Schedule UB Income Tax Corporate Form

What is the Schedule UB Income Tax Corporate

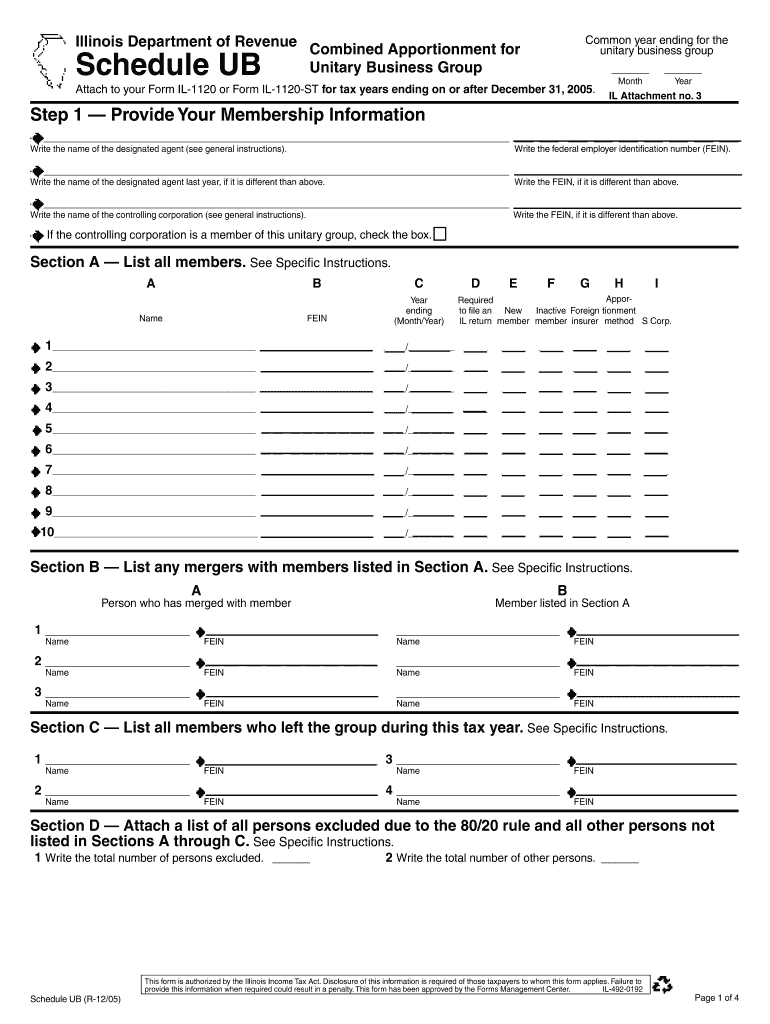

The Schedule UB Income Tax Corporate is a specific tax form used by corporations in the United States to report their income and calculate their tax liabilities. This form is essential for ensuring compliance with federal tax regulations. Corporations must accurately complete this schedule to reflect their financial activities for the tax year, including income, deductions, and credits. The information reported on the Schedule UB is crucial for the Internal Revenue Service (IRS) to assess the corporation's tax obligations.

How to use the Schedule UB Income Tax Corporate

Using the Schedule UB Income Tax Corporate involves several steps to ensure accurate reporting. First, gather all necessary financial documents, including income statements, expense reports, and previous tax returns. Next, fill out the form by entering the required information, such as total income, allowable deductions, and any applicable credits. It is important to follow the instructions provided by the IRS carefully to avoid errors. Finally, review the completed form for accuracy before submission.

Steps to complete the Schedule UB Income Tax Corporate

Completing the Schedule UB Income Tax Corporate requires a systematic approach:

- Collect all relevant financial records, including profit and loss statements and balance sheets.

- Begin filling out the form by entering the corporation's name, address, and Employer Identification Number (EIN).

- Report total income from all sources, including sales, interest, and dividends.

- Deduct allowable expenses, such as operating costs and depreciation.

- Calculate any tax credits applicable to the corporation.

- Review the calculations for accuracy and ensure all required fields are completed.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines when filing the Schedule UB Income Tax Corporate. Generally, the due date for filing is the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this typically falls on April fifteenth. If additional time is needed, corporations may file for an extension, but they must still pay any taxes owed by the original due date to avoid penalties.

Required Documents

To complete the Schedule UB Income Tax Corporate accurately, several documents are necessary:

- Income statements detailing revenue from operations.

- Expense reports outlining all deductible costs.

- Previous tax returns for reference.

- Documentation for any tax credits being claimed.

- Records of any adjustments or corrections made to financial statements.

IRS Guidelines

The IRS provides comprehensive guidelines for completing the Schedule UB Income Tax Corporate. These guidelines include instructions on how to report various types of income, allowable deductions, and the calculation of tax credits. It is essential for corporations to refer to the latest IRS publications and instructions to ensure compliance with current tax laws and regulations. Following these guidelines helps prevent errors and reduces the risk of audits.

Quick guide on how to complete schedule ub income tax corporate

Complete [SKS] effortlessly on any gadget

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can locate the appropriate form and safely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle [SKS] on any platform using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign [SKS] easily

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your changes.

- Choose how you want to send your form: via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule UB Income Tax Corporate

Create this form in 5 minutes!

How to create an eSignature for the schedule ub income tax corporate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule UB Income Tax Corporate?

Schedule UB Income Tax Corporate is a specific form used by corporations to report their income tax obligations. It helps businesses accurately calculate their tax liabilities and ensures compliance with federal regulations. Utilizing airSlate SignNow can streamline the process of completing and submitting this form.

-

How can airSlate SignNow help with Schedule UB Income Tax Corporate?

airSlate SignNow provides an easy-to-use platform for businesses to eSign and send documents, including the Schedule UB Income Tax Corporate. With its intuitive interface, users can quickly fill out and submit their tax forms, reducing the risk of errors and saving valuable time.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for small businesses and larger corporations. Each plan includes features that support the completion of documents like Schedule UB Income Tax Corporate. You can choose a plan that best fits your budget and requirements.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with numerous applications, enhancing your workflow when dealing with documents like Schedule UB Income Tax Corporate. These integrations allow you to connect with popular tools such as Google Drive, Dropbox, and CRM systems, making document management more efficient.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents like Schedule UB Income Tax Corporate. These features ensure that your documents are completed accurately and can be easily accessed whenever needed.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect sensitive information related to Schedule UB Income Tax Corporate. You can trust that your documents are safe and compliant with industry standards.

-

Can I access airSlate SignNow on mobile devices?

Yes, airSlate SignNow is accessible on mobile devices, allowing you to manage your Schedule UB Income Tax Corporate documents on the go. This flexibility ensures that you can complete and sign important tax documents anytime, anywhere, enhancing your productivity.

Get more for Schedule UB Income Tax Corporate

- Notice of default on residential lease virginia form

- Landlord tenant lease co signer agreement virginia form

- Application for sublease virginia form

- Inventory and condition of leased premises for pre lease and post lease virginia form

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out virginia form

- Property manager agreement virginia form

- Agreement for delayed or partial rent payments virginia form

- Tenants maintenance repair request form virginia

Find out other Schedule UB Income Tax Corporate

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form