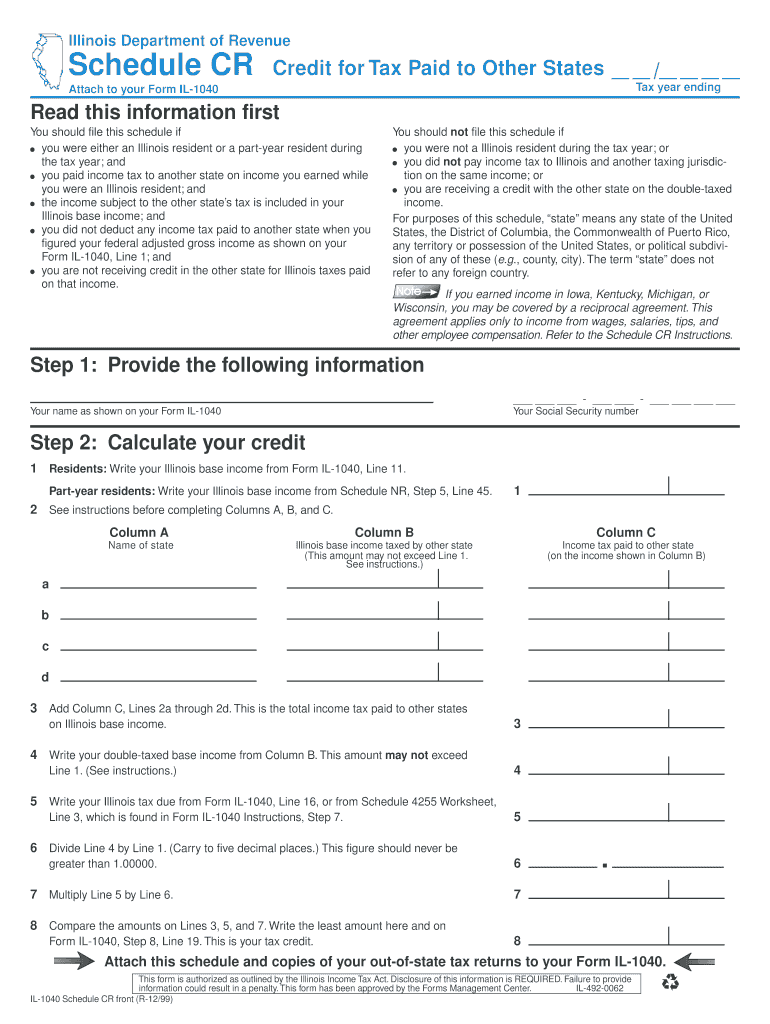

The Schedule CR Income Tax Individual is a specific tax form used by individuals in the United States to claim a credit for taxes paid to other states. This form is particularly relevant for residents who earn income in multiple states and wish to avoid double taxation. By completing this form, taxpayers can report the taxes they have paid to other jurisdictions, which may reduce their overall tax liability in their home state.

How to use the Schedule CR Income Tax Individual

To effectively use the Schedule CR Income Tax Individual, taxpayers should first gather all necessary documentation regarding income earned in other states and the taxes paid. This includes W-2 forms, 1099 forms, and any state tax returns filed. Once the information is compiled, the taxpayer can fill out the Schedule CR form, detailing the credit they are claiming. It is essential to follow the instructions carefully to ensure accurate reporting and compliance with state tax laws.

Steps to complete the Schedule CR Income Tax Individual

Completing the Schedule CR Income Tax Individual involves several key steps:

- Collect all relevant income documentation, including forms from other states.

- Obtain the Schedule CR form from the state's tax authority or their website.

- Fill out the taxpayer information section accurately.

- Report the total income earned in other states and the taxes paid.

- Calculate the credit amount based on the instructions provided.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule CR Income Tax Individual typically align with the general tax filing deadlines set by the IRS. For most taxpayers, the deadline is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any specific state deadlines that may differ from federal timelines.

Required Documents

When preparing to file the Schedule CR Income Tax Individual, certain documents are essential:

- W-2 forms from employers showing income earned.

- 1099 forms for any freelance or contract work.

- State tax returns from other states where income was earned.

- Proof of taxes paid to other states, such as receipts or tax payment confirmations.

Penalties for Non-Compliance

Failing to accurately complete and submit the Schedule CR Income Tax Individual can result in penalties. Taxpayers may face fines for underreporting income or failing to claim credits they are entitled to. Additionally, states may impose interest on unpaid taxes if the form is not filed by the deadline. It is crucial for taxpayers to ensure compliance to avoid these consequences.

Quick guide on how to complete schedule cr income tax individual

Effortlessly prepare [SKS] on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to acquire the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and without delays. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign [SKS] effortlessly

- Locate [SKS] and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight key sections of your documents or black out sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and has the same legal standing as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your preference. Modify and eSign [SKS] to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule CR Income Tax Individual

Create this form in 5 minutes!

How to create an eSignature for the schedule cr income tax individual

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule CR Income Tax Individual?

Schedule CR Income Tax Individual is a form used by taxpayers to claim credits against their individual income tax liability. It helps individuals reduce their tax burden by providing a structured way to report eligible credits. Understanding this form is crucial for maximizing your tax benefits.

-

How can airSlate SignNow help with Schedule CR Income Tax Individual?

airSlate SignNow simplifies the process of preparing and submitting your Schedule CR Income Tax Individual by allowing you to eSign and send documents securely. Our platform ensures that your tax documents are handled efficiently, reducing the time spent on paperwork. This streamlines your tax filing process, making it easier to manage your credits.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of individuals and businesses. Our plans are cost-effective, ensuring you get the best value while managing your Schedule CR Income Tax Individual and other documents. You can choose a plan that fits your budget and requirements.

-

Are there any features specifically for tax document management?

Yes, airSlate SignNow includes features designed for efficient tax document management, including templates for Schedule CR Income Tax Individual. You can easily create, edit, and store your tax documents securely. Our platform also allows for easy collaboration with tax professionals, ensuring accuracy and compliance.

-

Can I integrate airSlate SignNow with other tax software?

Absolutely! airSlate SignNow integrates seamlessly with various tax software solutions, enhancing your ability to manage your Schedule CR Income Tax Individual. This integration allows for a smoother workflow, enabling you to import and export documents easily. You can streamline your tax preparation process with our user-friendly platform.

-

What are the benefits of using airSlate SignNow for tax filing?

Using airSlate SignNow for tax filing, including your Schedule CR Income Tax Individual, offers numerous benefits. It provides a secure and efficient way to manage your documents, reduces the risk of errors, and saves you time. Additionally, our platform is designed to be user-friendly, making it accessible for everyone.

-

Is airSlate SignNow secure for handling sensitive tax information?

Yes, airSlate SignNow prioritizes the security of your sensitive tax information. We utilize advanced encryption and security protocols to protect your data while you manage your Schedule CR Income Tax Individual. You can trust our platform to keep your information safe and confidential.

Get more for Schedule CR Income Tax Individual

- Xceed pro glucose meter competency assessment test form

- Belleville east lancer bands car raffle tickets pkb5znet k b5z form

- Application for retirement ret 54 new york state teachers nystrs form

- Regents earth science plotting epicenter worksheet form

- Maryland commissioner of financial regulation md net tangible benefit worksheet form

- Channel enrollment form

- Limited review form

- Hvac commissioning checklist form

Find out other Schedule CR Income Tax Individual

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe

- Sign Pennsylvania Insurance Contract Safe

- How Do I Sign Louisiana Legal Cease And Desist Letter

- How Can I Sign Kentucky Legal Quitclaim Deed

- Sign Kentucky Legal Cease And Desist Letter Fast

- Sign Maryland Legal Quitclaim Deed Now

- Can I Sign Maine Legal NDA

- How To Sign Maine Legal Warranty Deed

- Sign Maine Legal Last Will And Testament Fast