Schedule UBNLD Income Tax Corporate Form

What is the Schedule UBNLD Income Tax Corporate

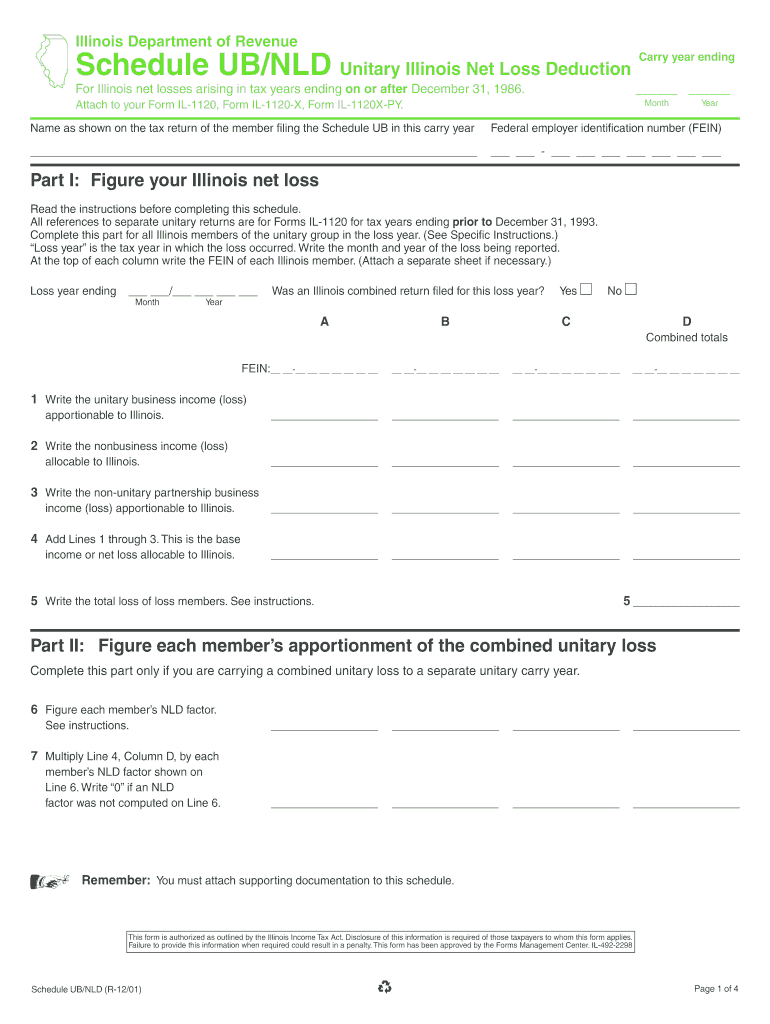

The Schedule UBNLD Income Tax Corporate is a specific form used by corporations in the United States to report income and deductions related to their business activities. This form is essential for ensuring compliance with federal tax regulations. It helps the Internal Revenue Service (IRS) assess the tax liability of corporations based on their earnings and expenses for the tax year. Understanding this form is crucial for corporate entities aiming to maintain accurate financial records and fulfill their tax obligations.

How to use the Schedule UBNLD Income Tax Corporate

Using the Schedule UBNLD Income Tax Corporate involves several steps. First, corporations must gather all relevant financial information, including income statements, balance sheets, and records of deductible expenses. Next, the form should be filled out accurately, reflecting the corporation's financial activities. It is important to ensure that all figures are correct to avoid discrepancies that could lead to penalties. Once completed, the form can be submitted along with the corporation's main tax return to the IRS.

Steps to complete the Schedule UBNLD Income Tax Corporate

Completing the Schedule UBNLD Income Tax Corporate requires careful attention to detail. Here are the key steps:

- Gather all necessary financial documents, including income records and expense receipts.

- Fill out the form by entering income, deductions, and any applicable credits.

- Review the form for accuracy, ensuring all calculations are correct.

- Attach the completed schedule to the main corporate tax return.

- Submit the return to the IRS by the designated deadline.

Filing Deadlines / Important Dates

Corporations must be aware of specific filing deadlines for the Schedule UBNLD Income Tax Corporate. Generally, the due date aligns with the corporation's tax return deadline, which is typically the fifteenth day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the form is due by April fifteenth. It is crucial to file on time to avoid penalties and interest on any taxes owed.

Required Documents

To accurately complete the Schedule UBNLD Income Tax Corporate, certain documents are required. These typically include:

- Income statements detailing revenue earned during the tax year.

- Expense records, including receipts for deductible business expenses.

- Balance sheets that provide a snapshot of the corporation's financial position.

- Any prior year tax returns that may inform current filings.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule UBNLD Income Tax Corporate. These guidelines outline the required information, acceptable deductions, and the proper way to report income. Corporations should refer to the IRS instructions for the form to ensure compliance with current tax laws and regulations. Staying informed about changes in tax legislation can also help corporations avoid errors and potential audits.

Quick guide on how to complete schedule ubnld income tax corporate

Prepare [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the appropriate form and securely archive it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents promptly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choosing. Edit and eSign [SKS] to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule UBNLD Income Tax Corporate

Create this form in 5 minutes!

How to create an eSignature for the schedule ubnld income tax corporate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to Schedule UBNLD Income Tax Corporate using airSlate SignNow?

To Schedule UBNLD Income Tax Corporate with airSlate SignNow, simply log in to your account, select the document you need to eSign, and follow the prompts to schedule your tax submission. Our platform guides you through each step, ensuring a seamless experience. You can also set reminders to ensure you never miss a deadline.

-

What features does airSlate SignNow offer for scheduling UBNLD Income Tax Corporate?

airSlate SignNow provides a variety of features to help you Schedule UBNLD Income Tax Corporate efficiently. These include customizable templates, automated reminders, and secure eSigning capabilities. Our user-friendly interface makes it easy to manage your documents and track their status.

-

How much does it cost to use airSlate SignNow for scheduling UBNLD Income Tax Corporate?

The pricing for airSlate SignNow varies based on the plan you choose, but it is designed to be cost-effective for businesses of all sizes. We offer flexible subscription options that cater to your needs, ensuring you can Schedule UBNLD Income Tax Corporate without breaking the bank. Check our website for the latest pricing details.

-

Can I integrate airSlate SignNow with other software for scheduling UBNLD Income Tax Corporate?

Yes, airSlate SignNow offers integrations with various software applications, making it easier to Schedule UBNLD Income Tax Corporate. You can connect with popular tools like CRM systems, accounting software, and more. This integration streamlines your workflow and enhances productivity.

-

What are the benefits of using airSlate SignNow for UBNLD Income Tax Corporate scheduling?

Using airSlate SignNow to Schedule UBNLD Income Tax Corporate provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to manage your documents digitally, saving time and resources. Additionally, eSigning ensures that your documents are legally binding and secure.

-

Is airSlate SignNow secure for scheduling UBNLD Income Tax Corporate?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your data when you Schedule UBNLD Income Tax Corporate. Our platform is designed to keep your information safe while providing a reliable eSigning experience.

-

How can I get support for scheduling UBNLD Income Tax Corporate with airSlate SignNow?

If you need assistance while scheduling UBNLD Income Tax Corporate with airSlate SignNow, our dedicated support team is here to help. You can signNow out via live chat, email, or phone for prompt assistance. We also provide a comprehensive knowledge base with guides and FAQs to help you navigate our platform.

Get more for Schedule UBNLD Income Tax Corporate

- Warranty deed trust to two individuals virginia form

- Quitclaim deed from trust to trust virginia form

- Special warranty deed from an individual to an individual virginia form

- Virginia deed correction form

- Virginia special warranty form

- Virginia deed trust form

- Special warranty deed template form

- Virginia deed form 497428043

Find out other Schedule UBNLD Income Tax Corporate

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy