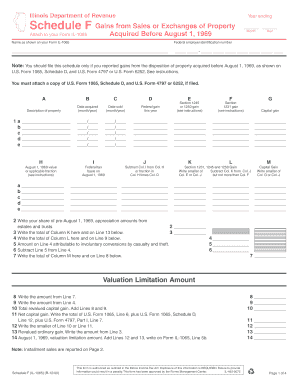

Any Modified Date State of Illinois Tax Illinois Form

Understanding the Any Modified Date State Of Illinois Tax Illinois

The Any Modified Date State Of Illinois Tax Illinois is a specific tax form used by residents and businesses in Illinois for various tax reporting purposes. This form allows individuals to report income, claim deductions, and fulfill their tax obligations in accordance with state regulations. It is essential for ensuring compliance with Illinois tax laws and may be required for both personal and business tax filings.

Steps to Complete the Any Modified Date State Of Illinois Tax Illinois

Completing the Any Modified Date State Of Illinois Tax Illinois involves several key steps:

- Gather necessary documentation, including income statements, deduction records, and previous tax returns.

- Carefully read the instructions provided with the form to understand the requirements.

- Fill out the form accurately, ensuring all information is complete and correct.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the designated deadline to avoid penalties.

How to Obtain the Any Modified Date State Of Illinois Tax Illinois

The Any Modified Date State Of Illinois Tax Illinois can be obtained through several channels:

- Visit the official Illinois Department of Revenue website to download the form directly.

- Request a physical copy from local tax offices or government buildings.

- Consult with a tax professional who may provide assistance in obtaining and completing the form.

Required Documents for the Any Modified Date State Of Illinois Tax Illinois

To complete the Any Modified Date State Of Illinois Tax Illinois, you will need to gather several important documents:

- W-2 forms from employers for reporting wages.

- 1099 forms for reporting other income sources.

- Receipts and records for any deductions you plan to claim.

- Previous year’s tax return for reference.

Legal Use of the Any Modified Date State Of Illinois Tax Illinois

The Any Modified Date State Of Illinois Tax Illinois is legally required for residents and businesses to report their income and pay taxes owed to the state. Failing to complete this form accurately and on time can result in penalties, including fines and interest on unpaid taxes. It is crucial to understand the legal implications of this form and ensure compliance with all state tax laws.

Filing Deadlines / Important Dates for the Any Modified Date State Of Illinois Tax Illinois

Filing deadlines for the Any Modified Date State Of Illinois Tax Illinois typically align with federal tax deadlines. Important dates include:

- The standard filing deadline is April 15 for individual taxpayers.

- Extensions may be available, but must be filed before the original deadline.

- Quarterly estimated tax payments may be required for certain taxpayers, with specific due dates throughout the year.

Quick guide on how to complete any modified date state of illinois tax illinois

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign [SKS] without hassle

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive data with tools that airSlate SignNow has specifically designed for that intention.

- Generate your signature using the Sign feature, which takes moments and carries the same legal weight as a conventional wet ink signature.

- Review all the information and then click on the Done button to preserve your modifications.

- Choose how you wish to send your form, by email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your needs in document management in just a few clicks from any device you prefer. Alter and eSign [SKS] and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Any Modified Date State Of Illinois Tax Illinois

Create this form in 5 minutes!

How to create an eSignature for the any modified date state of illinois tax illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the Any Modified Date State Of Illinois Tax Illinois?

The Any Modified Date State Of Illinois Tax Illinois refers to the specific date when tax documents must be updated or modified. Understanding this date is crucial for compliance with state tax regulations. By using airSlate SignNow, you can easily manage and eSign your tax documents, ensuring they are always up-to-date.

-

How does airSlate SignNow help with the Any Modified Date State Of Illinois Tax Illinois?

airSlate SignNow provides a streamlined process for managing documents related to the Any Modified Date State Of Illinois Tax Illinois. Our platform allows you to create, send, and eSign tax documents efficiently. This ensures that you meet all necessary deadlines and maintain compliance with state tax laws.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Our plans are designed to provide cost-effective solutions for managing documents, including those related to the Any Modified Date State Of Illinois Tax Illinois. You can choose a plan that fits your budget while still accessing essential features.

-

What features does airSlate SignNow offer for tax document management?

Our platform includes features such as customizable templates, automated workflows, and secure eSigning capabilities. These tools are particularly beneficial for handling documents related to the Any Modified Date State Of Illinois Tax Illinois. With airSlate SignNow, you can enhance your document management process and improve efficiency.

-

Can airSlate SignNow integrate with other software for tax management?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing your tax management capabilities. This is especially useful for managing documents related to the Any Modified Date State Of Illinois Tax Illinois. By integrating with your existing tools, you can streamline your workflow and improve productivity.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for your tax documents offers numerous benefits, including increased efficiency, reduced errors, and enhanced security. This is particularly important for documents related to the Any Modified Date State Of Illinois Tax Illinois. Our platform simplifies the eSigning process, allowing you to focus on your core business activities.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your sensitive tax documents are protected. Our platform uses advanced encryption and secure storage solutions, making it ideal for managing documents related to the Any Modified Date State Of Illinois Tax Illinois. You can trust us to keep your information safe.

Get more for Any Modified Date State Of Illinois Tax Illinois

- Business impact operational form

- Msfa guidelines for nfpa 1403 live training exercise on line msfa form

- Recruitment information form rif hampton roads chi omega

- New jersey office of the attorney general new jersey division of njconsumeraffairs form

- Qualitative fit test qlft form employee name date of birth year

- Demande de r vocation de radiation pr sent e par un tiers crac form

- Parental authorization for minors for oci form to

- Membership application form nmacte com

Find out other Any Modified Date State Of Illinois Tax Illinois

- How Can I Sign Michigan Personal Leave Policy

- Sign South Carolina Pregnancy Leave Policy Safe

- How To Sign South Carolina Time Off Policy

- How To Sign Iowa Christmas Bonus Letter

- How To Sign Nevada Christmas Bonus Letter

- Sign New Jersey Promotion Announcement Simple

- Sign Louisiana Company Bonus Letter Safe

- How To Sign Delaware Letter of Appreciation to Employee

- How To Sign Florida Letter of Appreciation to Employee

- How Do I Sign New Jersey Letter of Appreciation to Employee

- How Do I Sign Delaware Direct Deposit Enrollment Form

- How To Sign Alabama Employee Emergency Notification Form

- How To Sign Oklahoma Direct Deposit Enrollment Form

- Sign Wyoming Direct Deposit Enrollment Form Online

- Sign Nebraska Employee Suggestion Form Now

- How Can I Sign New Jersey Employee Suggestion Form

- Can I Sign New York Employee Suggestion Form

- Sign Michigan Overtime Authorization Form Mobile

- How To Sign Alabama Payroll Deduction Authorization

- How To Sign California Payroll Deduction Authorization