Schedule K 1 T2 Income Tax Business Tax Illinois Form

What is the Schedule K-1 T2 Income Tax Business Tax Illinois

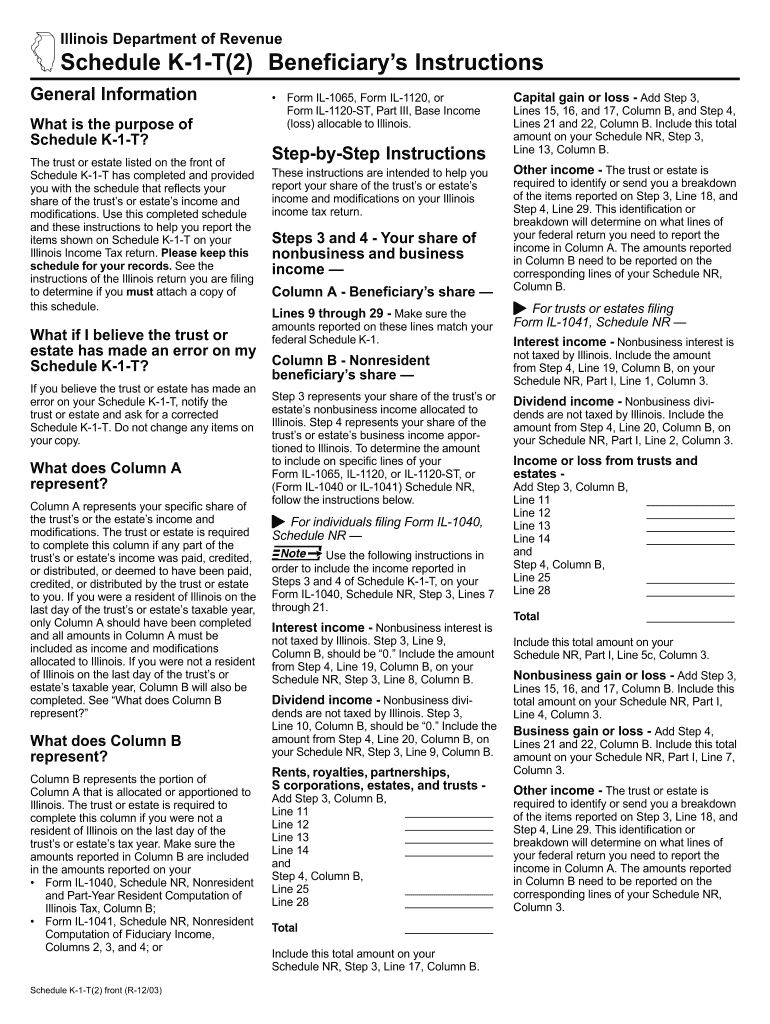

The Schedule K-1 T2 is a tax form used in Illinois for reporting income, deductions, and credits from partnerships, S corporations, estates, and trusts. This form is essential for individuals who receive income from these entities, as it provides detailed information about their share of the entity's financial activity. The K-1 T2 specifically caters to the needs of business entities operating within Illinois, ensuring compliance with state tax regulations.

How to use the Schedule K-1 T2 Income Tax Business Tax Illinois

To effectively use the Schedule K-1 T2, taxpayers need to first obtain the form from the entity that issued it. Once received, individuals should review the information provided, which includes their share of income, deductions, and credits. This information must be accurately reported on the taxpayer's individual income tax return. It is crucial to ensure that all figures align with the entity's financial statements to avoid discrepancies during filing.

Steps to complete the Schedule K-1 T2 Income Tax Business Tax Illinois

Completing the Schedule K-1 T2 involves several key steps:

- Obtain the Schedule K-1 T2 from the issuing entity.

- Review the details, including your share of income and deductions.

- Transfer the relevant figures to your individual income tax return.

- Ensure all information is accurate and consistent with entity records.

- File your return by the applicable deadline.

Legal use of the Schedule K-1 T2 Income Tax Business Tax Illinois

The Schedule K-1 T2 is legally required for reporting income from partnerships and S corporations in Illinois. Failing to report this income can lead to penalties and interest charges from the Illinois Department of Revenue. It is important for taxpayers to understand their obligations under Illinois tax law and to use the K-1 T2 to ensure compliance.

State-specific rules for the Schedule K-1 T2 Income Tax Business Tax Illinois

Illinois has specific rules regarding the use of the Schedule K-1 T2. Taxpayers must adhere to the state's filing deadlines and ensure that the information reported aligns with Illinois tax regulations. Additionally, any adjustments made at the federal level may also affect state filings, necessitating careful review of both federal and state tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule K-1 T2 typically align with the due dates for the entity's tax return. For partnerships and S corporations, this is usually the fifteenth day of the third month following the end of the tax year. Taxpayers receiving a K-1 must ensure they file their individual returns by the April 15 deadline, unless an extension has been granted.

Who Issues the Form

The Schedule K-1 T2 is issued by partnerships, S corporations, estates, and trusts. These entities are responsible for providing accurate and timely K-1 forms to their partners or shareholders. It is essential for these entities to maintain proper records and ensure that all income and deductions are reported correctly to facilitate compliance for their stakeholders.

Quick guide on how to complete schedule k 1 t2 income tax business tax illinois

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without hindrance. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to Alter and Electronically Sign [SKS] with Ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to preserve your modifications.

- Choose how you wish to share your form; via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing additional copies. airSlate SignNow satisfies all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] to ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule k 1 t2 income tax business tax illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule K 1 T2 Income Tax Business Tax Illinois?

Schedule K 1 T2 Income Tax Business Tax Illinois is a tax form used by partnerships and S corporations to report income, deductions, and credits to their partners or shareholders. Understanding this form is crucial for accurate tax reporting and compliance in Illinois. It ensures that all income is properly accounted for and taxed at the individual level.

-

How can airSlate SignNow help with Schedule K 1 T2 Income Tax Business Tax Illinois?

airSlate SignNow provides an efficient platform for businesses to prepare, send, and eSign documents related to Schedule K 1 T2 Income Tax Business Tax Illinois. With our user-friendly interface, you can streamline the process of gathering signatures and ensure that all necessary forms are completed accurately and on time.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents like Schedule K 1 T2 Income Tax Business Tax Illinois. These features help businesses maintain compliance and improve efficiency in their tax preparation processes.

-

Is airSlate SignNow cost-effective for small businesses handling Schedule K 1 T2 Income Tax Business Tax Illinois?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses managing Schedule K 1 T2 Income Tax Business Tax Illinois. Our pricing plans are flexible and cater to various business sizes, ensuring that you can access essential features without breaking the bank.

-

Can I integrate airSlate SignNow with my accounting software for Schedule K 1 T2 Income Tax Business Tax Illinois?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage your Schedule K 1 T2 Income Tax Business Tax Illinois documents. This integration allows for a smoother workflow, ensuring that all financial data is accurately reflected in your tax filings.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including Schedule K 1 T2 Income Tax Business Tax Illinois, offers numerous benefits such as enhanced security, faster turnaround times, and improved organization. Our platform ensures that your documents are stored securely and can be accessed anytime, streamlining your tax preparation process.

-

How does airSlate SignNow ensure the security of my Schedule K 1 T2 Income Tax Business Tax Illinois documents?

airSlate SignNow prioritizes the security of your documents, including Schedule K 1 T2 Income Tax Business Tax Illinois, by employing advanced encryption and secure cloud storage. This ensures that your sensitive tax information is protected from unauthorized access and complies with industry standards.

Get more for Schedule K 1 T2 Income Tax Business Tax Illinois

- Qualification sheet oct 1 2013doc maryland state police form

- Reading racetrack form

- Coc kpdnkk form

- 2016 asa umpire exam answer key form

- 876 application for transit subclass 771 visa for australia form

- Compassion and choices good to go toolkit form

- Residential mechanical ventilation record csa f326 form

- Emergency management plan draft form

Find out other Schedule K 1 T2 Income Tax Business Tax Illinois

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe