Schedule NR Income Tax Individual Form

What is the Schedule NR Income Tax Individual

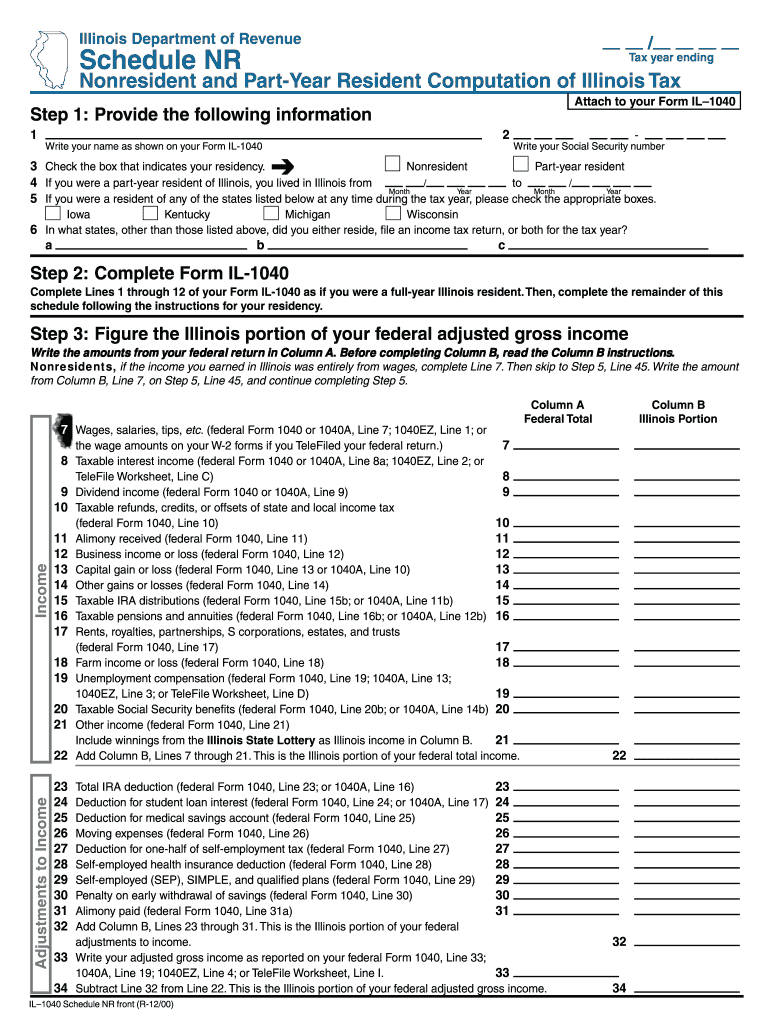

The Schedule NR Income Tax Individual is a tax form used by non-resident aliens in the United States to report their income and calculate their tax liability. This form is essential for individuals who are not U.S. citizens or residents but have earned income from U.S. sources. It allows them to comply with U.S. tax laws and ensures that they pay the appropriate amount of tax on their income.

How to use the Schedule NR Income Tax Individual

To use the Schedule NR Income Tax Individual, taxpayers must first determine their filing requirements based on their income sources and residency status. Once eligibility is confirmed, individuals should gather all necessary documents, including W-2 forms, 1099 forms, and any other relevant income statements. The form must be filled out accurately, reporting all U.S.-sourced income and applicable deductions. After completing the form, it should be submitted along with the main tax return.

Steps to complete the Schedule NR Income Tax Individual

Completing the Schedule NR Income Tax Individual involves several key steps:

- Gather all necessary income documentation, such as W-2 and 1099 forms.

- Determine your residency status and confirm that you qualify as a non-resident alien.

- Fill out the form accurately, ensuring all income and deductions are reported.

- Review the completed form for accuracy and completeness.

- Submit the form along with your main tax return by the appropriate deadline.

Legal use of the Schedule NR Income Tax Individual

The Schedule NR Income Tax Individual is legally required for non-resident aliens who have U.S.-sourced income. Failing to file this form can result in penalties and interest on unpaid taxes. It is crucial for individuals to understand their legal obligations and ensure compliance with IRS regulations to avoid potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule NR Income Tax Individual typically align with the general tax return deadlines. For most individuals, the deadline is April fifteenth of the following year. However, non-resident aliens may have different deadlines depending on their specific circumstances, such as whether they are in the U.S. for a short period. It is essential to be aware of these dates to avoid late filing penalties.

Required Documents

When completing the Schedule NR Income Tax Individual, individuals must have several documents ready:

- W-2 forms for any employment income.

- 1099 forms for other types of income, such as freelance work or investment income.

- Any relevant documentation regarding deductions or credits claimed.

- Identification information, such as a Social Security Number or Individual Taxpayer Identification Number.

Who Issues the Form

The Schedule NR Income Tax Individual is issued by the Internal Revenue Service (IRS). The IRS is the U.S. government agency responsible for tax collection and tax law enforcement. Taxpayers can obtain the form directly from the IRS website or through tax preparation software that includes IRS forms.

Quick guide on how to complete schedule nr income tax individual

Easily Prepare [SKS] on Any Device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without any hold-ups. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Modify and Electronically Sign [SKS] Effortlessly

- Locate [SKS] and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize relevant parts of your documents or hide sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule NR Income Tax Individual

Create this form in 5 minutes!

How to create an eSignature for the schedule nr income tax individual

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule NR Income Tax Individual?

Schedule NR Income Tax Individual is a tax form used by non-resident individuals to report their income earned in a specific jurisdiction. It is essential for ensuring compliance with local tax laws and helps in calculating the correct tax liability. Understanding this form is crucial for non-residents to avoid penalties.

-

How can airSlate SignNow help with Schedule NR Income Tax Individual?

airSlate SignNow provides a seamless platform for eSigning and sending documents related to Schedule NR Income Tax Individual. With its user-friendly interface, you can easily manage your tax documents, ensuring they are signed and submitted on time. This efficiency can save you valuable time during tax season.

-

What are the pricing options for using airSlate SignNow for Schedule NR Income Tax Individual?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of individuals and businesses handling Schedule NR Income Tax Individual. You can choose from monthly or annual subscriptions, with options that provide access to essential features at competitive rates. This makes it a cost-effective solution for managing your tax documentation.

-

Are there any integrations available for Schedule NR Income Tax Individual with airSlate SignNow?

Yes, airSlate SignNow integrates with various applications that can assist in managing Schedule NR Income Tax Individual. These integrations allow you to connect with accounting software, cloud storage, and other tools, streamlining your workflow. This ensures that all your tax-related documents are easily accessible and organized.

-

What features does airSlate SignNow offer for managing Schedule NR Income Tax Individual?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for Schedule NR Income Tax Individual. These tools enhance your ability to manage tax documents efficiently and securely. Additionally, the platform provides reminders and notifications to keep you on track with deadlines.

-

How does airSlate SignNow ensure the security of my Schedule NR Income Tax Individual documents?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like Schedule NR Income Tax Individual. The platform employs advanced encryption and secure cloud storage to protect your data. This ensures that your tax information remains confidential and secure throughout the signing process.

-

Can I access airSlate SignNow on mobile devices for Schedule NR Income Tax Individual?

Absolutely! airSlate SignNow is accessible on mobile devices, allowing you to manage your Schedule NR Income Tax Individual documents on the go. The mobile app provides the same features as the desktop version, ensuring you can eSign and send documents anytime, anywhere. This flexibility is ideal for busy individuals.

Get more for Schedule NR Income Tax Individual

- Hro application checklistpdf colorado national guard co ng form

- Act of de immobilization of mobile home caddo parish clerk of form

- Town of stowe special event permit application form

- Property registration form

- Traditional ira withdrawal instruction form 2306t americas uecu

- Ktenskapscertifikat anskan och frskran skv 7881 skatteverket form

- Wedding ceremony request form rockdale county rockdalecounty

- Attendance form for troopgroup meetings girl scouts of west future girlscouts

Find out other Schedule NR Income Tax Individual

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast